With over 310 million shares in circulation, GMD is estimated to spend approximately VND 683 billion on this dividend payout. The ex-dividend date is July 15, with a projected payment date of August 16.

GMD’s 2024 Annual General Meeting of Shareholders, held on June 25, approved a profit distribution plan for 2023 with a 22% cash dividend. Thus, GMD decided to pay the 2023 dividend in a single installment.

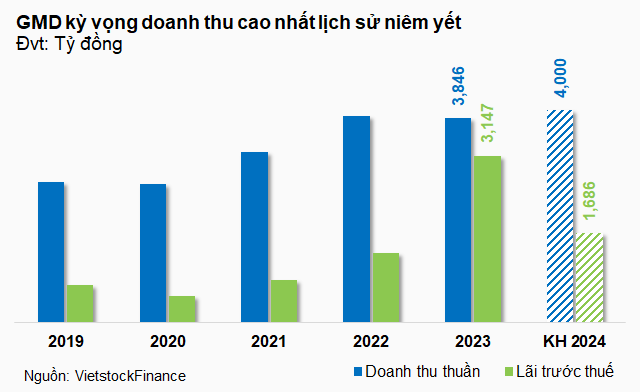

At the meeting, shareholders also approved the highest-ever revenue plan since the company’s listing in 2002, targeting VND 4,000 billion, a 4% increase compared to the 2023 performance. GMD expects a pre-tax profit of VND 1,686 billion, including VND 1,350 billion from business operations and VND 336 billion from the transfer of capital in its subsidiary.

GMD’s management has outlined a development roadmap focusing on the Nam Dinh Vu Port Phase 3 project (scheduled to commence in July 2024 and complete in December 2025) and the Gemalink Port Phase 2A project (expected to start construction in Q2 2025 and become operational in 2026).

In the first quarter, GMD recorded a 11% and 130% increase in revenue and pre-tax profit, respectively, compared to the same period last year, amounting to VND 1,006 billion and VND 708 billion. The VND 336 billion profit from the transfer of capital in its subsidiary was accounted for in Q1 after GMD divested its entire 99.98% stake in Nam Hai Port JSC to Vietsun.

As of the end of Q1, GMD had achieved 25% of its revenue target and 42% of its profit goal for the year.

In addition to the upcoming dividend payment, GMD shareholders have also benefited from the upward trend in the share price. As of the market close on July 3, GMD’s share price stood at VND 82,200 per share, a 58% increase compared to the same period last year. The performance of GMD’s share price, particularly in the logistics and port industry, has been positively influenced by recent events causing disruptions in global supply chains.

| GMD’s share price maintains an upward trend |

At the recent AGM, GMD representatives shared insights into the freight rate situation and provided a forecast for the upcoming period: “Freight rates have increased by 300% compared to the same period in 2023 and 34% compared to May 2024. This upward trend is expected to continue until the end of 2024, influenced by various factors such as disputes in the Red Sea, conflicts, and shortages of ships and equipment.”

Huy Khai