|

Hanoi hosts online conference on credit growth solutions for 2024 – Photo: VGP/HT

|

Debt structure has little impact on bank governance

At the recent online conference on credit growth solutions for 2024, held in Hanoi, the State Bank of Vietnam (SBV) announced the issuance of Circular No. 06/2024/TT-NHNN amending and supplementing Circular No. 02/2023/TT-NHNN on debt restructuring and debt classification to support customers facing difficulties.

Accordingly, the SBV has extended the implementation period of the policies in Circular No. 02 on debt restructuring and debt classification until December 31, 2024. The SBV requires credit institutions to closely monitor the implementation of Circular No. 06/2024/TT-NHNN and promptly address any difficulties faced by customers.

Speaking to the media on the sidelines of the conference, Mr. Pham Nhu Anh, CEO of Military Commercial Joint Stock Bank (MB), shared his assessment of the impact of the extended debt rescheduling. He noted that businesses currently under debt rescheduling and restructuring are still facing challenges. The extension is necessary as, despite supportive policies, businesses continue to struggle with cash flow issues. By preventing the downgrade of their debt classification, these businesses can maintain their credit relationships with various banks. MB’s leadership hopes that by the end of 2024, the situation will improve and the global economy will recover.

Mr. Anh further analyzed that, in theory, this move could reduce pressure on the balance sheets of banks that have extended loans to these businesses. However, he emphasized MB’s governance approach, which involves proactively making provisions for risky debts, even for those that have been rescheduled or restructured. As a result, the issuance and implementation of Circular No. 06/2024/TT-NHNN have not impacted MB’s credit governance or its customers.

|

Mr. Pham Nhu Anh, CEO of Military Commercial Joint Stock Bank (MB) – Photo: VGP/HT

|

According to experts, supporting businesses to recover their production and business activities and promoting economic growth are key policies of the Party and the State, especially given the numerous challenges faced by the business community due to the pandemic and the global economic situation. As per the General Statistics Office, in the first five months of 2024, 98,800 businesses were established or resumed operations, while 97,300 businesses withdrew from the market. This data highlights the need for continuous and comprehensive support for the business community. Providing credit support to businesses will be more effective when they are also assisted in seizing business opportunities.

In addition to capital, businesses require a more favorable investment and business environment, a comprehensive legal framework, and transparent and efficient administrative procedures, free from barriers that hinder their development.

Implementing solutions to channel credit to the right addresses

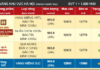

The State Bank of Vietnam (SBV) reported that, as of June 14, credit growth reached 3.79% compared to the end of 2023. The pace of credit growth has gradually improved, with the credit volume provided by banks to the economy exceeding that of the same period in the previous three years.

Among state-owned banks, as of mid-June 2024, VietinBank recorded the highest credit growth rate, with a 4.9% increase compared to the end of last year, aiming to achieve the 14% target set by the SBV at the beginning of the year.

Banks have proactively reduced lending rates to stimulate credit demand. VietinBank’s leadership shared that the bank has lowered lending rates eight times since the beginning of the year. Currently, some customers are offered short-term loans with interest rates lower than deposit rates.

|

Mr. Le Ngoc Lam, CEO of BIDV – Photo: VGP/HT

|

Mr. Le Ngoc Lam, CEO of BIDV, acknowledged the supportive policies of the Government and the SBV, as well as the recovery of the economy, the increase in FDI, and the low-interest-rate environment as positive factors for credit growth. However, he noted that credit growth is facing challenges. “While banks are eager to lend and even anxious about the slow growth, the weak capital absorption capacity of businesses has resulted in slow credit growth,” he said. He attributed this to the aftermath of the COVID-19 pandemic, which has significantly weakened the financial health of businesses, as evident from the high number of businesses withdrawing from the market or temporarily suspending their operations.

Mr. Pham Toan Vuong, CEO of Agribank, affirmed the bank’s commitment to aggressively implementing solutions to promote safe and effective credit growth.

To boost credit growth in the remaining months of the year, Mr. Pham Toan Vuong, CEO of Agribank, stated that the bank will continue to implement solutions to promote safe and effective credit growth. Agribank will focus its credit on key sectors driving development, including export, investment, and consumption. The bank will also continue to approach and invest in social housing projects and the agriculture sector (rice, forestry, and fisheries). Additionally, Agribank will implement preferential interest rate programs for specific customer segments and adopt appropriate interest rate policies to support customers in overcoming difficulties, restoring production and business activities, and enhancing access to credit. The bank will strengthen supervision and strictly handle any violations in lending activities.

|

Mr. Pham Toan Vuong, CEO of Agribank – Photo: VGP/HT

|

Mr. Nguyen Thanh Tung, CEO of Vietcombank, shared that as of June 17, Vietcombank’s credit growth reached 2.1%. He attributed the slow credit growth to the decline in personal credit, particularly in real estate loans, which even saw negative growth in the first quarter of 2024. Legal challenges, limited real estate supply, reduced income, and a sluggish real estate market have made customers cautious. Mr. Tung acknowledged the difficulty in reducing lending rates in the context of rising deposit rates in the market. Nonetheless, Vietcombank is committed to taking the lead in lowering lending rates to support the economy. Despite the slow start, Vietcombank is expected to achieve a credit growth rate of 4.3% by the end of June, 8.2% by the end of September, and 12% for the full year.

|

Mr. Nguyen Thanh Tung, CEO of Vietcombank – Photo: VGP/HT

|

Some bank leaders are optimistic about a breakthrough in the second half of June, as many credit contracts have been finalized and are awaiting signing and disbursement.

Mr. Pham Nhu Anh, CEO of MB, attributed the limited credit growth to both objective and subjective factors, including the stagnation in some markets, particularly the real estate market. He expressed hope that the new Land Law, which will take effect on August 1, will bring about legal improvements.

While MB’s credit growth reached only 5% by the end of June, it is expected to accelerate in the second, third, and fourth quarters. Therefore, MB remains confident in achieving its credit growth target of approximately 15%. As the macroeconomic situation improves and the current interest rate level becomes more reasonable, the economy’s absorption capacity will enhance credit growth.

MB’s leadership affirmed its commitment to further streamlining processes and procedures. This includes leveraging applications for individual and corporate customers to automate loan approval processes.

Customers can directly experience the streamlined processes and reduced human intervention through these automated approval procedures, ensuring the best possible experience.

Regarding interest rates, MB’s leadership acknowledged the challenges posed by external pressures, including the U.S. Federal Reserve’s maintenance of interest rates, which has impacted domestic exchange rates. In this context, the SBV’s efforts to maintain stable interest rates are commendable. The SBV has effectively utilized monetary policy tools to flexibly manage exchange rates and keep interest rates low to support the economy.

“Maintaining the current interest rate level in the next six months may be challenging, but I believe the SBV will strive to do so to minimize the impact of interest rates and exchange rates on banks, businesses, and the economy,” said Mr. Pham Nhu Anh.

|

Addressing commercial banks, Mr. Dao Minh Tu, Permanent Deputy Governor of the SBV, emphasized that while the SBV aims to promote credit growth to support the economy, it does not pursue credit growth at all costs. Credit growth must be accompanied by quality. Most importantly, banks need to understand the reasons behind the difficulties and bottlenecks in credit activities to find appropriate solutions. |

Anh Minh

Hanoi to reclaim over 2,600 hectares of agricultural land in two districts

The plan for land use in 2024 for Hoang Mai district and Dong Anh district has just been approved by the city of Hanoi. As a result, a total area of over 2,600ha of agricultural land is expected to be reclaimed by these two units within the year.

Hanoi’s Update on the Delayed 1.000 billion VND Hospital Project

To address the challenges faced by investors, the Hanoi People’s Committee has instructed the Long Bien People’s Committee and the Department of Natural Resources and Environment to resolve any obstacles that arise during the implementation of the Thang Long 1,000-Year Oncology and Plastic Surgery Hospital project.

Astonishingly high price for old and dilapidated apartment buildings reaching nearly 200 million VND/m2, rivaling the most luxurious condominiums in Hanoi

Old collective apartments with prices starting from 100 million VND/m2 are usually the first-floor units that can be used for commercial purposes, while the upper-floor units are priced at 60-80 million VND/m2 for residential purposes.