In the international market, the US Dollar Index fell below the 105 mark, settling at 104.88, a 1% decrease week-on-week.

The USD weakened to a one-month low as the latest PCE data for May indicated a continued easing of inflation in the US, setting the stage for the Fed to initiate monetary policy easing in the coming months.

Expectations for a Fed rate cut further intensified following a weaker-than-expected jobs report.

According to the US Department of Labor’s report released on July 5, non-farm payrolls increased by 206,000, slightly higher than economists’ forecast of 200,000. However, this figure was lower than May’s upwardly revised figure of 218,000 (initially estimated at 272,000).

The unemployment rate unexpectedly rose to 4.1%, the highest since October 2021, and above the expected 4% forecast by economists.

This data reflects the pressure on the US economy and bolsters expectations of a Fed rate cut, reducing the demand for the USD.

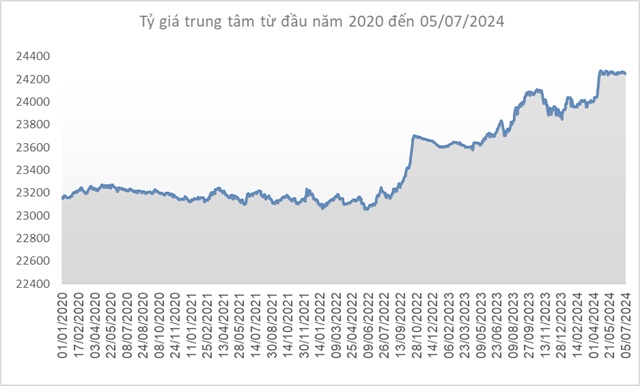

Source: SBV

|

In Vietnam, the central exchange rate of the Vietnamese Dong to USD weakened by 14 VND, settling at 24,246 VND per USD on July 5.

The State Bank of Vietnam (SBV) kept the immediate buying rate unchanged at 23,400 VND per USD. Additionally, the selling rate remained at 25,450 VND per USD since April 19. This is the intervention selling rate at which the SBV offers USD to commercial banks with negative foreign currency positions to bring their positions back to zero.

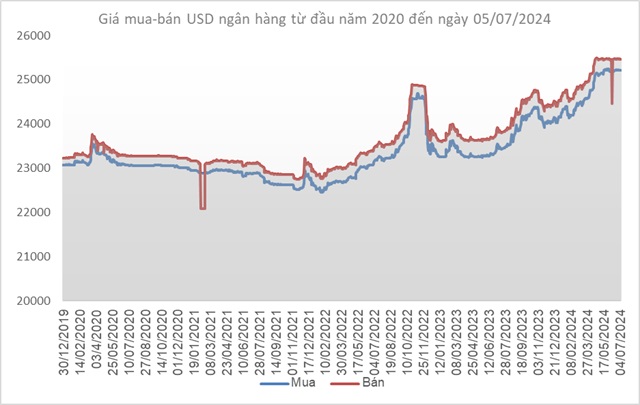

Source: VCB

|

Following a similar trend, Vietcombank’s posted exchange rates decreased by 15 VND in both buying and selling rates, settling at 25,208-25,458 VND/USD.

Source: VietstockFinance

|

Which region has the largest and smallest wealth inequality in the country?

With a staggering 11-12 times difference in income, this individual earns in a month what others make in a whole year.