On July 1st, 330 million DSE shares of DNSE Securities Joint Stock Company were officially listed on the Ho Chi Minh City Stock Exchange (HoSE). DNSE is the only securities company to have conducted an initial public offering (IPO) and been approved for listing in the past five years.

DNSE’s listing on HoSE is expected to bring a fresh dynamic to the stock market, which has been lacking in new listings.

A positive sign from the first two trading sessions was the net buying of DSE shares by foreign investors. On July 2nd, they net bought more than 6.6 million DSE shares. This was attributed to Consilium Investment Management (USA). Following this transaction, the fund holds over 2% of DNSE’s capital.

This is an attractive feature of DSE shares, given the net selling of billions of USD by foreign investors in 2024. Previously, in January 2024, Pyn Elite Fund (Finland) invested in DNSE with a value equivalent to 12% of the company’s capital at that time.

Historical data shows that the stock prices of securities companies tend to increase significantly after listing. Specifically, stock prices can rise by up to 5.9%-90.9% within one month, 5.9%-198.7% within three months, and 22.1%-198.7% within one year compared to the initial offering price. This provides a solid foundation for investors’ expectations of DSE’s growth trajectory.

However, the company’s potential lies in its solid long-term prospects.

DNSE’s Potential

DNSE’s reputation as a technology-driven securities company is evident in its pioneering efforts. In 2020, they introduced a 100% digital e-KYC account opening process, followed by an AI system capable of answering investors’ queries on stock valuation and data analysis. They also introduced a Margin Deal system that manages transactions proactively. In parallel, DNSE developed the ‘Bull and Bear’ social network to create an ecosystem that retains investors and expanded partnerships with multimedia platforms like ZaloPay, MBB, BID, VIB, and NAB.

In 2024, DNSE aims to enhance its order processing speed for derivative and spot market matching to 10 milliseconds per transaction and potentially achieve 5-8 milliseconds per transaction. The company also invests significantly in security systems, utilizing eSentire’s MDR solution to ensure network security. Additionally, they plan to integrate more AI features to gain a competitive edge.

DNSE’s focus on enhancing customer experience has quickly borne fruit. Their collaboration with partners like ZaloPay, which enables account opening and securities trading on e-wallets and other financial platforms, has resulted in impressive account growth. From the third quarter of 2023 to the second quarter of 2024, DNSE accounted for 25-35% of all new accounts opened in the market, a significant increase compared to previous periods.

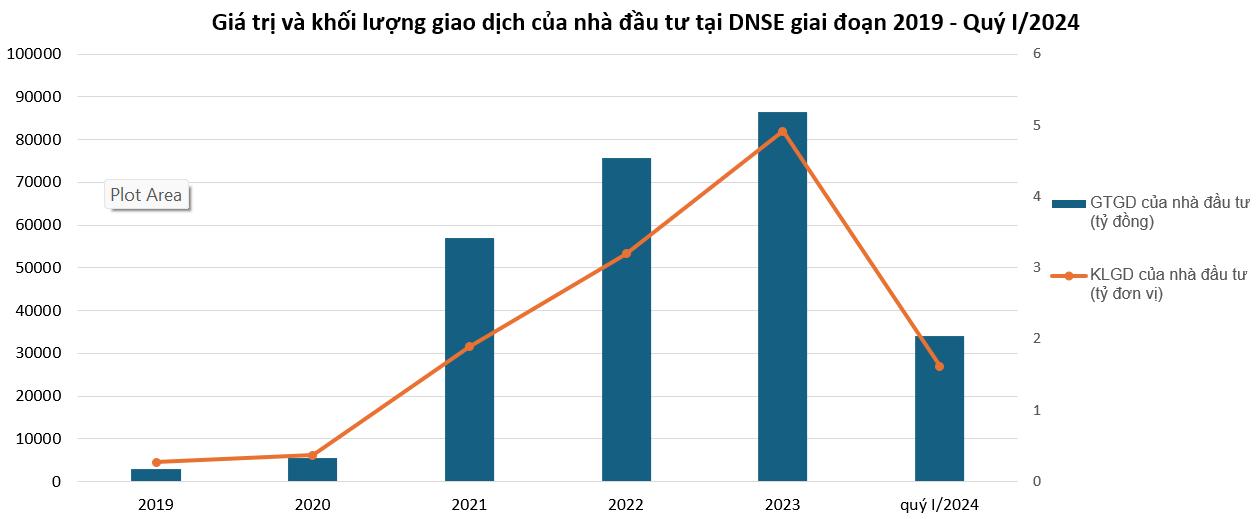

Moreover, the number of investor accounts trading at DNSE has been consistently increasing from 2019 to 2023.

In a thriving stock market that attracts new investors, DNSE’s technology-focused model is highly regarded for maintaining growth, attracting customers, and generating revenue and profits without directly competing with established industry players.

With a strong focus on technology, DNSE has been able to optimize costs more effectively than traditional competitors. In the first quarter of 2024, DNSE’s operating cost-to-revenue ratio was 27.4%, significantly lower than the industry average of 37.2%.

Additionally, DNSE’s automated investment advisory signals have delivered impressive performance. Since the beginning of 2024, the average profitability of stock recommendations based on “Fundamental Analysis” and “Wave Surfing” strategies on the Entrade X app has reached 31.2%, with a maximum of 120.8%.

For social media platforms, the average profitability of stock recommendations from DNSE’s “Investment Radar” program on YouTube is 21.5%, with a maximum of 83%. Given this proven track record, automated trading is expected to gain traction in the future, and DNSE is well-positioned to lead in this domain.

Furthermore, the effectiveness of DNSE’s business models is evident in its financial results. As of March 31, 2024, the company’s margin lending balance stood at VND 3,042 billion, a 26% increase. Additionally, the fair value of financial assets through profit and loss (FVTPL) reached VND 621 billion, more than doubling since the beginning of the year.

DNSE’s operating revenue for the first quarter of 2024 was VND 183 billion, a 120% increase year-over-year. Its pre-tax profit was VND 87.8 billion, up 20% from the same period last year, and after-tax profit was VND 70.1 billion, an 180% increase. In just the first three months of 2024, DNSE achieved 85% of its quarterly business plan under the base case scenario.

DNSE’s compound annual growth rate (CAGR) for margin lending in 2021-2023 was an impressive 47.6%, far outpacing the -2.7% growth rate of other securities companies. This indicates that DNSE has successfully captured the attention and interest of investors.

In addition to the remarkable profit growth mentioned above, DNSE has also formulated strategies for the derivatives segment, where it has already achieved success. In the first quarter of 2024, DNSE ranked among the top five brokerage market shares on the HNX with a 4.01% market share, just one year after launching its derivatives products. With a goal of reaching the top two by the end of 2024, DNSE is committed to building robust and sustainable derivative products for investors.

What to invest in the Year of the Dragon with a fortune?

According to experts, the domestic and global economy is facing challenges this year. As a result, individuals with available funds have various investment options to choose from, which are evaluated by experts to have profit potential, such as savings, gold, real estate, bonds, or stocks.