Commercial Banks Continue to Raise USD Prices

This morning (June 27), the central exchange rate was listed at 24,264 VND/USD, up 6 VND from the previous session.

With the applied +/- 5% margin, today’s ceiling rate is 25,477 VND/USD, and the floor rate is 23,050 VND/USD.

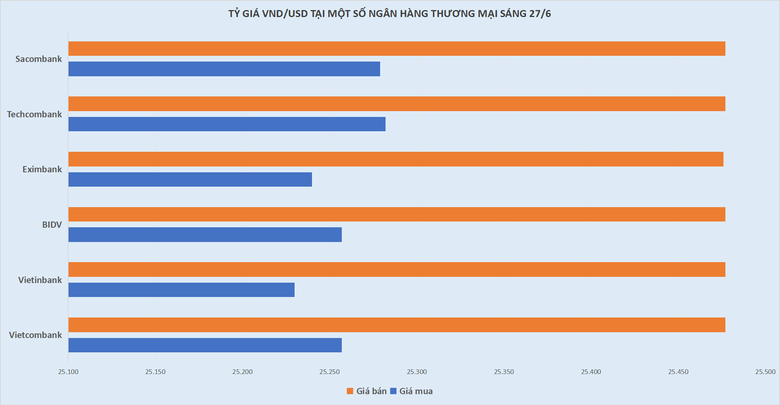

Meanwhile, the selling price of USD at commercial banks this morning was also slightly adjusted upwards compared to the previous session.

Vietcombank and BIDV listed USD at 25,257 – 25,477 VND/USD, up 7 VND in both buying and selling rates compared to the previous session.

Vietinbank listed USD at 25,230 – 25,477 VND/USD, down 20 VND on the buying side and up 7 VND on the selling side.

Eximbank maintained the buying price and increased the selling price by 6 VND from the previous session, listing USD at 25,240 – 25,476 VND/USD.

Techcombank listed USD at 25,282 – 25,477 VND/USD, down 3 VND on the buying side and up 7 VND on the selling side. Meanwhile, Sacombank listed USD at 25,279 – 25,477 VND/USD, up 5 VND on the buying side and 7 VND on the selling side compared to the previous session.

Compiled by N. Nga

Previously, in the June 26 session, the State Bank of Vietnam listed the central exchange rate at 24,258 VND/USD, up 5 VND from the previous session. The buying and selling rates were kept unchanged at 23,400 VND/USD and 25,450 VND/USD, respectively.

In the interbank market, the exchange rate ended the session at 25,464 VND/USD, up 5 VND from June 25. In the free market, the buying and selling rates both increased by 10 VND, trading at 25,880 VND/USD and 25,960 VND/USD, respectively.

Gold Prices Maintain Their Momentum

At the opening of the trading session this morning, the buying and selling prices of SJC gold bars at Saigon Jewelry Company (SJC) were at 74.98 – 76.98 million VND/tael, unchanged from the previous session. The buying and selling prices differed by 2 million VND/tael.

Similarly, the buying and selling prices of DOJI gold in Hanoi remained unchanged at 74.98 – 76.98 million VND/tael. The buying and selling prices differed by 2 million VND/tael.

At Bao Tin Minh Chau, gold bullion prices were traded at 75.5 – 76.98 million VND/tael, while at PNJ, they were at 74.98 – 76.98 million VND/tael.

Gold price movements at domestic enterprises on June 27. Compiled by N. Nga

Meanwhile, the prices of round-bar products at enterprises this morning continued to decrease by 100,000 to 280,000 VND per tael, currently hovering around 73 million VND/tael on the buying side and 75 million VND/tael on the selling side.

In the global market, precious metal prices continued to plunge, losing 1% to hit a near two-week low as the US dollar strengthened and investors awaited a report on the Federal Reserve’s preferred inflation gauge for the latest clues on the central bank’s outlook for interest rate cuts.

Kitco Chart

Currently, the spot gold price on Kitco is at $2,297.70/ounce, down $21.80, or 0.94% in value, from the previous session’s close. When converted according to the exchange rate at Vietcombank, the global gold price is equivalent to 70.6 million VND/tael, lower than the domestic gold price by about 4.38 million VND/tael.

Market Update on February 2nd: Oil, Copper, Iron & Steel, Rubber, and Sugar Prices Decline, Gold Surges to Almost 1-Month High.

At the end of the trading session on February 1st, the prices of oil, copper, iron and steel, rubber, and sugar all dropped, while natural gas hit a nine-month low and gold reached its highest point in nearly a month.