Liquidity in the market increased compared to the previous trading session, with the matched trading volume of the VN-Index reaching nearly 1.1 billion shares, equivalent to a value of over 28 trillion VND; HNX-Index reached more than 110 million shares, equivalent to a value of more than 2.3 trillion VND.

| HOSE’s liquidity increased strongly on June 24, 2024 |

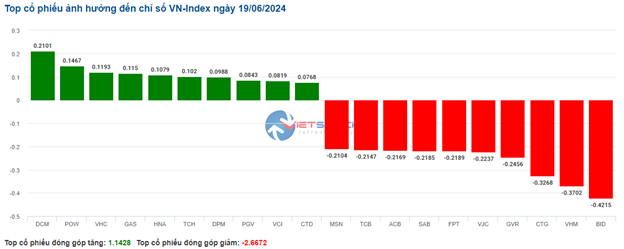

VN-Index opened the afternoon session with a tug-of-war below the reference level, and selling pressure continued to increase, causing the index to plunge until the end of the session. In terms of impact, GVR, VPB, FPT, and HVN were the most negative stocks, taking away more than 5.6 points from the index. On the other hand, POW, HNG, ITA, and KBC tried to salvage the index with a gain of more than 0.37 points.

| Top 10 stocks with the strongest impact on VN-Index |

HNX-Index also followed a similar trend, with the index negatively impacted by MBS (-8.65%), VCS (-5.98%), PVS (-3.72%), and NTP (-9%),…

|

Source: VietstockFinance

|

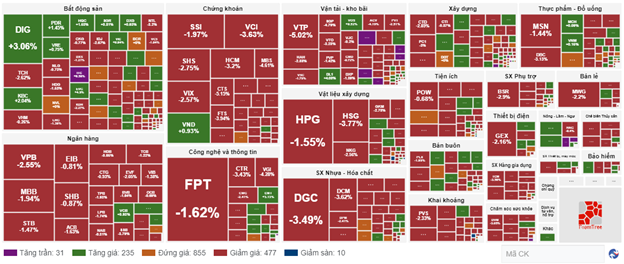

The securities industry recorded the sharpest decline in the market, falling by -4.53%, mainly due to SSI (-2.54%), VCI (-5.6%), HCM (-5.68%), and MBS (-8.65%). This was followed by the mining and plastics – chemicals industries, which fell by 4.49% and 4.36%, respectively. In contrast, the agriculture – forestry – fishery industry witnessed the strongest recovery, with a gain of 2.53%, mainly driven by HAG (+1.61%), VIF (+9.55%), and HNG (+6.97%).

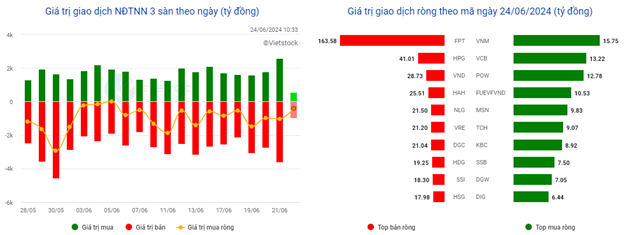

In terms of foreign trading activities, they continued to net sell over 1,012 billion VND on the HOSE exchange, focusing on FPT (609.25 billion VND), NLG (76.77 billion VND), SSI (58.08 billion VND), and VPB (54.55 billion VND). On the HNX exchange, foreign investors net bought over 23 billion VND, focusing on IDC (23.52 billion VND), PVS (15.73 billion VND), TVC (3.04 billion VND), and BVS (2.42 billion VND).

| Foreigners’ Buying and Selling Activities |

Morning Session: Large-cap stocks put pressure on the market, causing VN-Index to plunge

The pressure from large-cap stocks caused the market to plunge during the morning session. VN-Index extended its losing streak compared to the beginning of the session. By the end of the morning session, VN-Index had lost more than 18 points, falling to 1,263.99 points. VN30-Index fell more than 22 points, settling at 1,297.88 points.

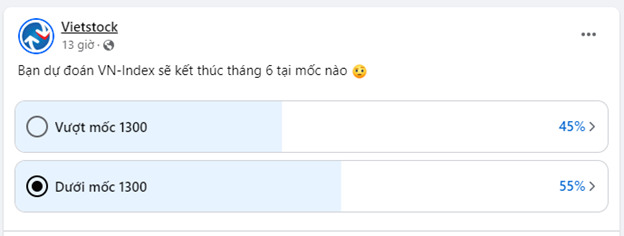

According to a survey on Vietstock’s fanpage, out of more than 1,300 votes, 55% predicted that VN-Index would end June below the 1,300-point threshold. Market sentiment seems to be somewhat pessimistic.

The survey received over 1,300 votes on Vietstock’s Fanpage

|

As of the end of the morning session, the VN30 group was dominated by red, with 24 declining stocks, while only 4 stocks posted gains. POW, VCB, VRE, and VIC were the only stocks in the VN30 basket that managed to stay in the green, but their impact on the index was not significant.

Stocks in the mining, securities, and plastics – chemicals industries continued to paint a negative picture throughout the morning session. In the securities industry, 23 out of 26 stocks declined, while the remaining 3, including IVS and WSS, remained unchanged. VND was the only stock that managed to stay in the green, posting a gain of 0.62%.

In the mining industry, 19 out of 29 stocks declined, while the banking industry also witnessed a sea of red, with 18 out of 21 stocks trading in negative territory.

Similarly, the plastics – chemicals industry painted a gloomy picture. This was mainly due to stocks such as DGC, which fell sharply by 4.25%, while GVR, DCM, and DPM all declined by nearly 4%,…

10:45 am: Red Dominates as Money Flows Out of the Securities Industry

Investor sentiment turned quite bearish as selling pressure intensified, causing the main indices to reverse course and fall sharply. As of 10:40 am, VN-Index had lost 12 points, trading around the 1,270-point level. HNX-Index fell 2.91 points, trading around 241 points.

FPT, VPB, and MWG were the top three stocks with the most negative impact on the VN30 index, taking away 3 points, 1.97 points, and 1.34 points, respectively, from the VN30-Index. On the other hand, VIC, VCB, VNM, and VJC were among the few stocks that attempted to support the index, contributing 0.68 points, 0.66 points, 0.26 points, and 0.16 points, respectively.

Source: VietstockFinance

|

Leading the decline was the securities industry, which fell sharply by 3.36%. Notably, VCI, HCM, MBS, and FTS dropped between 3.37% and 4.61%… Only VND managed to stay in positive territory, but the gain was insignificant. As of 10:40 am, outflows from this industry exceeded 1,600 billion VND, with a trading volume of nearly 65 million units.

Next was the plastics – chemicals industry, which fell by 3.24%. Specifically, GVR (-4.2%), DGC (-4.1%), DCM (-4.56%), and DPM (-3.35%) led the decline…

From a technical perspective, DGC stock formed a Black Marubozu candlestick pattern after testing the upper edge (corresponding to the 128,900-135,000 range) of the Ascending Triangle pattern during the morning session. This formation, coupled with increased trading volume, indicated a pessimistic investor sentiment. At the moment, the Stochastic Oscillator indicator is still trending upward after providing a buy signal. If the optimistic outlook is maintained in the coming period and DGC stock successfully breaks above the upper edge of the Ascending Triangle pattern, the potential price target could be in the range of 175,000-178,000.

Source: https://stockchart.vietstock.vn/

|

The market breadth inclined towards sellers, with over 470 declining stocks, outnumbering the approximately 230 advancing stocks.

Source: VietstockFinance

|

Total trading volume on the three exchanges exceeded 495 million units, corresponding to a value of over 12.3 trillion VND. Foreign investors continued to net sell over 404 billion VND, focusing on FPT, HPG, and VND.

Source: VietstockFinance

|

10:05 am: Unexpected Plunge

VN-Index unexpectedly plunged more than 10 points after a tug-of-war at the beginning of the session. The index even dipped below the 1,270-point support level. Trading volume also surged as the index fell sharply.

HPG led the market in terms of liquidity, with a trading volume of nearly 13 million shares. This stock witnessed a sharp drop in tandem with the decline of VN-Index.

Opening: Tug-of-War

At the start of the June 24 session, VN-Index fluctuated around the reference level, reaching 1,282.2 points. HNX-Index edged slightly higher, climbing to 244.79 points.

Large-cap stocks, such as BID, VCB, and VNM, led the market higher, contributing nearly 2 points to the index. Conversely, FPT, GVR, and VPB weighed on the market, dragging the index down by more than 1 point.

Green prevailed in the morning session, with insurance stocks making a strong showing from the beginning. Notably, BVH rose 0.78%, PVI climbed 1.48%, BIC jumped 3.6%, MIG gained 2.49%, BMI inched up 0.57%, and PGI advanced 1.25%. The remaining insurance stocks, including VNR, PTI, and PRE, maintained their opening prices.

Additionally, real estate stocks exhibited stable growth, with most stocks trading in positive territory. Notably, DIG rose 3.25%, PDR climbed 2.07%, CEO gained 2.3%, VRE advanced 1.25%, NVL inched up 1.1%, VHM rose 0.66%, and DXG climbed 1.58%,…

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.