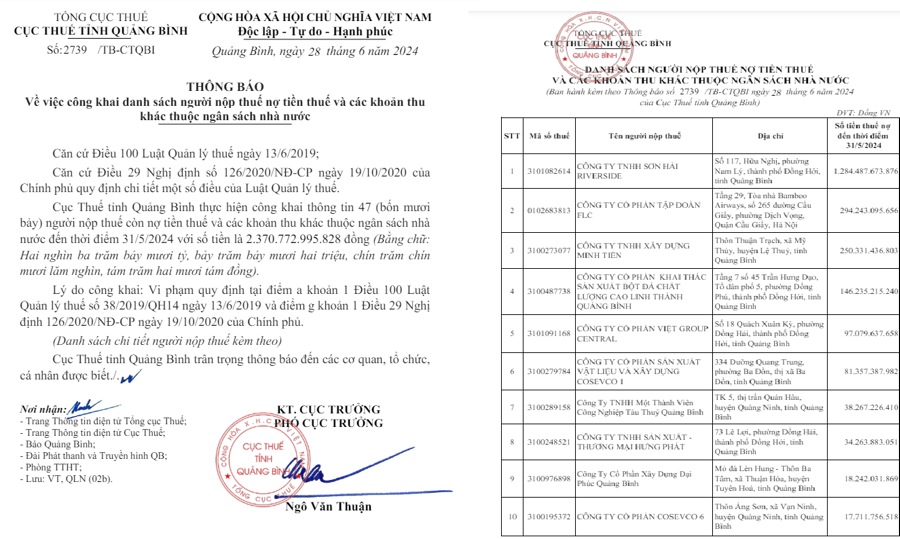

Topping the tax debt list in Quang Binh is Son Hai Riverside JSC, with nearly VND 1,300 billion in debt. The company, headquartered in Dong Hoi City, specializes in real estate and is a subsidiary of Son Hai Group JSC – a renowned construction and transportation enterprise in Quang Binh, famous for its 10-year highway warranty.

Following closely is FLC Group JSC, located on Cau Giay Street in Hanoi, with tax debts of nearly VND 295 billion. The group has a massive 2,000-hectare resort and golf course project in Quang Ninh and Le Thuy districts of Quang Binh. However, since the arrest of Mr. Trinh Van Quyet, the group’s chairman, the project has stalled, with only two golf courses operating intermittently.

In third place is Minh Tien Construction JSC, based in Le Thuy district, Quang Binh province, with tax debts of over VND 250 billion. The company has a real estate project in Le Thuy district but has not yet started operations.

The next on the list is Linh Thanh Quang Binh High-Quality Stone Powder Production and Exploitation JSC, located on Tran Hung Dao Street in Dong Hoi city, with tax debts of over VND 146 billion. The company invested in a stone powder factory in Tuyen Hoa district but has not been able to implement it due to land clearance issues.

Vietnam Group Central JSC, located on Quach Xuan Ky Street in Dong Hoi city, owes more than VND 97 billion in taxes. The company is involved in the construction of a 5-star hotel and commercial housing but has faced delays…

This list highlights a pattern, as most of the tax-indebted businesses in Quang Binh are connected to the real estate sector or investments in resort-style accommodations combined with real estate developments.

Recently, the Quang Binh Tax Department sent a notification to the Exit and Entry Management Department – Ministry of Public Security, requesting a temporary suspension of exit for 55 individuals due to tax debts. These individuals are legal representatives of companies and enterprises subject to enforced administrative decisions on tax management and have not fulfilled their tax obligations.

According to the Quang Binh Tax Department, to effectively manage tax debts and enforce tax collection, the provincial tax sector publicly discloses the list of tax-indebted enterprises monthly, especially those with large and prolonged debts. They also actively implement temporary suspension of exit for legal representatives of enterprises subject to enforced tax collection who have not fulfilled their tax obligations, particularly those no longer operating at their registered addresses.

In 2023, GELEX earns nearly 1,400 billion VND

In the face of macroeconomic pressures over the past year, GELEX Corporation has implemented flexible strategies to maintain stability and strive for sustainable growth.