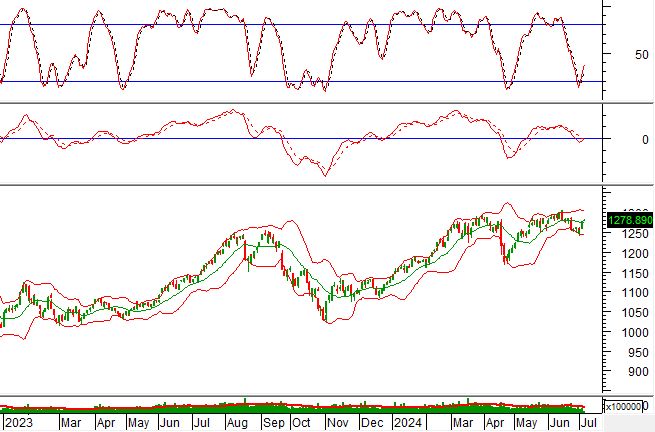

Technical Indicators for VN-Index

During the trading session on the morning of 07/04/2024, the VN-Index gained points as trading volume slightly increased, indicating investors’ optimism.

Currently, the VN-Index has cut above the Middle Bollinger Band, while the MACD indicator is gradually narrowing the gap with the Signal line. If a buy signal appears, the short-term uptrend will likely resume in the upcoming sessions.

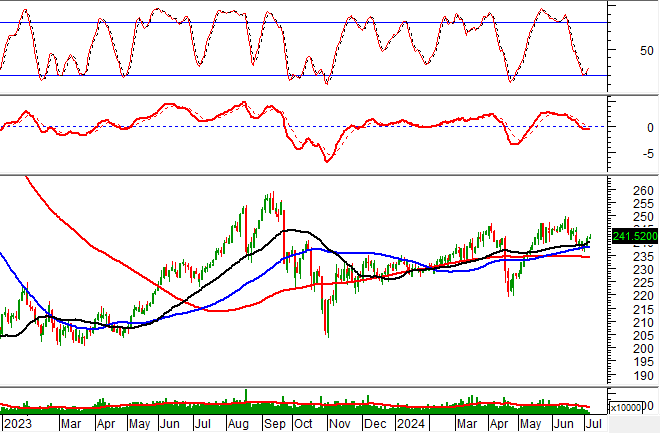

Technical Signals for HNX-Index

On 07/04/2024, the HNX-Index increased alongside a slight rise in trading volume during the morning session, reflecting investors’ positive sentiment.

Moreover, the HNX-Index is well-supported by the 50-day and 100-day SMA lines, while the Stochastic Oscillator continues to trend upward after previously giving a buy signal, indicating that the medium-term optimistic outlook remains intact.

BSR – Binh Son Refining and Petrochemical Joint Stock Company

During the morning session of 07/04/2024, BSR witnessed a significant surge in both stock prices and trading volume, expected to surpass the 20-day average by the session’s end, reflecting investors’ optimism.

Additionally, the stock price continues to retest the old peak from September 2023 (equivalent to the 22,000-23,000 range) as the MACD indicator narrows the gap with the Signal line after previously giving a sell signal. Should a buy signal reappear, a positive upward scenario is likely to unfold in the upcoming sessions.

Furthermore, the 50-day SMA line solidly supports the stock price, suggesting that the medium-term uptrend remains valid.

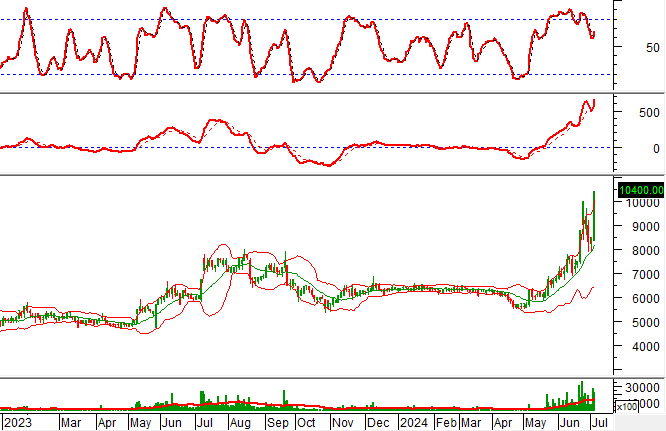

TVN – Vietnam Steel Corporation – Joint Stock Company

On 07/04/2024, TVN soared to the daily limit, forming a White Marubozu candlestick pattern, and liquidity surpassed the 20-session average, indicating active trading by investors.

Currently, the stock price continues to rally after successfully testing the Middle Bollinger Band, and the Stochastic Oscillator provides a buy signal again, further reinforcing the short-term uptrend.

Moreover, the stock price consistently forms higher highs and higher lows, confirming the robustness of the established uptrend.

Technical Analysis Department, Vietstock Consulting

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.