Oil prices fell on Friday as progress was made towards a ceasefire in Gaza

Oil Slides as Gaza Ceasefire Talks Progress, Gold Hits One-Month High

Oil prices fell on Friday as progress was made towards a ceasefire in Gaza, despite strong fuel demand and potential supply disruptions from storms in the Gulf of Mexico. Brent crude futures fell 1.02% to $86.54 per barrel, while WTI crude futures settled at $83.16, a decrease of 0.9%. The potential for a ceasefire comes as a relief to oil markets, which have been concerned about the impact of ongoing conflicts on supply and demand.

According to the EIA, US oil inventories saw a larger-than-expected decline of 12.2 million barrels last week, compared to analyst estimates of a 700,000-barrel drop. As for supply, Hurricane Beryl made landfall in Mexico, with oil production in the region expected to be unaffected, but oil projects in the northern US could face disruptions.

Gold Reaches Over One-Month High After US Jobs Data

Gold prices continued to climb on Friday, reaching their highest level in over a month after crucial US jobs data indicated a weakening labor market. Spot gold rose 1.3% to $2,385.63 per ounce, with gold bullion prices up over 2% for the week. Gold futures also increased by 1.2% to $2,397.70. The non-farm payrolls data showed an addition of 206,000 jobs in June, slightly above estimates, while the unemployment rate rose to 4.1%, indicating a potential shift in the Fed’s interest rate trajectory.

Copper Hits Three-Week High as US Rate Cut Expectations Grow

Copper prices on the LME reached a three-week high on Friday, ending the week with gains for the first time in seven weeks. The metal’s futures rose 0.7% to $9,946 per tonne, supported by expectations of a potential US rate cut. The metal touched a session high of $10,000 and faced resistance at the 50-day moving average of $9,993. Copper’s performance this week reflects a shift in market sentiment as investors anticipate a more dovish stance from the Fed.

Coffee Prices Rise on Dry Weather in Brazil

Coffee futures rose on Friday, with arabica coffee for September delivery up 2.1% to $2.2895 per lb. The rise was attributed to dry weather in Brazil, which could impact the size of the coffee beans. Robusta coffee for September also increased by 0.8% to $4,185 per tonne.

Wheat, Corn, and Soybean Prices Surge on Export Demand and Weather Concerns

Wheat futures on the Chicago Board of Trade surged on Friday due to increased demand for US wheat and a weaker dollar. Corn and soybean futures also rose amid concerns about hot and dry weather disrupting crops during a critical growing period. Red soft winter wheat futures ended the day up 16-1/2 cents at $5.90-1/2 per bushel. Soybean futures for November rose 8-1/4 cents to $11.29-3/4, while December corn gained 4-1/2 cents to $4.24 per bushel.

Rubber Hits Seven-Week Low on Profit-Taking, Strong Yen

Rubber futures in Japan fell to a seven-week low on Friday as traders locked in profits after recent gains, and a stronger yen weighed on prices. The most active rubber contract on the Osaka Exchange fell 1.85% to 324.1 yen per kg ($2.02), with the yen touching a session low of 320.2 yen earlier in the day. Rubber futures on the Shanghai Futures Exchange also declined, ending down 465 yuan at a six-week low of 14,580 yuan ($2,006.11) per tonne.

Rice Exports from Thailand and Vietnam Fall on Policy Changes and High Freight Rates

Rice export prices from Thailand and Vietnam declined this week due to slow buying ahead of policy changes in the Philippines, a key importer. High freight rates also impacted demand for Indian rice from African buyers. Thai 5% broken rice prices fell to $585 per tonne, the lowest since April 25, while Vietnamese 5% broken rice was offered at $575 per tonne, down from $575-$580 a week earlier.

Iron Ore Falls on Profit-Taking, But Posts Second Weekly Gain on China Stimulus Hopes

Iron ore futures fell on Friday as traders locked in profits following recent gains, but prices posted their second consecutive weekly increase on hopes of further economic stimulus in China. The September iron ore contract on China’s Dalian Commodity Exchange ended the session over 2% lower at 845.5 yuan ($116.3) per tonne. The contract rose 3.2% for the week. Singapore’s iron ore futures for August fell 3.3% to $110.20 per tonne, up 3.6% on a weekly basis.

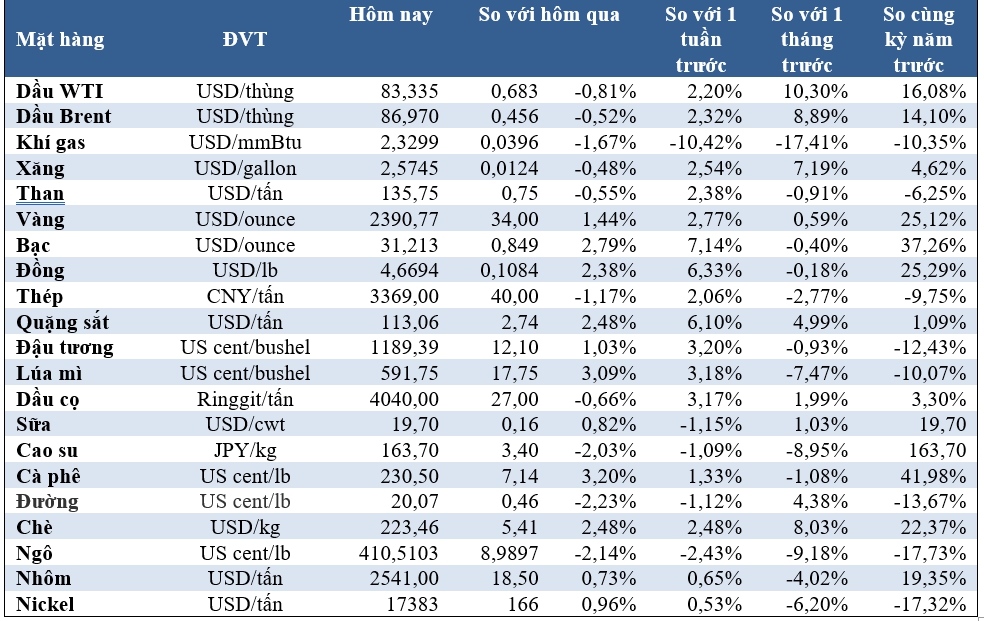

Prices of Key Commodities on July 6:

Commodity prices as of July 6, 2024

Market Update on February 2nd: Oil, Copper, Iron & Steel, Rubber, and Sugar Prices Decline, Gold Surges to Almost 1-Month High.

At the end of the trading session on February 1st, the prices of oil, copper, iron and steel, rubber, and sugar all dropped, while natural gas hit a nine-month low and gold reached its highest point in nearly a month.