The “Asia Bond Monitor” report, released by the Asian Development Bank (ADB) on June 26, revealed a rise in bond yields in emerging East Asia amid expectations of prolonged elevated interest rates. Slower-than-anticipated disinflation further bolstered this trend, pushing up bond yields in both advanced economies and regional markets.

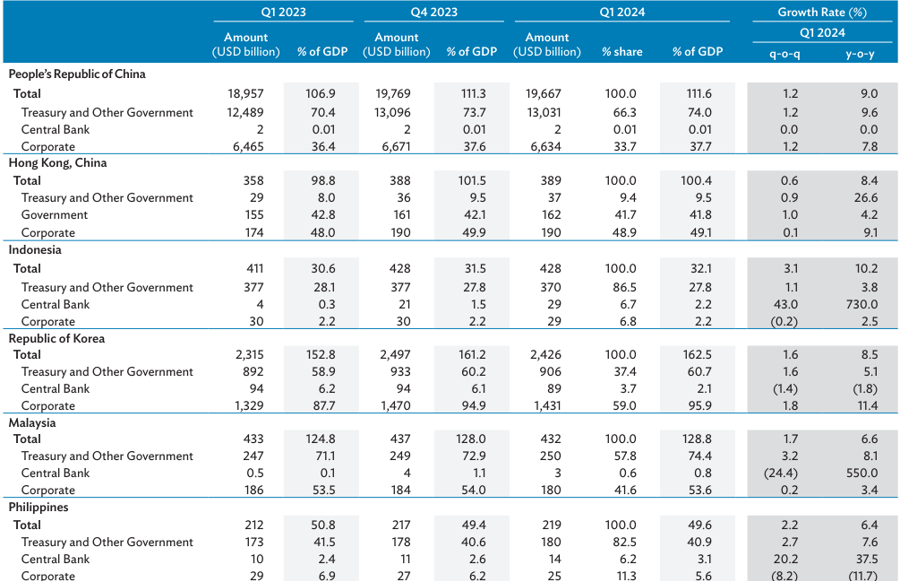

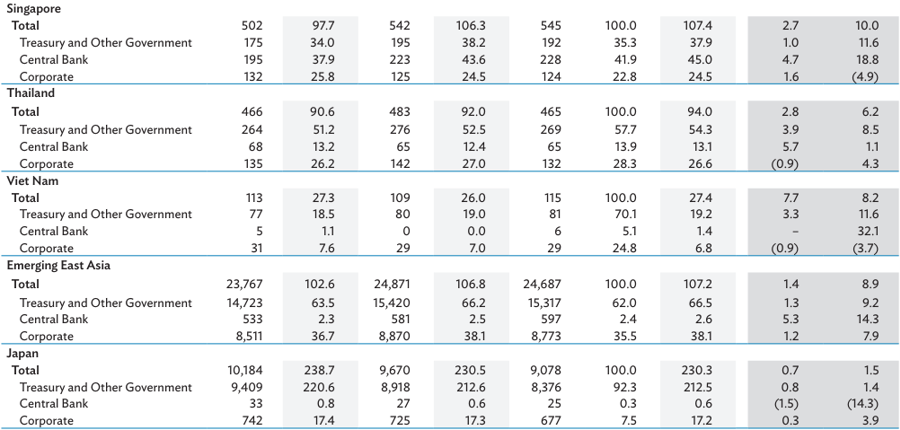

Emerging East Asia encompasses the economies of ASEAN members, China, Hong Kong, and the Republic of Korea (ROK). The report highlighted a notable expansion in the region’s local currency (LCY) bond markets, with outstanding bonds reaching $24.7 trillion as of the end of March, reflecting an impressive 8.9% year-on-year growth. This pace outperformed both the US and European Union markets, showcasing the region’s robust financial landscape.

Vietnam and Thailand stood out as shining stars, experiencing growth in their LCY bond markets after previous contractions. Vietnam, in particular, witnessed a remarkable 7.7% quarter-on-quarter expansion in the first quarter of this year, a stark contrast to the 0.4% decline in the final quarter of 2023. This improvement can be attributed to increased government issuance and the resumption of central bank bills by the State Bank of Vietnam to bolster the Vietnamese dong (VND)

Delving into the specifics of Vietnam’s bond market, we find that treasury and other government bonds accounted for the lion’s share of the country’s total debt stock. These bonds, totaling VND2,004.2 trillion ($78.69 billion), exhibited a 3.3% quarter-on-quarter growth in Q1 due to increased issuance to support the government’s financial needs.

On the other hand, corporate bonds, valued at VND709.7 trillion ($27.8 billion), made up a significant 24.8% of the total LCY bond market at the end of March. However, they experienced a 0.9% contraction quarter-on-quarter due to a high volume of maturities and low issuance during the same period. This contraction stands in contrast to the overall LCY bond market growth of 7.7%, underscoring the challenges faced by corporate bond issuers.

The report also shed light on the impact of Decree No.08/2023/ND-CP, which suspended or postponed certain provisions from Decree No.65/2022/ND-CP. As a result, corporate bond issuers faced difficulties in meeting the requirements of Decree No. 65, creating a challenging environment for them.

Additionally, the issuance of central bank bills contracted by 45.2% quarter-on-quarter, as the State Bank of Vietnam resumed issuance only in the last month of the quarter. In contrast, treasury and other government bond issuances witnessed a substantial increase, more than doubling from the previous quarter to VND90.5 trillion ($3.55 billion)

The Vietnamese sustainable bond market, comprising solely corporate-issued green and sustainable bonds, contracted slightly by 0.5% quarter-on-quarter to $800 million in Q1. The majority of this market consisted of short-term sustainability bonds, with green bonds making up the remaining portion and resulting in an average tenor of 3.2 years.

Foreign-currency-denominated instruments dominated the economy’s sustainable bond landscape, accounting for over 70% of the total at the end of March. This highlights the reliance on foreign investment and the potential impact of exchange rate fluctuations on the market.

In comparison to other markets, the size of emerging East Asian LCY bond markets was impressive. As of the end of March, it equated to 64% of the US bond market and a substantial 115.3% of the EU-20. China, South Korea, and Japan were the key drivers of this regional success story.

“Emerging East Asia’s financial resilience is evident,” remarked ADB Chief Economist Albert Park. However, he also cautioned about the impact of lingering geopolitical tensions and adverse climate events, which could push inflation higher and create uncertainty in disinflation trends. This, in turn, may lead some regional monetary authorities to maintain higher interest rates for an extended period to safeguard their currencies.

The most extensive bribery case ever in Thanh Hoa: Numerous suspects prosecuted for “Giving and Receiving Bribes”

The Provincial Security Investigation Agency (PSIA) of Thanh Hoa province announced on January 31st that it has made the decision to initiate a prosecution against 23 individuals in connection with the offenses of “Accepting bribes” and “Giving bribes” as stipulated in Article 354(3) and Article 364(2) of the Criminal Code.

“Prosecution of government officials, land registration officers, and tax department employees in the largest bribery case ever”

The Thanh Hoa Police Investigative Agency has initiated legal proceedings against 23 individuals involved in the crimes of “Bribery” and “Receiving bribes”. This is the largest bribery case in terms of the number of suspects ever discovered and apprehended by the Thanh Hoa Police.