According to the Q4/2023 Financial Statements of Petrovietnam Gas Corporation (PV Gas, stock code: GAS), as of December 31, 2023, the company is the largest holder of cash and deposits on the stock market, with a total of VND 40,752 billion (approximately USD 1.7 billion), an increase of over VND 6,000 billion in one year. This amount also accounts for over 46% of the company’s total assets.

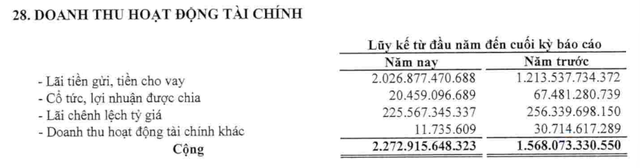

With such a huge amount of “fresh cash,” PV Gas has earned VND 2,026 billion in interest from deposits in the past year. Therefore, the company pockets an average of VND 5.5 billion in interest income from bank deposits every day, which greatly supports its business activities throughout the year.

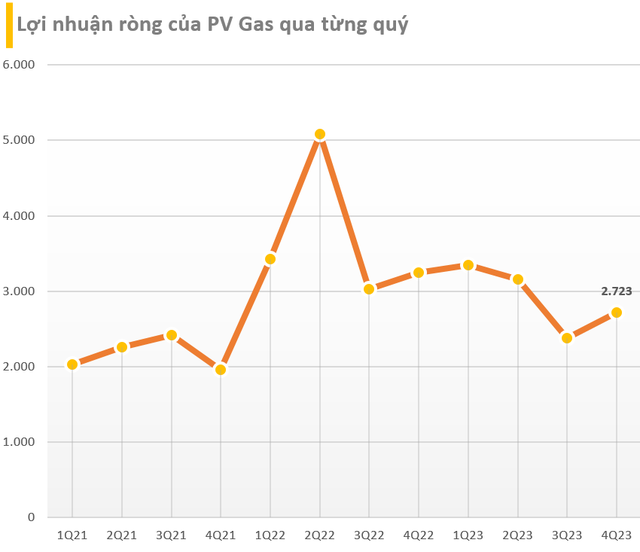

In terms of business performance, PV Gas achieved VND 22,670 billion in revenue in Q4/2023, a 2.3% increase compared to the same period last year. However, the cost of goods sold increased more significantly by 7.8% to VND 18,512 billion, resulting in a 16.7% decrease in the company’s gross profit to VND 4,058 billion.

PV Gas recorded VND 544 billion in financial income in the past quarter, an 11.2% increase due to mostly interest income from bank deposits. Although the company’s financial expenses decreased, its selling expenses and management expenses increased. As a result, PV Gas reported a net profit attributable to the parent company of VND 2,723 billion, a 16.2% decrease compared to Q4/2022. EPS decreased from VND 1,678 to VND 1,165.

For the entire year of 2023, PV Gas recorded VND 89,953 billion in revenue and VND 11,606 billion in net profit, representing an 11% and 21.5% decrease compared to the same period last year, respectively.

As of December 31, 2023, the company’s total assets reached VND 86,754 billion, an increase of over VND 5,000 billion compared to the beginning of the year. Besides its significant amount of “fresh cash,” the second largest component in the company’s asset structure is fixed assets, at VND 19,532 billion. The company’s short-term receivables amount to VND 16,865 billion.

As of the end of 2023, PV Gas’s total financial borrowings are at VND 5,874 billion, relatively small compared to its equity. The company’s equity reaches VND 65,298 billion.