Demand strength at large-cap stocks helped the VN-Index stay in the green for almost the entire trading session. The index closed 3.04 points higher on July 4, approaching the 1,280 threshold. Liquidity declined, with trading value on HOSE exceeding VND14 trillion.

Foreign trading was a downside, as they net sold VND534 billion across the market. This marked the 20th consecutive session of foreign net selling in Vietnam.

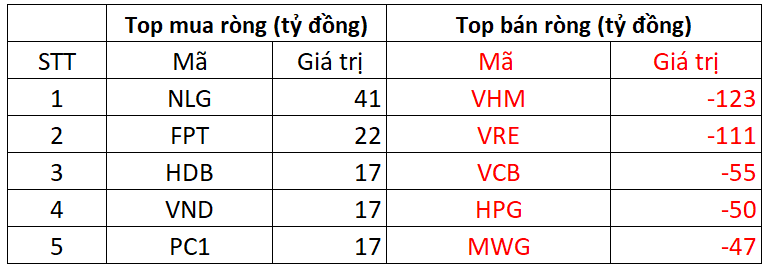

On HOSE, foreign investors net sold VND578 billion.

In the buying column, NLG was the top stock purchased by foreign investors, with a net buy value of VND41 billion. FPT and HDB followed, with net bought values of VND22 billion and VND17 billion, respectively. VND and PC1 were also bought for VND17 billion each.

On the other side, VHM faced the strongest selling pressure from foreign investors, with a net sell value of over VND123 billion. VRE and VCB were also offloaded, with net sell values of VND111 billion and VND55 billion, respectively.

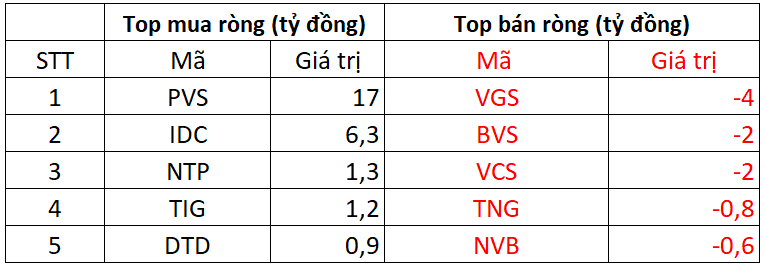

On HNX, foreign investors net bought VND20 billion

PVS was the most purchased stock by foreign investors on HNX, with a net buy value of VND17 billion. IDC followed, with a net buy value of VND6 billion. Foreigners also spent a few billion dong each to net buy NTP, TIG, and DTD.

On the selling side, VGS faced the highest net selling pressure from foreign investors, with a value of nearly VND4 billion. BVS, TNG, and NVB were also net sold for a few billion dong each.

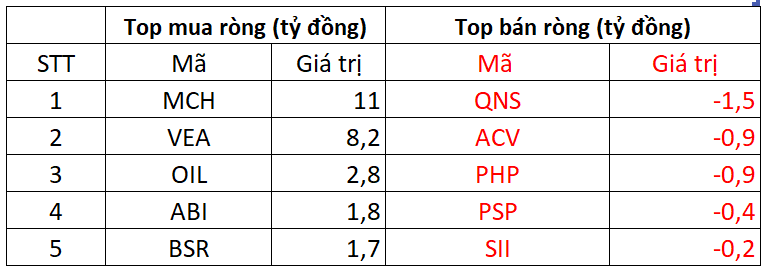

On UPCOM, foreign investors net bought VND22 billion

Conversely, QNS was net sold by foreign investors for nearly VND1.5 billion. ACV, PHP, and others were also net sold by foreign investors…

“DPM’s Profits Vanish Into Thin Air, Accounting for Over 90% in 2023”

“DPM, the industry leader, achieved a remarkable feat by generating a profit post-tax of over 90% in 2023, marking its lowest net earnings since 2019.”