Bitcoin witnessed a 2.5% decline on July 5, slipping to $56,870 USD by 9:25 am, marking its fourth consecutive daily drop. This translates to a 22% decrease from its record high. Smaller cryptocurrencies like Ether and XRP suffered a similar fate.

|

Bitcoin’s Performance Over the Past Month

|

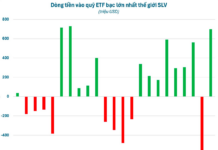

Crypto investors are currently navigating through a challenging landscape, ranging from diminishing demand for Bitcoin ETFs in the US to indications of the German government offloading seized tokens, and the unpredictable impact of US political developments.

Notably, administrators of the Mt. Gox exchange have started returning a significant amount of Bitcoin to creditors in phases. The question on everyone’s mind is, how much of the $8 billion Bitcoin will be dumped into the market? According to Arkham Intelligence, a wallet associated with Mt. Gox moved Bitcoin worth $2.7 billion on July 5.

Germany’s Federal Criminal Police Office transferred over $75 million to cryptocurrency exchanges, sparking concerns about a potential market dump.

“One of the main reasons for the price drop is the German government’s transfer of over $50 million to crypto exchanges, triggering market dump speculation,” shared Lucy Hu, a senior analyst at Metalpha, a crypto investment firm, via Telegram.

Fragile Correlation

Meanwhile, the MSCI global stock index hovers near its record high, and the 30-day short-term correlation between Bitcoin and this index has weakened significantly. The question arises whether the risk aversion in the crypto market is an isolated phenomenon or a harbinger of a cautious phase for mainstream investments after a robust first half for stocks.

Stefan von Haenisch, Head of Trading at OSL SG Pte, commented, “The crypto market currently lacks momentum. Most of the current news, such as Mt. Gox’s Bitcoin sale, is negative.”

Von Haenisch believes that the crypto market requires more positive signals from the US Federal Reserve’s monetary policy. “One to two rate cuts, coupled with the expansion of the Fed’s balance sheet, are the key factors that the crypto market is truly waiting for,” he added.

Investors are awaiting US jobs data on Friday (July 5) for the latest clues about the Fed’s policy outlook. Recent economic reports indicate a weakening US economy, reinforcing the rationale for the central bank to loosen monetary policy in the coming months.

Bitcoin reached an all-time high of $73,798 USD in March 2024, fueled by the excitement surrounding the first Bitcoin ETFs in the US. However, the momentum has faded since then, dragging Bitcoin down and exerting pressure on the entire digital asset market.

Applications for approval of Ethereum ETFs, the second-largest cryptocurrency, are pending, but interest in these products could wane if the crypto sell-off persists.

Vu Hao (According to Bloomberg)

Export of agricultural, forestry, and aquatic products increases by over 79%

According to the Ministry of Agriculture and Rural Development, in January 2024, the total export turnover of agriculture, forestry, and fisheries reached $5.14 billion, a 79.2% increase compared to the same period last year; while the import value was $3.72 billion. Therefore, the agriculture, forestry, and fisheries sector achieved a trade surplus of over $1.4 billion in the first month of 2024, a more than 4.6-fold increase compared to the same period last year.

Ensuring a Stable Fuel Supply for the Lunar New Year 2024

The Ministry of Industry and Trade has recently issued a letter to key petroleum producers, petroleum trading companies, and petroleum distribution businesses, requesting them to ensure a stable supply of petroleum for production, business, and consumption during the Lunar New Year holiday in 2024, which falls on the Year of the Wood Dragon.