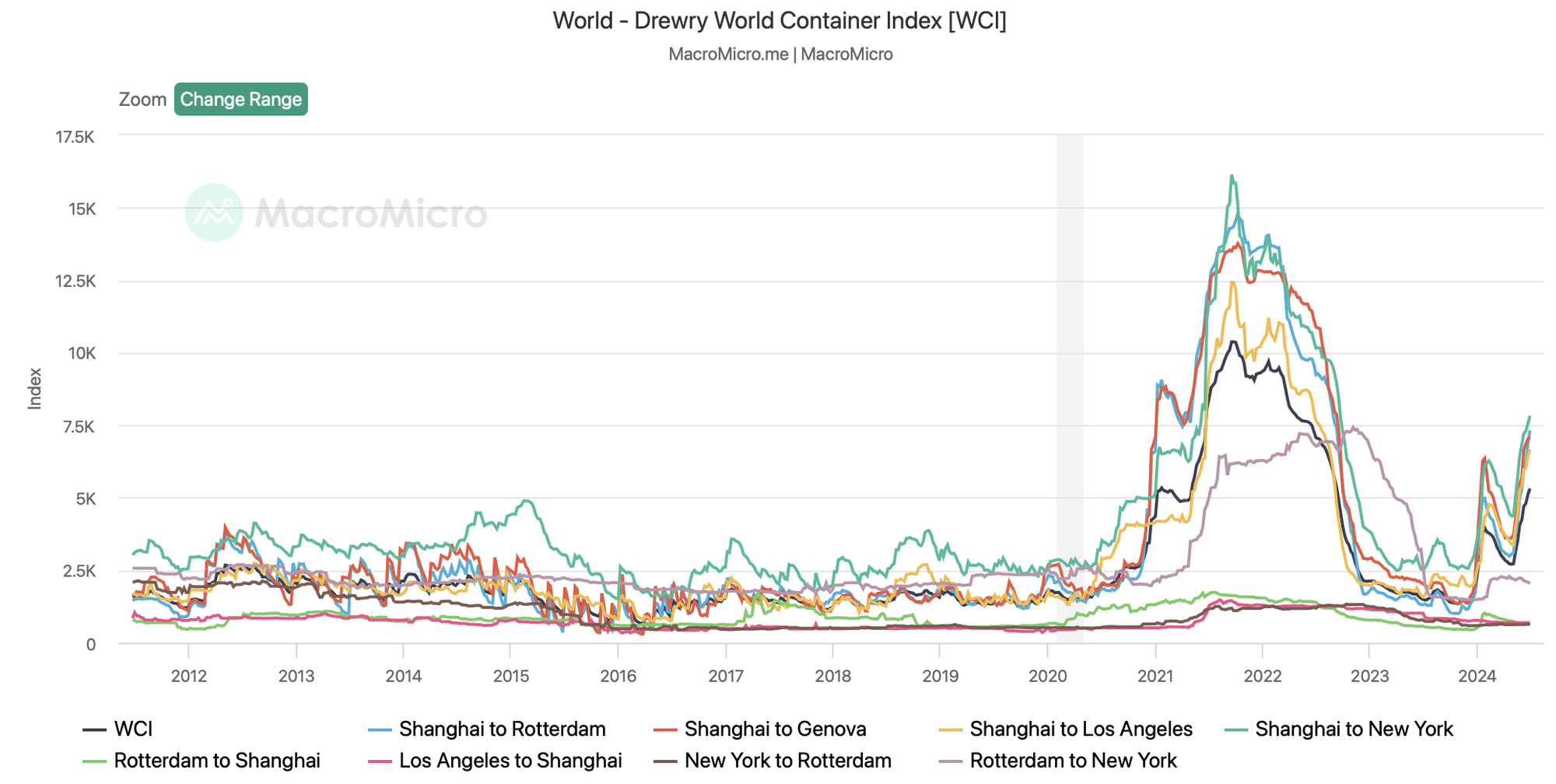

Red Sea regional tensions are causing freight rates to soar during the peak shipping season. As of June 27, freight rates from Asia to key routes such as the US and Europe have more than doubled since the beginning of the year. Compared to the record high during the Covid-19 pandemic, current rates are equivalent to about 50% of that level.

Since February 2024, most shipping lines have had to alter their routes and divert their vessels away from the Red Sea region, leading to a resurgence of bottlenecks in the supply chain and causing a “stacking” effect at major ports worldwide. A notable example is the Port of Singapore, the world’s largest transshipment hub, which is facing more severe congestion than during the peak of the Covid-19 pandemic.

The combination of port congestion and the need to reroute vessels will result in higher container rates. “The longer the disruption lasts, the higher our costs will be,” said Vincent Clerc, CEO of Maersk, the Danish shipping giant, during a recent online event with clients. “We don’t yet know exactly how much of these costs we will be able to recover and how long it will take. The current high rates are only temporary.”

Echoing this sentiment, a recent report by SSI Research suggests that the current pressures will persist and may even intensify during the peak season, with some relief expected in Q4 2024 when the peak shipping season ends and shipping lines can adjust their routes.

In addition to high freight rates, factors such as easing global inflationary pressures, recovering demand in China as economic support policies begin to take effect, and stable trade growth forecasts for the Asian region in 2024 are expected to positively impact shipping companies.

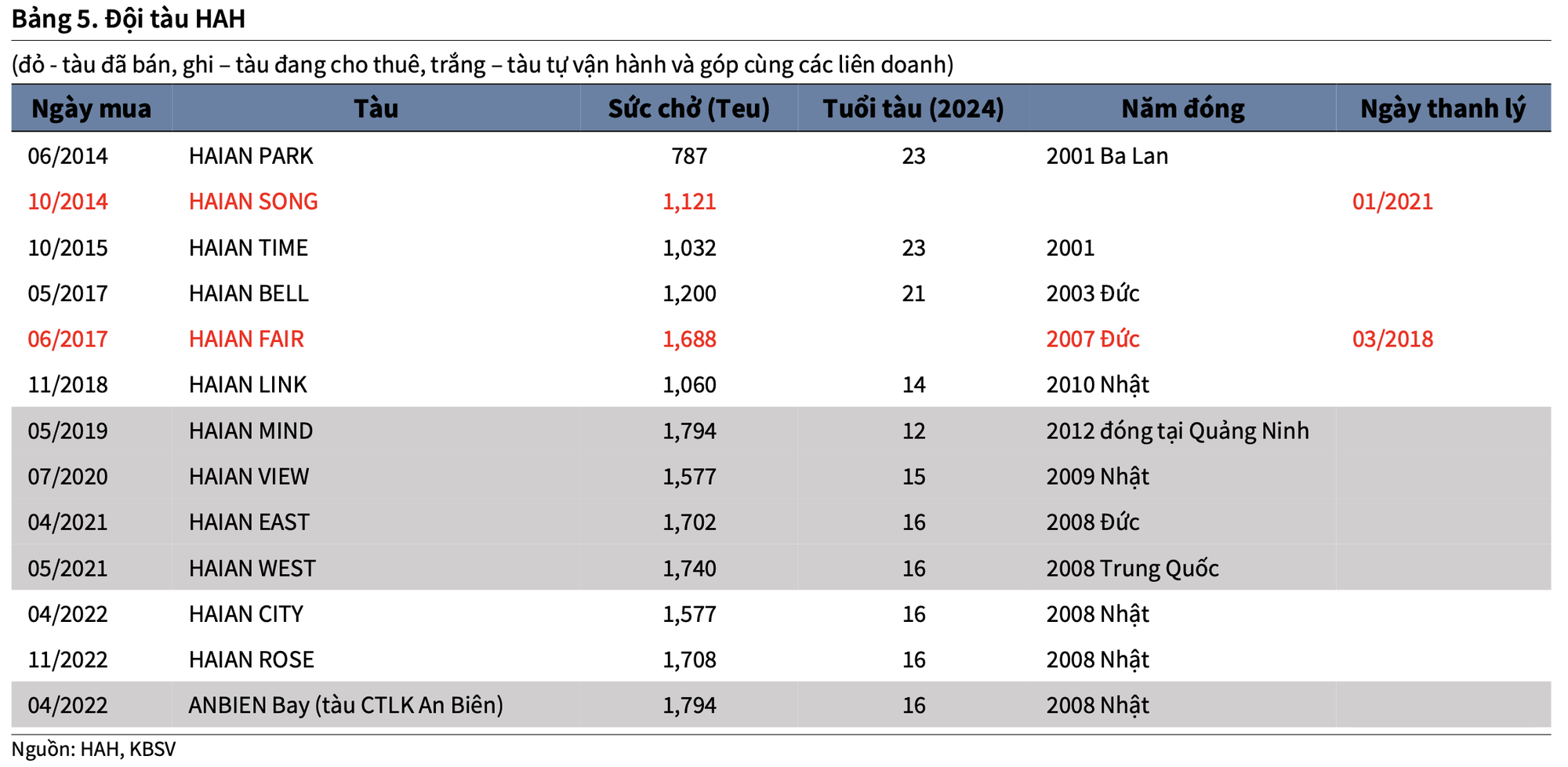

As a leading player in the Vietnamese maritime transport industry, Hai An Transport and Stevedoring (HAH) owns a large, young, and modern fleet of 15 vessels, accounting for 30% of the domestic market share. HAH is well-positioned to benefit significantly from the rising freight rates thanks to its large fleet size and diverse operating routes, with 40% of its capacity dedicated to the charter market and collaborations with top global shipping lines, including Israel’s ZIM and Singapore’s ONE.

In Q3 2024, Hai An is expected to add a new 1,800 TEU container vessel to its fleet, bringing the total number of vessels to 16. KBSV believes that the addition of new, modern vessels will attract more foreign shipping line partners. The current high demand for transportation and the prolonged Red Sea crisis are expected to alleviate concerns about potential overcapacity this year.

According to KBSV, Hai An is not directly impacted by the Red Sea crisis as its vessels mainly operate on domestic and intra-Asian routes. However, the global shortage of empty containers and high demand for vessels will indirectly affect overall freight rates, pushing up Hai An’s transportation rates.

Hai An’s vessel leasing business is expected to yield higher profits in the second half of the year, with four leasing contracts signed so far: three long-term contracts signed at the beginning of the year (valid until the end of 2024) and a new contract for Anbien Bay (valid until mid-2025). Additionally, two more vessels have been leased out from July 2024 to January 2025.

Moreover, Hai An’s vessel utilization is anticipated to recover strongly in the coming months. KBSV forecasts a total transportation volume of over 500,000 TEU for 2024, representing a 20% increase compared to 2023, driven by the recovery of goods demand in major markets such as the US and the EU.

Hai An is also strengthening its partnerships with leading shipping lines to expand its intra-Asian network, introducing new routes such as Vietnam-Singapore, calling at new ports, and seeking additional partners for slot exchanges, further solidifying and expanding the operations of its self-operated fleet.

Convenient Shipping Company Increases Fees

Shipping companies only notify changes in fees 15 days in advance without undergoing any checks, explaining the components of the fee, surcharges, or any binding reports.