Liquidity in the market increased compared to the previous trading session, with the VN-Index matching volume reaching over 501 million shares, equivalent to a value of more than 13.3 trillion VND; HNX-Index reached nearly 43 million shares, equivalent to more than 865 billion VND.

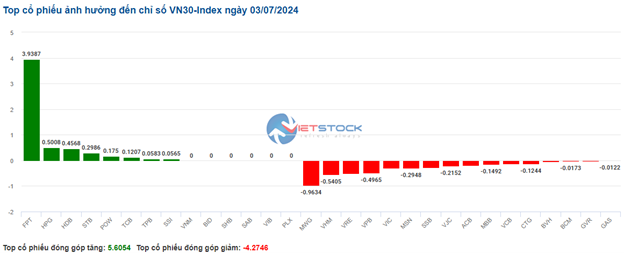

VN-Index opened the afternoon session with a surprise as buying power increased sharply, pushing the index higher, and then fluctuated around the reference level until the end of the session. In terms of impact, BID, FPT, TCB, and VCB were the codes with the most positive impact on the VN-Index, with an increase of over 4.1 points. On the contrary, HVN, VIC, VRE, and MWG were the codes with the most negative impact, taking away more than 0.89 points from the overall index.

| Top 10 stocks impacting the VN-Index on July 3, 2024 |

HNX-Index also had similar movements, with the index positively impacted by the codes DHT (+7.21%), SHS (+1.73%), CDN (+6.25%), KSV (+1.12%)…

|

Source: VietstockFinance

|

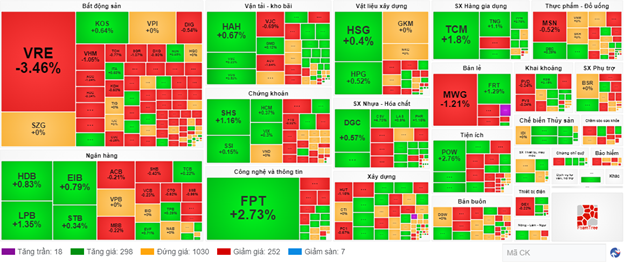

The information and technology sector was the group with the strongest increase, up 2%, mainly driven by the codes FPT (+2.34%), CTR (+0.49%), and DAD (+1.62%). This was followed by the accommodation, catering, and entertainment services sector, and the rubber products sector, with increases of 1.35% and 1.2%, respectively. On the other hand, the consulting and support services sector recorded the largest decrease in the market, falling by -0.8%, mainly due to the codes TV2 (-1.48%) and TV4 (-0.7%)

In terms of foreign investors’ transactions, they continued to net sell over 461 billion VND on the HOSE exchange, focusing on the codes VRE (408.74 billion), MWG (101.81 billion), VHM (68.34 billion), and DCM (18.19 billion). On the HNX exchange, foreign investors net bought over 8 billion VND, focusing on the code PVS (24.93 billion), NTP (1.55 billion), and TVC (1.14 billion).

| Foreign investors’ net buying and selling activities |

Morning Session: Persistent Mixed Sentiment, Weak Trading Volume

At the end of the morning session, mixed sentiment prevailed, resulting in most of the market hovering around the reference level. The VN-Index gained 1.5 points, temporarily standing at 1,271.29 points; HNX-Index rose 0.31 points to 241.11 points. The number of gainers temporarily outnumbered decliners, with 344 stocks rising and 269 falling.

The market’s trading volume remained low, while foreign investors net sold over 515 billion VND, narrowing the gains of the main indices compared to the early morning session. The trading volume of the VN-Index reached only 220 million units, with a value of nearly 6 trillion VND. The HNX-Index recorded a trading volume of just 22 million units, equivalent to 430 billion VND. If the market continues to be lackluster in the afternoon session, the trading volume is likely to remain below the 20-session average.

The information technology sector is leading the market with a solid gain of 2.42%. This growth is mainly driven by the stock FPT, which rose by 2.89%. Additionally, stocks such as ICT, ITD, and GLT also contributed positively to the sector’s performance, increasing by 3.5%, 3.36%, and 1.94%, respectively.

Following closely is the plastics and chemicals production sector, with prominent stocks in the industry, including DGC (+1.38%), DCM (+2.7%), DPM (+2.06%), and BMP (+1.32%). Other stocks in the sector also performed well, with DPR rising by 2.15%, LAS by 2.24%, BFC by 2.83%, and CSV reaching the ceiling price with a gain of 6.91%.

However, there was a clear divergence in trading activity within the mining stocks group. Notably, KSB maintained a strong gain of nearly 4%, along with KSV (+2.81%) and KSQ (+2.78%). In contrast, stocks such as PVS, TMB, HGM, PVB, THT, NBC, TNT, and others turned red by the end of the morning session.

Regarding foreign investors’ transactions, they continued to net sell for the tenth consecutive session. In the morning session, they net sold nearly 498 billion VND on the HOSE exchange, focusing on the stock VRE. On the HNX exchange, foreign investors net sold nearly 1 billion VND, mainly offloading the stock MBS.

10:40 AM: Selling Pressure Persists

Investor sentiment remained uncertain, causing the main indices’ gains to weaken and fluctuate around the reference level. As of 10:40 AM, the VN-Index rose slightly by 0.7 points, hovering around 1,270 points. The HNX-Index gained 0.5 points, trading around 241 points.

Stocks such as MWG, VHM, VRE, and VPB are negatively impacting the VN30-Index, taking away 0.96 points, 0.54 points, 0.51 points, and 0.50 points, respectively, from the overall index. Conversely, FPT, HPG, HDB, and STB are the pillars supporting the VN30, adding more than 4.3 points.

Source: VietstockFinance

|

The information and technology sector stood out with a notable gain of 2.19%. This growth was mainly driven by the large-cap stock FPT (+2.5%) and several other stocks, including GLT (+1.94%), ICT (+3.5%), and ITD (+0.56%)… Meanwhile, CMG (-1.11%) and CTR (-0.35%) are moving against the overall trend as selling pressure remains high.

From a technical analysis perspective, during the morning session of July 3, 2024, the FPT stock continued its upward momentum, accompanied by an increase in trading volume compared to the previous session, indicating a positive investor sentiment. Currently, FPT is consistently forming higher highs and higher lows after the appearance of a golden cross between the 50-day and 100-day simple moving averages (SMAs), suggesting a positive long-term outlook. However, the Stochastic Oscillator and MACD indicators continue to trend downward after generating sell signals, suggesting that a short-term correction is still in play, and the 50-day SMA will act as a crucial support level for this stock going forward.

Source: https://stockchart.vietstock.vn/

|

Following this upward momentum is the seafood processing industry, which has maintained its positive performance since the beginning of the session. Specifically, the positive impact mainly came from large-cap stocks such as VHC (+0.98%), ANV (+0.45%), ASM (+0.44%), and FMC (+0.1%)… The remaining stocks, including ACL, CMX, KHS, and others, remained unchanged.

On the other hand, the real estate sector continued to face challenges as most stocks recorded losses. Specifically, VHM fell by -0.92%, VIC by -0.48%, BCM by -0.78%, and VRE by -2.76%… Conversely, a few stocks showed slight recovery, including HAR (+0.73%), KOS (+0.64%), LDG (+2.17%), and ITA (+0.38%).

Compared to the beginning of the session, the number of unchanged stocks remained high at over 1,000. However, buyers slightly outnumbered sellers. There were 298 stocks that advanced, while 252 stocks declined.

Source: VietstockFinance

|

Opening: Maintaining a Positive Outlook

The market started the session on July 3, 2024, on a positive note. The VN-Index opened in the green. As of 9:30 AM, the index gained nearly 2 points, reaching 1,271.17 points. Meanwhile, the HNX-Index edged higher, standing at 241.38 points.

Buyers are showing a more optimistic stance, with 305 stocks rising and over 133 stocks falling, indicating a clear advantage for the buying side.

The information and technology sector led the market’s growth and contributed positively to the morning session’s performance, with stocks such as FPT rising by 2.11%, ICT by 2.8%, and ELC by 0.2%. Conversely, stocks such as CTR and CMG are in negative territory, falling by less than 1%.

Following closely is the electrical equipment sector, which also maintained its positive performance from the start of the session. Notably, stocks such as GEX rose by 0.44%, RAL by 2.05%, SAM by 0.87%, PAC by 0.1%, and MBG by 2.44%.

Most sectors are in positive territory, except for the real estate, mining, and auxiliary production sectors, which recorded slight declines.