On July 3, in Hanoi, the Institute of Economics and Finance (Academy of Finance) coordinated with the Price Management Department (Ministry of Finance) to organize a workshop on “Market and price movements in Vietnam in the first six months of 2024 and forecasts for the whole year.”

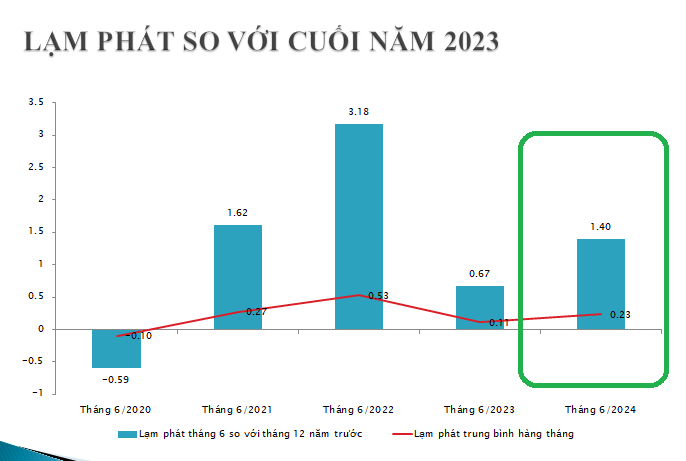

CPI RISES BY 1.4% COMPARED TO THE END OF 2023, MANAGEABLE INFLATION PRESSURE

According to the General Statistics Office’s newly published data, the consumer price index (CPI) in June 2024 increased by 0.17% compared to the previous month. Compared to December 2023, CPI in June 2024 rose by 1.4%, and by 4.34% over the same period. The CPI average in the second quarter of 2024 increased by 4.39% over the same period. For the first six months of 2024, CPI rose by 4.08% over the same period last year; core inflation increased by 2.75%.

The data released by the General Statistics Office has raised concerns about the ability to control inflation for the whole of 2024.

However, Mr. Nguyen Duc Do, Deputy Director of the Institute of Economics and Finance, emphasized that, in reality, the inflationary pressure this year is not too high.

“The inflation index compared to the same period last year and the average inflation rate are currently high, mainly due to the impact of adjustments in health care and education service prices in the third quarter of 2023. Therefore, in the third quarter of 2024, when the effect of these price adjustments decreases, inflation compared to the same period will decrease significantly, and the average inflation rate will also decrease if there are no large-scale price adjustments for goods managed by the State,” Mr. Do analyzed.

Also, according to Mr. Do, if we look at the CPI growth rate in the first six months of 2024, we can see a different picture that shows inflationary pressure is at a moderate level, as it does not yet take into account the price adjustments for health care and education services made in the third quarter of 2023.

Specifically, compared to the end of 2023, CPI has only increased by 1.40%, equivalent to an average of about 0.23%/month. If we consider only the second quarter of 2024, CPI only increased by an average of 0.1%/month. These are all moderate levels in the last five years.

This expert assessed that there are not many factors that could cause a sudden increase in prices in the last six months of 2024, except for the adjustment of prices of goods managed by the State, the scale of which has not yet been announced, and the timing of which experts are waiting for.

“It is possible to expect that the price increase rate in the last six months will be equivalent to that of the first six months of 2024 if there are no large-scale service price adjustments,” Mr. Do said.

THE SECOND-HALF UNKNOWNS ARE NOT TOO CONCERNING

Clarifying the roadmap for adjusting the price of public services and goods managed by the State in the latter half of the year, Ms. Vu Huong Tra, Deputy Head of the Synthesis Department, Price Management Department (Ministry of Finance), said that the price of health care services is expected to be adjusted according to the base salary level. Education services also have a roadmap for adjustment in 2024-2025 for the non-public sector, whereby the framework will be increased, but the specific level must follow the actual developments.

In addition, the Price Law, which took effect in July 2024, will consolidate the list of goods with prices controlled by the State, instead of being stipulated in various specialized documents. “Although salaries have increased, not all goods with prices set by the State will increase, and the extent of the increase will be appropriate to control inflation,” emphasized Ms. Tra.

Apart from the unknowns regarding the adjustment of public service prices according to the market roadmap, Mr. Nguyen Duc Do believes that inflationary pressure in the last six months of 2024 is not too concerning when considering six influencing factors.

First, although the economy is recovering with a GDP growth rate in the first six months of 2024 reaching 6.42% and the whole year’s forecast to reach 6.5%, considering the whole period of 2020-2024, GDP has only grown by an average of about 5%/year, lower than the average of 6.1% in the 2014-2024 period.

“That is, the economy in 2024 is still operating below its potential,” Mr. Do stated.

Second, the consumption growth rate in the 2020-2024 period has always been much lower than the GDP growth rate, at about 3.9%/year.

In other words, consumer demand is still weak. In this context, businesses will be more concerned about consuming goods than raising prices.

Considering the supply-side shocks, Mr. Do analyzed the third factor: although the exchange rate has increased strongly in the first six months (up by 4.17% compared to December 2023 and by 7.66% over the same period, with an average increase of 5.64% in the first six months of 2024), monthly inflation in the first six months of 2024 has not been high.

“Moreover, the upward momentum of the exchange rate has slowed down in May-June 2024 and is expected to stabilize or even decrease in the last six months. The market is waiting for the Fed to cut interest rates sooner, which could lead to a depreciation of the US dollar in the international market,” Mr. Do said.

Fourth, oil prices have been relatively stable recently, fluctuating around $80/barrel, and are unlikely to rise sharply in the last six months due to the risk of a US economic recession as the Fed maintains high interest rates.

Fifth, although low, interest rates have been maintained at a positive level, helping to curb inflation.

Money supply and credit growth have also been low in the first six months of 2024. Specifically, as of June 24, 2024, the growth in capital mobilization and credit of credit institutions reached only 1.50% and 4.45%, respectively. Thus, they are far from the set targets.

The sixth factor is that the impact of the increase in the base salary on inflation in the coming time will not be too significant, as the public sector is not large in the economy, accounting for less than 8% of the labor force.

TWO SCENARIOS FOR INFLATION IN 2024

Forecasting the situation in the second half of 2024, the Deputy Director of the Institute of Economics and Finance said that CPI will peak around July-August 2024 and then decrease gradually. On average, for the whole of 2024, according to Mr. Do, overall, if there are no large-scale service price adjustments, the average inflation rate for the whole of 2024 is forecast to be around 3.4% (+/- 0.2%), that is, it will fall into the high scenario predicted at the beginning of 2024, which is 3.0% (+/-0.5%).

Assoc. Prof. Dr. Vu Duy Nguyen, Director of the Institute of Economics and Finance, presented two scenarios.

Scenario 1: CPI averages around 3.95% (+0.25%) assuming a GDP growth target of 6-6.5% and no abnormal fluctuations in geopolitical situations and world oil prices.

Scenario 2: CPI averages around 3.95% (-0.25%) assuming a GDP growth target of below 6% and no abnormal fluctuations in geopolitical situations and world oil prices.

To curb inflation in the second half of the year and ensure the realization of the CPI average target of 4-4.5% in 2024, the Director suggested that it is necessary to continue maintaining a loose monetary policy, with the State Bank keeping interest rates low and expanding credit in a controlled manner.

“However, it is necessary to tightly control the disbursement of credit for the right purposes and improve capital usage efficiency in production and consumption to ensure total supply output and business efficiency, and increase total demand through personal consumption,” Mr. Nguyen recommended.

In addition, it is crucial to stabilize the gold, foreign exchange, and money markets and the value of the currency in the context of the Government’s loose monetary policy, which goes against the trend of policies in other countries worldwide. At the same time, we must prepare for a scenario to respond effectively to the possibility of central banks in major countries adopting a policy of lowering interest rates.

Along with that, it is essential to effectively and flexibly play the role of regulating and stabilizing the prices of goods managed by the State. Ministries and sectors should proactively propose plans to adjust the prices of goods managed by the State, avoiding concentrating them in the last months of 2024 (the time of preparation for the Lunar New Year holiday in 2025) or at the same time, to limit the impact of resonance and reduce pressure on price management and inflation control.

“It is necessary to adequately prepare sources of goods to meet the needs of the people, especially essential commodities, food, and consumer goods and services, especially in the context of climate change occurring in many countries, which could affect the global food and commodity supply, and epidemics in livestock,” the Director of the Institute of Economics and Finance said.

Additionally, it is vital to strengthen propaganda and ensure timely, transparent, and complete information on prices and the Government’s and the Steering Committee for Price Management’s direction in price control.

Which bank offers the highest interest rate for online savings in early February 2024?

Beginning February 1st, 2024, several banks have been adjusting their interest rates downwards for savings accounts ranging from 1 to 24 months. Based on a survey conducted across 16 banks, the highest annual interest rate for online savings deposits at a 6-month term is 5%, while for a 12-month term, it is 5.35%.

New currency exchange service: Rare small denominations

The demand for exchanging small denominations of money increases during the Lunar New Year, but the availability of small bills is limited. The familiar “money exchange kiosks” are also gradually disappearing from this service.