Market liquidity increased compared to the previous session, with the VN-Index matching volume reaching over 589 million shares, equivalent to a value of more than 15.2 trillion VND; HNX-Index reached nearly 58 million shares, equivalent to a value of more than 1.1 trillion VND.

VN-Index opened the afternoon session with a tug-of-war around the reference level but towards the end of the session, buying power continued to increase, helping buyers dominate and close above the reference level.

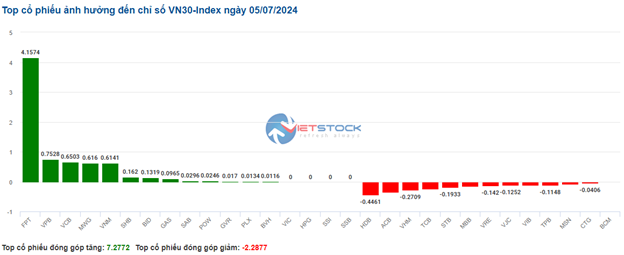

In terms of impact, HVN, FPT, LPB, and CTG were the codes that had the most positive impact on the VN-Index, with an increase of more than 3.4 points. On the contrary, SAB, VRE, HDB, and DXG were the codes with the most negative impact, taking away more than 0.75 points from the overall index.

| Top 10 stocks with the strongest impact on the VN-Index on July 5th |

The HNX-Index also followed a similar trajectory, with positive impacts from the codes NTP (+5%), MBS (+2.18%), PVI (+1.58%), and PTI (+4.75%)…

|

Source: VietstockFinance

|

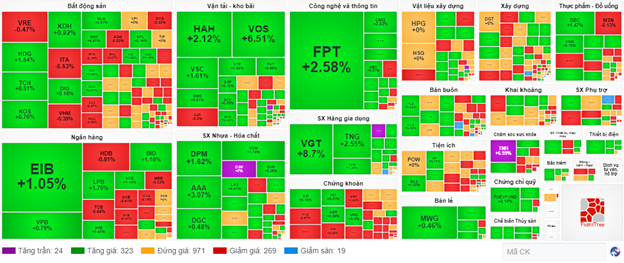

The transportation and warehousing sector was the group with the strongest increase, up 2.28%, mainly driven by the codes HVN (+6.29%), VJC (+0.4%), GMD (+1.95%), VOS (+6.77%), HAH (+1.9%), and VSC (+1.83%). This was followed by the information and technology sector and the household goods manufacturing sector, with increases of 2.03% and 1.68%, respectively.

On the other hand, the consulting and support services sector experienced the largest decrease in the market, with a decline of -4.94%, mainly due to the codes TV2 (-6.9%) and TV4 (-0.7%)

In terms of foreign transactions, they continued to net sell more than 365 billion VND on the HOSE exchange, focusing on the codes FPT (230.97 billion), VRE (145.1 billion), HPG (92.33 billion), and VPB (56.75 billion).

On the HNX exchange, foreigners net bought nearly 43 billion VND, focusing on the codes PVS (48.84 billion), LAS (4.93 billion), and MBS (2.93 billion).

| Foreign Buying and Selling Dynamics |

Morning Session: Sellers Win, VN-Index Drops Below Reference Level

VN-Index after a tug-of-war around the reference level for most of the morning session, returned to negative territory. At the end of the morning session, the VN-Index decreased by 1.76 points, equivalent to 0.14%. The HNX decreased by 1.16 points, equivalent to 0.48%.

The trading volume of the VN-Index recorded in the morning session exceeded 269 million units, with a value of nearly 7 trillion VND. The HNX-Index recorded a trading volume of more than 27 million units, with a trading value of over 500 billion VND.

FPT, BID, and VCB were the main factors in the VN30 basket that helped the VN-Index avoid a more negative decline at the end of the morning session. On the contrary, the Large Caps that dragged down the index included the codes VRE, SAB, HDB, TPB, VIB, BCM, GVR,…

Most sectors were in the red at the end of the morning session, including the transportation and warehousing sector, which was also affected despite achieving a fairly positive growth rate earlier. Some sectors, such as consulting and support services, agriculture, forestry, fisheries, and other financial sectors, even experienced more negative declines. Meanwhile, the utilities and banking groups maintained a good growth rate from the beginning of the session but ended with a relatively low proportion.

On the other hand, the household goods manufacturing sector continued to record positive growth until the end of the morning session. This included stocks such as TNG (+1.46%), STK (+3.46%), GIL (+1.05%), ADS (+1.16%), GDT (+3.7%),… Notably, SAV stock hit the ceiling price right from the start of the morning session with a 6.76% increase.

10:40 am: FPT and CSV Impress with Strong Gains

VN-Index increased by 4.68 points, trading around 1,284 points. HNX-Index slightly increased by 0.06 points, trading around 241 points.

The majority of stocks in the VN30 basket witnessed strong increases. Notably, FPT, VPB, VCB, and MWG contributed 4.16 points, 0.75 points, 0.65 points, and 0.62 points to the VN30 index, respectively. On the contrary, HDB, ACB, VHM, and TCB were the stocks that continued to face selling pressure, taking away more than 1 point from the index.

Source: VietstockFinance

|

Stocks in the information and technology sector impressed with a 1.96% increase. Specifically, the green color mainly focused on large-cap stocks such as FPT, which increased by 2.58%, CMG by 2.02%, CTR by 3.31%, and ELC by 0.2%… The remaining stocks remained unchanged, while a few still faced slight selling pressure, including DST, ITD, and SGT, but the impact was not significant.

Following this was the plastics and chemicals manufacturing sector, which also contributed to the market’s overall upward momentum, with most stocks in the green, such as GVR, which increased by 0.43%, DGC by 0.32%, DCM by 1.88%, and DPM by 1.76%… Notably, CSV stood out from the beginning of the session, maintaining a positive purple color.

From a technical analysis perspective, during the morning session of July 5, 2024, CSV continued to surge strongly and closely followed the upper band (Upper Band) of the Bollinger Bands, with projected liquidity exceeding the 20-day average at the end of the session, indicating a positive outlook. Additionally, the stock’s price successfully broke through the upper edge of the bullish price channel (Bullish Price Channel), while the MACD continued to stay above the zero level and trended upward after giving a buy signal, further reinforcing the medium-term uptrend.

Currently, the CSV stock price has successfully surpassed the 100% Fibonacci Projection threshold (corresponding to the 26,600-28,600 region) and is heading towards the potential price target (target price) of the 161.8% Fibonacci Projection threshold (corresponding to the 39,000-40,000 region).

Source: https://stockchart.vietstock.vn/

|

Additionally, the seafood processing group recorded a fairly positive growth rate, with the upward momentum mainly concentrated in four large-cap stocks: VHC, which increased by 1.1%, ANV by 0.6%, ASM by 0.44%, and IDI by 0.42%…

In contrast, the real estate and securities sectors exhibited less optimistic dynamics, with the breadth of the decline continuing to outweigh the advancing stocks. Specifically, VHM decreased by 0.39%, BCM by 0.78%, VRE by 0.71%, NVL by 0.37%, HCM by 0.18%, SHS by 0.56%, and FTS by 0.58%….

Compared to the beginning of the session, the majority of stocks remained unchanged, with over 970 codes. However, the buying side still held a slight advantage. There were more than 323 codes that increased, while more than 269 codes decreased.

Source: VietstockFinance

|

Opening: Cautious Start to the Session

As of 9:40 am, the VN-Index fluctuated around the reference level, hovering around 1,280 points. The HNX-Index also slightly increased, trading around 242 points.

The red color temporarily held the upper hand in the VN30 basket, with 18 decreasing codes, 10 increasing codes, and 2 unchanged codes. Among them, FPT, GVR, and PLX were the stocks that witnessed the strongest gains. Conversely, VHM, BCM, and VRE were the stocks that experienced the most significant losses.

Stocks in the information and technology sector were among the most prominent industries in the market during the morning session. These stocks displayed positive green colors, such as FPT, which increased by 1.33%, CMG by 2.02%, CTR by 0.14%, ELC by 0.59%, ICT by 3.38%,…

On the contrary, the consulting and support services sector led the declining groups, negatively impacting the market in the morning session. The stocks in this sector that experienced declines included TV2, KPF, and TV4, with decreases of 6.9%, 0.66%, and 0.7%, respectively.