Market liquidity decreased compared to the previous trading session, with the VN-Index matching volume reaching over 702 million shares, equivalent to a value of more than 18 trillion VND; HNX-Index reached over 71 million shares, equivalent to a value of more than 1.3 trillion VND.

VN-Index opened the afternoon session with increased selling pressure, causing the index to weaken and fall below the reference mark, despite the emergence of unexpected demand. In terms of impact, HPG, HDB, ACB, and VHM were the most negative stocks, taking away more than 1.3 points from the index. On the other hand, LPB, FPT, GVR, and PLX were the most positive influences on the VN-Index, contributing over 3 points.

| Top 10 stocks with the strongest impact on the VN-Index on June 21st |

In contrast, the HNX-Index performed quite positively, with positive influences from stocks such as DTK (-9.79%), VIF (-9.94%), PVI (-2.69%), and MBS (-1.46%).

|

Source: VietstockFinance

|

The seafood processing industry recorded the sharpest decline in the market at -0.97%, mainly due to VHC (-1.73%), ASM (-0.43%), FMC (-1.38%), and IDI (-0.41%). This was followed by the construction materials and securities industries, which fell by 0.83% and 0.77%, respectively. On the other hand, the wholesale industry witnessed the strongest recovery, rising by 2.01%, driven by PLX (+2.42%), DGW (+1.43%), PET (+1.05%), and VFG (+6.18%).

In terms of foreign investors’ transactions, they continued to net sell over 1,040 billion VND on the HOSE exchange, focusing on FPT (227.38 billion), VND (106.84 billion), VRE (85.04 billion), and VHM (73.73 billion). On the HNX exchange, foreign investors net sold nearly 35 billion VND, focusing on SHS (14.67 billion), PVS (13.39 billion), HUT (11.65 billion), IDC (10.54 billion), and CEO (3.85 billion).

| Foreign Investors’ Buying and Selling Activities |

Morning Session: Foreign Investors Continue Net Selling, VN-Index Remains in Green

At the end of the morning session, all three exchanges maintained their upward momentum, with the VN-Index gaining over 4.5 points to temporarily stand above 1,286 points. The HNX-Index also edged up slightly to 244.85 points. The number of rising stocks temporarily outnumbered declining ones, with 454 gainers and 262 losers.

The agriculture, forestry, and fisheries sector led the market with a solid increase of 2.54%. Stocks in this sector, such as HAG, HNG, and NSC, ended the morning session in positive territory. Notably, CTP and VIF surged by 6.67% and 9.94%, respectively.

The index improvement was largely attributed to the contribution of information technology stocks, including FPT (+1.58%), CTR (+1.39%), ELC (+1.96%), SGT (+6.67%), and ICT (+3.99%), among others. Conversely, GLT and EBS witnessed sharp declines from the beginning of the session, falling by 2.91% and 8.87%, respectively.

Money flow was also evident in the plastics and chemicals production group, as most stocks in this sector turned green from the start of the morning session. Notable performers included GVR, DGC, DPM, DCM, and NTP. In particular, TNC hit the ceiling price with a gain of 6.93%.

However, there was a clear divergence in the electrical equipment group. While RAL reached the ceiling price with a gain of 6.96%, and GEX and DQC rose by nearly 1% and 3%, respectively, other stocks in this sector, such as MBG and TYA, remained in negative territory until the end of the morning session.

Regarding foreign investors’ transactions, they continued net selling for the tenth consecutive session. In the morning session, they net sold over 594 billion VND on the HOSE exchange, focusing on FPT and VHM. On the HNX exchange, foreign investors net sold over 8 billion VND, mainly offloading PVS.

10:40 am: Real Estate Sector Creates Obstacles, VN-Index Continues to Fluctuate

Balanced buying and selling pressures kept the indices fluctuating around the reference marks. As of 10:40 am, the VN-Index rose slightly by 2.46 points to trade around 1,284 points, while the HNX-Index gained 0.92 points to trade around 244 points.

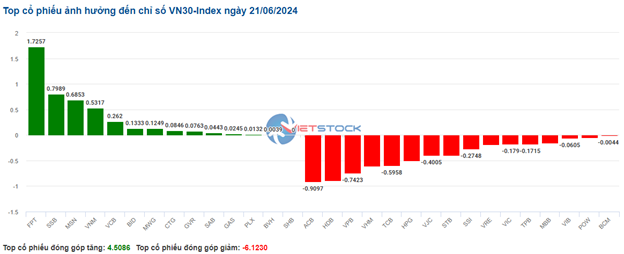

Stocks in the VN30 basket showed a slightly negative bias, with 16 decliners, 10 gainers, and 4 unchanged. Specifically, ACB, HDB, VPB, and VHM were the biggest drags on the index, subtracting 0.91, 0.89, 0.74, and 0.61 points, respectively. Conversely, FPT, SSB, MSN, and VNM were among the most bought stocks, contributing over 3.6 points to the VN30-Index.

Source: VietstockFinance

|

The agriculture, forestry, and fisheries sector led the market with a gain of 2.4%, driven by HAG (+0.8%), VIF (+9.94%), NSC (+0.92%), and others.

Following closely was the food and beverage sector, which contributed to the overall market gain with a rise of 0.93%. This increase was mainly driven by large-cap stocks such as VNM (+1.21%), MSN (+1.32%), SAB (+0.48%), and DBC (+1.93%). The majority of the remaining stocks in this sector remained unchanged. As of 10:40 am, the trading value reached over 610 billion VND, with a volume of nearly 15 million units.

Regarding BDC, from a technical perspective, the stock’s price surged in the morning session, accompanied by an increase in trading volume above the 20-session average, indicating more active trading. However, as the price of PVT is testing the old peak of March-April 2022 (corresponding to the 36,500-38,500 range), the emergence of a bearish divergence in the MACD and Stochastic Oscillator indicators suggests a less optimistic scenario. If these signals do not improve in the coming sessions, a correction may occur, with the SMA 50 and SMA 100 serving as strong support levels.

Source: https://stockchart.vietstock.vn/

|

On the other hand, the real estate sector exhibited strong divergence, with selling pressure dominating. Specifically, VHM (-1.18%), VIC (-0.48%), VRE (-0.99%), and KDH (-0.53%) remained in negative territory from the start of the session. Meanwhile, BCM (+0.31%), NVL (+0.74%), KBC (+0.17%), and TCH (+0.24%) managed to stay in positive territory but with modest gains.

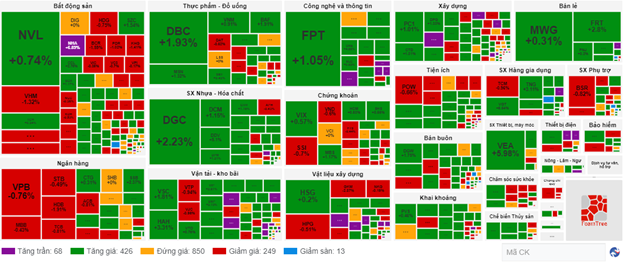

Compared to the opening, buying and selling forces were well-balanced, with 850 stocks trading around the reference price. However, buyers slightly edged out sellers, with 426 gainers (including 68 stocks hitting the ceiling price) and 249 losers (including 13 stocks hitting the floor price).

Source: VietstockFinance

|

9:40 am: Cautious Start to the Session

At the start of the June 21st session, as of 9:40 am, the VN-Index edged slightly lower, fluctuating around the reference mark, near the 1,282-point level. Meanwhile, the HNX-Index posted a slight gain, trading above 244.05 points.

The red color temporarily dominated the VN30 basket, with 16 decliners, 10 gainers, and 4 unchanged stocks. In particular, HDB, VHM, and VJC were the top losers. On the other hand, GVR, VNM, and FPT were the biggest gainers.

The agriculture, forestry, and fisheries sector stood out at the beginning of the morning session, with stocks like VIF surging to the ceiling price (+9.94%), followed by HAG (+0.8%), CTP (+6.67%), HSL (+0.93%), and NSC (+0.39%), among others.

Along with this, the plastics and chemicals production group contributed positively to the market performance, rising by 1.1%. Notable performers in this sector included GVR (+1.62%), DGC (+1.31%), DCM (+1.78%), DPM (+1.34%), NTP (+2.07%), and PHR (+0.82%), to name a few.

Dragon Capital Chairman: “Long-term vision is needed, accepting necessary adjustments for a safer, more efficient, and higher quality market”

According to Mr. Dominic Scriven, Chairman of Dragon Capital, the role of the finance industry in the stock market will be significant in 2023 and possibly in 2024. The roles of other industries, such as real estate or consumer goods, will depend on their respective challenges.