Backed by the state-owned investment company Temasek Holdings, CapitaLand is set to add assets worth between 100 and 150 million SGD (equivalent to 73-110 million USD) to its portfolio in Vietnam over the next two years, according to Ms. Patricia Goh, Chief Executive Officer of Investment for Southeast Asia at CapitaLand.

In addition to Vietnam, the company also plans to make similar investments in Malaysia and Thailand, with the ambition of boosting the rapid industrialization of the Association of Southeast Asian Nations (ASEAN).

Southeast Asia is becoming a focal point as industries seek to diversify their supply chains to cope with US-China trade tensions and lackluster economic growth.

“When you think about companies wanting to leave China, then Vietnam, particularly North Vietnam, and Thailand are the favorite destinations for many investors,” Ms. Goh shared in an interview with Nikkei Asia.

Ms. Patricia Goh, Chief Executive Officer of Investment for Southeast Asia at CapitaLand

|

Ms. Goh also revealed that Chinese textile and garment enterprises are eyeing Vietnam as a production base, while electronics manufacturers from South Korea are also considering setting up operations in the country.

Anticipating this shift, CapitaLand is scouting for land in Vietnam to build new factories or add existing industrial infrastructure to its portfolio. The company plans to own these facilities and lease them to manufacturing companies.

“Currently, in Vietnam, we don’t own any land. But we are very actively negotiating with several industrial park owners to be able to buy, and we have identified the sites that we want to make our mark on,” Ms. Goh stated.

CapitaLand Investment is also in “high-level” talks with manufacturers from China to establish new plants in Vietnam. The aim is to secure potential tenants for future properties in the country.

According to the company, they have a large network of potential clients from the Chinese market, thanks to managing six logistics parks and 11 business parks with over 7,000 tenants and customers in the world’s second-largest economy.

This investment plan comes as CapitaLand faces challenges in China. Last year, the company’s net profit fell 79% to 181 million SGD, mainly due to asset value write-downs in China due to declining rents.

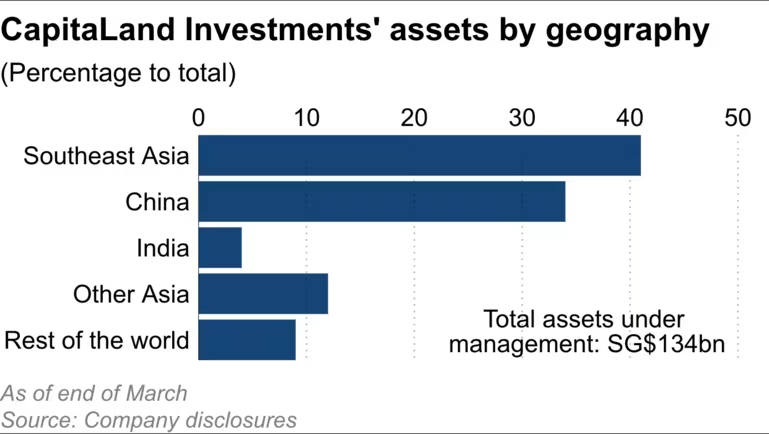

As of the end of March 2024, CapitaLand Investment managed 134 billion SGD worth of assets, of which China accounted for 34% and Southeast Asia 41%. Ms. Goh said the company does not have a plan for specific weightings for each ASEAN region but is focused on pursuing short-term growth in this area.

CapitaLand’s Asset Allocation

|

In Malaysia, CapitaLand is expected to inject about 300 million SGD over the next one to two years into industrial, logistics, and healthcare properties. The company is also considering the possibility of participating in a special economic zone in the state of Johor, which the Malaysian and Singaporean governments are jointly developing. However, she emphasized that CapitaLand is still in the initial phase of assessing the feasibility of this project.

Meanwhile, the company could invest 350 million SGD in Thailand over the next two years to buy land and build logistics properties such as warehouses, emphasizing that these facilities need to be modernized.

“Thailand has gone through the wave of manufacturing activity,” said Ms. Goh. “Now they are at the stage where warehouses and all those things will need to be modernized.”

In February, CapitaLand Investment announced its first logistics real estate project in Thailand, OMEGA 1 Bang Na, an automated storage facility with a total floor area of 229,000 square meters near Bangkok.

However, the CapitaLand director also pointed out several challenges in executing these investment plans. A prolonged high-interest rate environment is unfavorable for real estate managers seeking to expand their portfolios through debt. For CapitaLand, interest expenses rose to 574 million SGD in the 2023 financial year, up from 425 million SGD the previous year.

OCBC’s stock research department highlighted the increased borrowing costs in their April 2024 report. “Any sharp spike in interest rates could increase the borrowing costs of the real estate company,” the report said. The researchers also mentioned the “weakness in macroeconomic conditions” as another risk for CapitaLand.

The most extensive bribery case ever in Thanh Hoa: Numerous suspects prosecuted for “Giving and Receiving Bribes”

The Provincial Security Investigation Agency (PSIA) of Thanh Hoa province announced on January 31st that it has made the decision to initiate a prosecution against 23 individuals in connection with the offenses of “Accepting bribes” and “Giving bribes” as stipulated in Article 354(3) and Article 364(2) of the Criminal Code.

Mobile World achieves revenue of VND118,000 trillion: TVs, tablets, and phones all decrease by 10% – 50%, while one product grows in both quantity and revenue.

Mobile World Investment Corporation (MWG) has recently announced its 2023 business results. According to the report, the company’s consolidated revenue reached over 118 trillion Vietnamese dong, equivalent to 89% of the revenue in 2022.