|

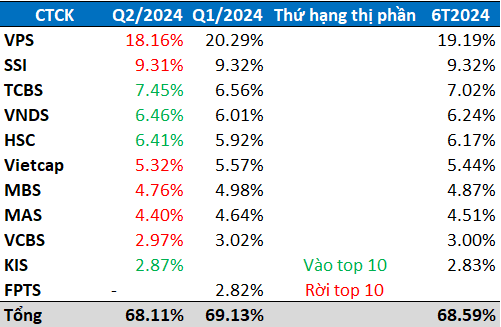

Top 10 Brokerage Market Share on HOSE in the First Half of 2024

Source: HOSE, Author’s Compilation

|

The ranking of the top 10 securities companies leading the brokerage market share on HOSE in Q2/2024 remained largely unchanged. VPS Securities took the top spot with an 18.16% market share, although it decreased by 2.13 percentage points compared to Q1.

Not only VPS, but among the 9 leading positions with no change in ranking, the market share of securities companies in the top 10 such as SSI Securities, Vietcap Securities (VCI), MB Securities (MBS), Mirae Asset Securities (MAS) and Vietcombank Securities (VCBS) also declined.

On the other hand, Techcom Securities (TCBS), VNDIRECT Securities (VNDS) and Ho Chi Minh City Securities Corporation (HSC) were the few securities companies that increased their market share.

There was a change in the 10th position as FPT Securities (FPTS) dropped out of the top 10 and was replaced by KIS Vietnam Securities (KIS) with a 2.87% market share.

With the overall declining trend, the total brokerage market share of the top 10 securities companies on HOSE narrowed to 68.11% in Q2, a decrease of 1.02 percentage points compared to Q1.

In the first 6 months of the year, the total brokerage market share of the top 10 leading securities companies accounted for 68.59% of the entire HOSE.

Foreign investors sell nearly 300 billion VND in the final trading session of the week, while strongly accumulating a real estate stock in the opposite direction.

In a fierce market session, foreign trading is a negative factor with net selling across all three exchanges.