Tightening Credit Limits for Large Borrowers. (Photo: Vietnam+)

|

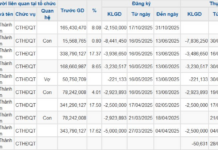

The Law on Credit Institutions 2024 came into force on July 1, marking the beginning of a planned reduction in lending limits.

Over the next five years, the total credit limit for a single borrower will decrease from the current maximum of 15% to 10% of a bank’s capital adequacy ratio (a reduction of 1% each year). The total credit limit for a borrower and related parties will also be reduced from 25% to 15% (a 2% reduction each year).

From July 1, 2024, to December 31, 2025, the credit limit will be reduced to 14% for a single borrower and 23% for a borrower and their related parties.

Previously, the Law on Credit Institutions stipulated that the total credit limit for a single borrower should not exceed 15% of the capital adequacy of a commercial bank, branch of a foreign bank, credit fund, or microfinance institution. The total credit limit for a borrower and related parties should not exceed 25%.

Analysts believe that this new regulation will help banks mitigate lending risks by reducing their dependence on a small group of borrowers, thereby maintaining system stability. The implementation of a gradual reduction in lending limits will also prevent large businesses from experiencing sudden funding disruptions.

Additionally, the new regulation will encourage credit institutions to diversify their loan portfolios and spread credit risk across multiple borrowers. This may create potential advantages for small businesses seeking loans.

Mr. Nguyen Quoc Hung, Secretary-General of the Vietnam Banks Association, stated that lowering credit limits would help banks limit the concentration of credit capital in a single borrower or group of borrowers, promote co-financing, reduce risks, and increase transparency. It would also boost the development of the capital market and reduce businesses’ over-reliance on bank loans.

However, some banks have expressed concerns that this regulation will impact their lending to large corporations and require adjustments to their lending strategies, credit risk management processes, and information technology systems.

Moreover, tightening credit limits may affect relationships with borrowers, who may face challenges due to increased borrowing complexity and costs associated with securing capital./.

Thuy Ha

Legal Loopholes in Bad Debt Processing

Bad debts and the speed of bad debt processing can be hindered when the right to collateral enforcement for borrowing customers is no longer inherited in Resolution 42/2017 amended by the Law on Amending Credit Institutions. This will force banks to carefully consider before lending, avoiding the risk of debt recovery in the future.

Vinatex Chairwoman: Without bank support, we risk losing the textile industry

“It is a statement made by Mr. Le Tien Truong, Chairman of Vietnam Textile Group (Vinatex, UPCoM: VGT) when discussing the fiber industry. He recommends that banks continue to support fiber businesses in 2024, without reducing credit limits or requiring fixed asset collateral.”