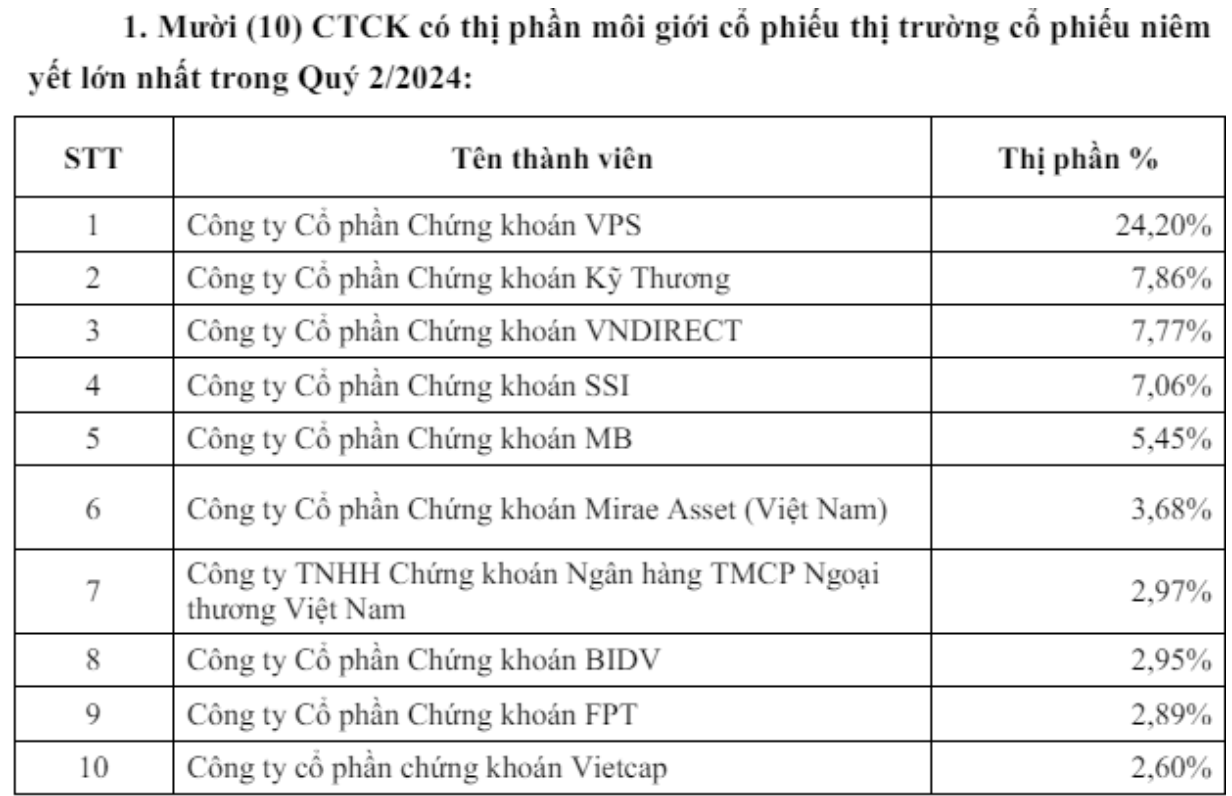

The Hanoi Stock Exchange (HNX) has just released the top 10 securities companies with the largest market share in trading stocks, the UPCoM market, and derivatives in the second quarter.

There were no changes at the top, with VPS maintaining its leading position, although its market share narrowed slightly from 24.7% in the first quarter to 24.2%. TCBS, VNDirect, SSI, MBS, and Mirae Asset followed suit, with VCBS in sixth place.

The most notable change was the entry of Vietcap, replacing BVSC in the top 10 with a market share of 2.6%. BIDV Securities (BSC) climbed from 10th to 8th place with a market share of 2.95%, pushing FPTS to ninth place.

In the UPCoM market, VPS also took the lead with a significant market share of 28.16%, up from 22.31% in the previous quarter. SSI, VNDirect, TCBS, and MBS secured the next spots to round up the top 5.

HSC made a notable entry into the top 10, replacing SHS with a market share of 3.18% and claiming the ninth position. Vietcap also climbed four spots from 10th to 6th place with a market share of 4.59%. FPTS, VCBS, HSC, and BSC held on to the remaining spots in the top 10.

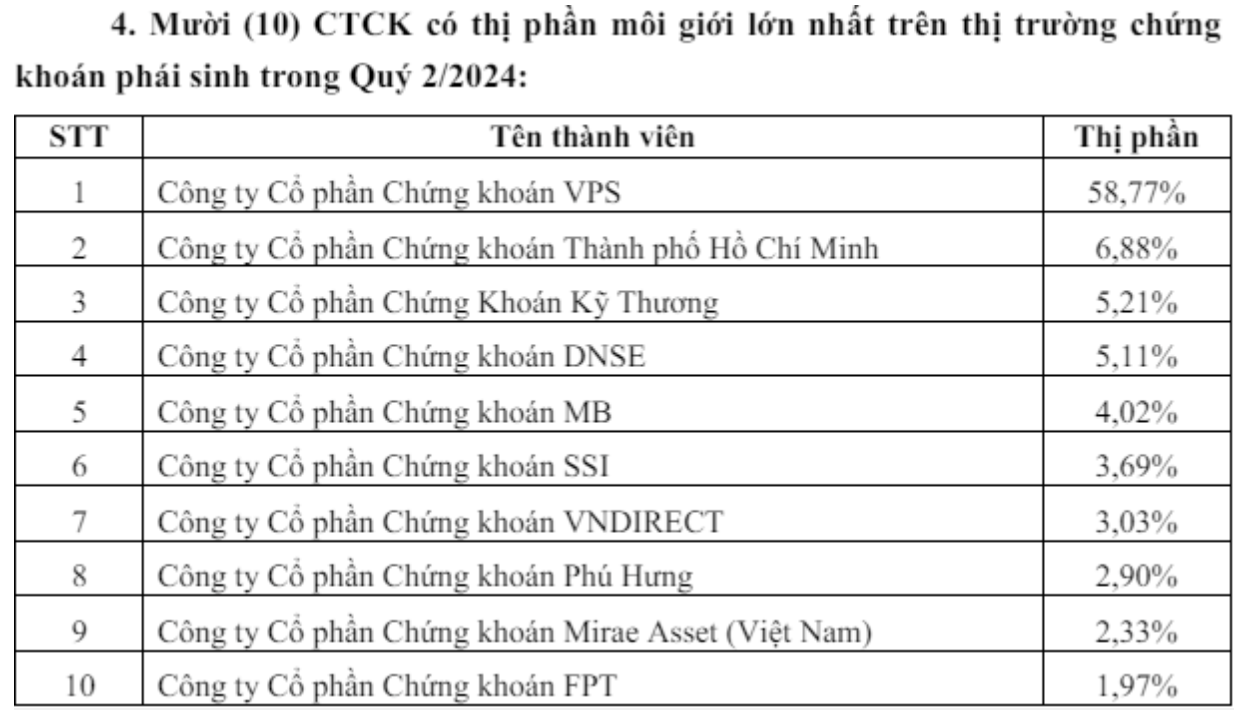

In the derivatives market, VPS continued to dominate, although its market share dipped slightly from 58.9% in the first quarter to 58.77% in the second quarter. HSC and TCBS trailed behind with market shares of 6.88% and 5.21%, respectively.

Notably, FPTS entered the top 10, replacing AIS Securities with a market share of 1.97%. DNSE, a newly listed company, climbed one spot to fourth place with a 5.11% market share. MBS also rose two spots from seventh to fifth, pushing SSI to sixth place.

Introducing a New Subsidiary of CII Issuing 550 Billion Dong Bonds

Following the success of BOT Binh Thuan, it is now the turn of the investor of the BOT project to expand Ha Noi Boulevard to issue a successful bond issue worth 550 billion VND. This is also a subsidiary of Ho Chi Minh City Infrastructure Investment JSC (CII).