Investment and Development Joint Stock Company I.P.A (coded IPA on HNX) has recently approved a plan to privately offer bonds in multiple tranches, with the specific issuance plan yet to be announced.

Mr. Vu Hien, Chairman of the Board of Directors of IPA, has been authorized to decide on issues, transactions, signing, transferring, executing agreements, contracts, and other documents related to the issued bonds.

Previously, on June 5, IPA successfully issued VND 317 billion of bonds coded IPAH2429001, with a 5-year term maturing on June 5, 2029. The fixed interest rate is 9.5%/year.

The bond issuance aims to restructure debts under loan contracts and other payables. Specifically, VND 309 billion will be used to repay debts to Can Tho Investment and Development JSC, a loan signed on July 4, 2023, and VND 8 billion to repay debts to another creditor, a loan signed on November 17, 2023.

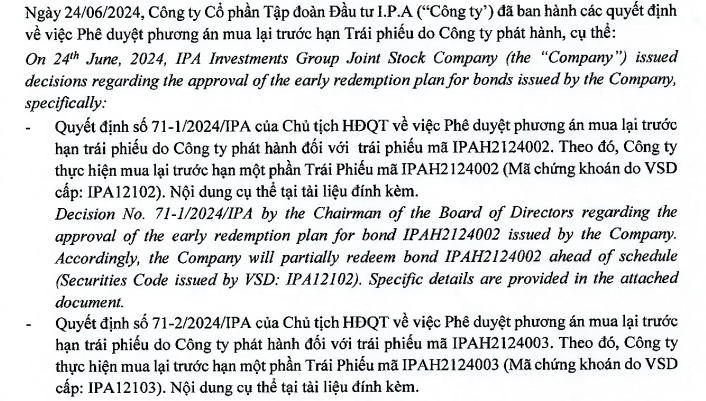

On the other hand, IPA has also approved a plan to repurchase bonds before maturity. The company intends to repurchase VND 300 billion of IPAH2104002 bonds and VND 400 billion of IPAH2124003 bonds between June 26 and July 15, 2024.

Source: IPA

Both IPAH2104002 and IPAH2124003 bond series have a value of VND 1,000 billion each, issued in November and December 2021, respectively, with a 3-year term and a fixed interest rate of 9.5%/year.

These two bond series are ‘4-no’ bonds: non-convertible, non-warrant attached, unsecured, and not subordinated debt of the company. The bondholders’ representative organization and paying agent is VNDirect Securities Corporation.

It is estimated that Investment and Development Joint Stock Company I.P.A will repurchase a total of VND 700 billion of these two bond series, both maturing at the end of 2024.

In terms of business performance, in the first quarter of 2024, IPA recorded net revenue of VND 85.5 billion, up 34.1% year-on-year. After-tax profit reached VND 104.8 billion, a significant improvement compared to the loss of over VND 136 billion in the same period last year.

For the full year 2024, IPA targets total revenue of VND 1,080 billion and pre-tax profit of VND 425 billion, representing a 5.7% decrease and a 23.7% increase, respectively, compared to the previous year’s results.

As of the first quarter of 2024, IPA’s total short-term and long-term borrowings amounted to VND 3,981.5 billion, accounting for 44.6% of total capital sources. Of this, VND 3,600 billion is in bond debt, with the remaining being loans from related parties, banks, and other individuals.

Investment and Development Joint Stock Company I.P.A is facing VND 3,000 billion of bonds maturing at the end of 2024 and early 2025.

Overcoming Challenges in Dealing with Bad Debts

In the newly passed Revised Securities Law, securities companies (SCs) no longer have the privilege to hold collateral. Therefore, SCs need to recognize that debt collection is their responsibility, and they should be extremely strict in assessing borrowers, ensuring compliance with principles, procedures, and conditions before granting loans.