Illustrative image

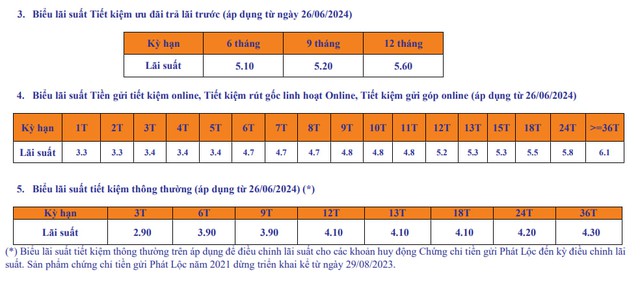

Joint Stock Commercial Bank for Foreign Trade of Vietnam (SHB) has just announced the

application of a new deposit interest rate schedule from June 26th, with an

increase of 0.2%/year for all terms from 1 month onwards. Accordingly, the highest

savings interest rate at SHB has reached 6.1%/year.

According to the Online Deposit Interest Rate Schedule – the product with the

highest interest rate at SHB, the interest rate for the term of 1-2 months has

increased to 3.3%/year, the term of 3-5 months is currently at 3.4%/year, the term

of 6-8 months is 4.7%/year, the term of 9-11 months is 4.8%/year, the term of 12

months has increased to 5.2%/year, the term of 13-15 months is 5.3%/year, the term of

18 months is 5.5%/year, the term of 24 months is 5.8%/year, and the term of 36 months

and above currently has the highest interest rate, up to 6.1%/year.

For counter deposits, SHB also increased by 0.2%/year for all terms from 1 month

onwards. Accordingly, the highest deposit interest rate for customers depositing

at the counter is 5.9%/year, applied to deposits from 36 months onwards with a

minimum deposit amount of VND 2 billion.

SHB’s latest savings interest rate schedule (Source: SHB)

This is the first time SHB has increased deposit interest rates this month and is

the fourth bank to offer an interest rate of up to 6.1%/year (along with NCB,

OceanBank, and HDBank).

In addition, SHB is also the next large private bank to raise interest rates in

June. Previously, ACB, VPBank, MB, and Techcombank also raised interest rates in

recent weeks.

Most recently, ACB has simultaneously increased deposit interest rates by 0.2 –

0.4%/year for terms of 1 – 12 months since June 21st.

Techcombank also adjusted savings interest rates last week with an average

increase of 0.1-0.3%/year, bringing the highest savings interest rate to 5%/year.

From June 14th, VPBank simultaneously increased deposit interest rates for all

terms with an increase of 0.2 – 0.3%/year. Meanwhile, MB increased interest rates

for terms of 1 – 18 months by 0.1 – 0.4%/year from June 7th.

The trend of increasing deposit interest rates has appeared since the end of March

and has become widespread in April, May, and continued into June. However, the

increase has mainly come from the group of joint-stock private banks.

Since the beginning of June, the market has recorded 23 commercial banks

increasing deposit interest rates, including: TPBank, VIB, GPBank, BaoViet Bank,

LPBank, Nam A Bank, OceanBank, ABBank, Bac A Bank, MSB, MB, Eximbank, OCB,

BVBank, NCB, VietBank, VietA Bank, VPBank, PGBank, Techcombank, ACB, SHB, and

VietinBank. Many of these banks have increased interest rates 2 – 3 times in June.

Accelerating disbursement of the 120 trillion VND credit package for social housing

Deputy Prime Minister Trần Hồng Hà has recently issued directives regarding the implementation of the 120,000 billion VND credit package for investors and buyers of social housing, workers’ housing, and projects for the renovation and construction of apartment buildings.