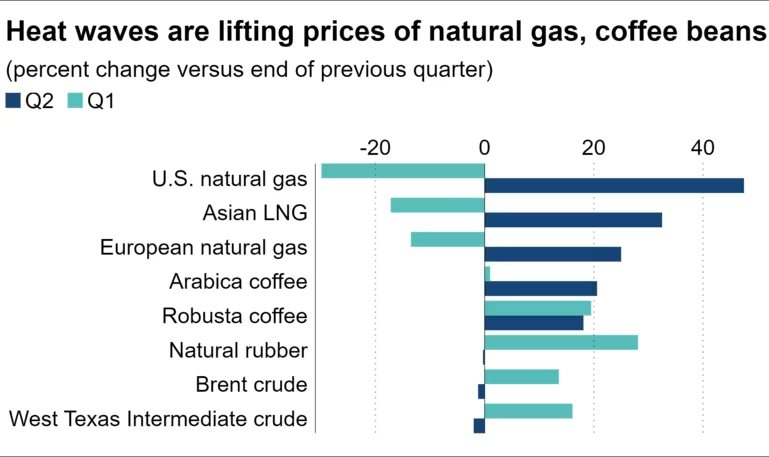

The price of robusta coffee futures in London rose 18.1% by the end of June compared to the end of March, reaching an all-time high of $4,394 per ton on June 6th. Meanwhile, arabica coffee futures prices surged 20.6%.

This increase occurred even as the FTSE/CoreCommodity CRB Index, a broad international indicator for the commodity market, hovered around 290 at the end of June, largely unchanged from the end of March. Futures prices for crude oil, a major component of the index, fell by about 1-2% during that period.

The main driver of the surge in coffee prices was the heatwave in Southeast Asia. Since April, the average temperature in the region, particularly in Vietnam, Thailand, and the Philippines, has been abnormally high, soaring to 48°C.

Vietnam produces about 40% of the world’s robusta coffee beans, which are used for instant coffee. However, Vietnamese coffee farmers are facing a severe drought. This has raised concerns about a potential impact on the autumn harvest.

Masanobu Takano, who works in the coffee and tea industry at Kobe-based trading firm S. Ishimitsu & Co., said, “Last year’s robusta harvest was poor, so prices have risen due to concerns about a second consecutive poor harvest, prolonging the tight supply-demand situation.”

The high temperatures in Southeast Asia have also affected the price of natural rubber, a key export for Thailand and Indonesia. Rubber futures prices on the Osaka Exchange, an international benchmark, rose to 360.90 yen ($2.23) per kg on June 10th, the highest since mid-March.

Rubber production tends to slow down between March and May due to a decrease in the supply of natural rubber liquid used in the manufacturing process. Subsequently, supply usually increases, causing prices to drop.

Gu Jiong of Yutaka Trusty Securities stated, “This year’s heatwave has damaged rubber trees, and the late recovery from the sluggish phase has contributed to the price surge in June.”

While rubber prices stabilized at the end of June at levels similar to the end of the previous quarter, they had previously spiked by up to 10%.

Heatwaves push up gas and coffee bean prices.

The heatwave’s impact wasn’t limited to Asia. Last month was the hottest May ever recorded globally, according to the National Oceanic and Atmospheric Administration. The average temperature surpassed the previous record high for the month, set in 2020.

The demand for electricity to power air conditioners drove up natural gas prices. Henry Hub natural gas futures, a North American benchmark, soared 48% since the end of March. Dutch TTF natural gas futures rose 25%, and the standard price of Asian liquefied natural gas increased by 33%.

The heatwave is likely to continue influencing commodity prices this quarter.

This year, we may witness a shift towards a La Nina climate pattern, which tends to bring hotter-than-usual summers to Japan and other regions. As a result, the demand for air conditioning is expected to keep LNG and other energy prices under upward pressure.

Reference: Nikkei Asia

First step in Mr. Dang Le Nguyen Vu’s plan to make 1 trillion USD: Opening 1,000 Trung Nguyen Legend stores in China and expanding into a global chain.

By the end of 2023, Vietnam’s economy is expected to reach a new nominal scale of 430 billion USD. However, Mr. Dang Le Nguyen Vu – the famous Chairman of Trung Nguyen Legend – boldly declares, “I will generate at least 1,000 billion dollars for Vietnam,” and confidently adds, “there must be something extraordinary behind such a statement!”