At the Workshop on Unblocking and Promoting the Real Estate Market Development held on July 5 in Hanoi by the Labor Newspaper, Mr. Nguyen Quoc Khanh, Vice Chairman of the Vietnam Real Estate Brokers Association (VARS), presented a thesis on “Obstacles and Solutions to Unblocking Capital Sources for the Vietnamese Real Estate Market.”

According to the Vice Chairman of VARS, the real estate market has gone through nearly four years of continuous difficulties. Real estate is the only industry with a declining number of newly established enterprises in 2023. On average, about 107 real estate businesses go bankrupt every month. Most companies face one or some of the following scenarios: bankruptcy, temporary suspension of operations, layoffs, downsizing, salary cuts, or restructuring. The fortunate businesses that remain in the market mostly prepare for either “loss” or a profit reduction of up to 80-90% compared to the same period in previous years.

Regarding the reality of the health of real estate businesses, apart from legal difficulties and obstacles, a “lack of capital” is the main reason why companies fall into a state of “exhaustion.”

Difficulties in capital mobilization have led to a severe decline in real estate supply, as ongoing projects have to be temporarily suspended, extended, or delayed due to a lack of funds to pay contractors and workers. According to VARS statistics, the total supply of new apartments in 2018 was nearly 180,000 products, but this number decreased to almost 110,000 in 2019 and just over 90,000 in 2020. In 2021, when the market was heavily impacted by COVID-19 and many projects had to stop construction due to unresolved policy bottlenecks, the supply of new apartments further dropped to over 50,000 products. In 2023, the supply slightly improved to 55,000 products, but it was still only about 30% compared to 2018.

Mr. Nguyen Quoc Khanh emphasized that the real estate market is one of the essential markets in the national economy, attracting resources and creating fixed assets, promoting the development of other industries (finance, construction, building materials production, furniture, labor, etc.). This sector also has a profound influence on numerous related fields. Statistics show that real estate directly affects approximately 35 different sectors and industries, including four major groups: finance and banking, tourism, construction, and accommodation.

The stagnation of capital flow in the real estate market inadvertently affects the production and business activities of related enterprises, and the wave of unemployment spreads from real estate to many other industries, significantly impacting social welfare.

Based on the above figures, homebuyers, including those in affordable housing projects and social housing, face challenges due to increasingly stringent credit policies from banks. If homebuyers cannot access mortgage loans, the market’s output will decline.

Capital has been, is, and will continue to be a “pressure” for most real estate businesses. Although the legal bottlenecks have been addressed with the passage of new laws (Housing Law, Real Estate Business Law, and Land Law), the market’s recovery rhythm will be affected if the “capital” issue is not resolved promptly. This is especially true for the two most critical capital channels: credit and corporate bonds, as Vietnam has not yet developed other capital channels such as real estate investment trusts (REITs) and housing funds.

Mr. Nguyen Quoc Khanh, Vice Chairman of the Vietnam Real Estate Brokers Association, presents his thesis. Photo: To The

According to Mr. Nguyen Quoc Khanh, Vice Chairman of the Vietnam Real Estate Brokers Association (VARS), in general, real estate businesses will still face challenges in accessing credit in 2024.

Although the State Bank of Vietnam has made efforts to adjust and support businesses and the economy through multiple interest rate reductions and preferential credit packages, the interest rates have significantly dropped. However, the actual credit agreements are mainly focused on enterprises with a solid financial position and a large land fund with clean projects.

Most real estate businesses cannot meet the borrowing requirements due to their long-weakened financial health and market difficulties.

To unblock and promote the safe, healthy, and sustainable development of the real estate market and accelerate the construction of social housing and worker housing, on March 11, 2023, the Government issued Resolution No. 33/NQ-CP, assigning the State Bank of Vietnam to lead the deployment of a credit package of about VND 120,000 billion. This program aims to provide loans to investors and homebuyers in social housing, worker housing, and old apartment rebuilding projects at interest rates during the preferential period, lower than the medium and long-term lending rates by 1.5% to 2%.

According to the Ministry of Construction, after more than half a year of implementation, the VND 120,000 billion credit package has initially shown results, but the disbursement has been slow. As of now, only six social housing projects in seven localities have been disbursed with a capital of about VND 530,973 billion. Meanwhile, 28 localities have announced a list of 68 eligible projects with a total loan demand of more than VND 30,000 billion under this program.

In the first months of 2024, consumer credit and real estate purchases continued to decline, even though lending rates remained low. Inflation and interest rate fluctuations are still unpredictable, and borrowing money to buy a house and repaying a monthly debt of over VND 10 million has become a burden for many families who are not confident about their future jobs and income.

Mr. Nguyen Quoc Khanh, Vice Chairman of the Vietnam Real Estate Brokers Association (VARS), proposed solutions to unblock the credit capital source for the real estate market.

Regarding the Government, ministries, and the banking system: First, it is necessary to promptly issue documents, decrees, and circulars providing detailed guidance on implementing the three recently passed laws: the Housing Law, the Real Estate Business Law, and the Land Law. Ensure “compatibility” between the three laws in terms of scope, objects, time, and space.

Second, for issues and obstacles not addressed in the laws, the ministries and sectors should proactively review, synthesize, and research solutions through drafting and approving specific mechanisms and policies via resolutions to support handling and avoid prolonged bottlenecks.

Third, along with interest rate adjustments, banks should consider loosening lending conditions to increase the borrowing opportunities for enterprises and customers. Avoid a situation where “interest rates have decreased,” but the procedures remain stringent.

For struggling real estate businesses, the State Bank of Vietnam should consider allowing debt rescheduling for maturing loans, similar to the approach during the COVID-19 outbreak, and providing access to new credit to ensure the continuous implementation of projects and reduce market pressure.

Fourth, commercial banks should continue to review and classify real estate projects to promptly provide appropriate credit solutions to eligible enterprises and projects, especially those with social housing and affordable commercial housing projects that meet the market’s actual needs.

Fifth, banks should pay more attention to industrial real estate, providing medium and long-term capital not only for infrastructure investment but also for secondary investors. They can offer loans with collateral in the form of future assets, patents, technology, or machinery, or even unsecured loans. While lending through this channel may entail risks, it will significantly contribute to developing production, creating jobs, and generating stable and sustainable revenue for the economy and participating organizations.

Regarding real estate enterprises: They should proactively review their investment project portfolios, considering selling part or all of the projects that do not align with their current resources. Simultaneously, they should actively restructure their debts and develop a cash flow plan. Focus capital on projects with solid legal grounds, feasible borrowing plans, early completion potential, and good liquidity to provide a basis for commercial banks to extend credit.

Moreover, enterprises should reduce profit expectations and even accept selling at a loss, using previous years’ profits to maintain operations. For new projects in the research phase, enterprises should proactively target the affordable housing segment, focusing on products for use rather than investment, ensuring absorption when launched into the market.

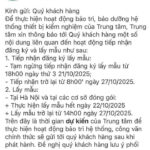

Which bank offers the highest interest rate for online savings in early February 2024?

Beginning February 1st, 2024, several banks have been adjusting their interest rates downwards for savings accounts ranging from 1 to 24 months. Based on a survey conducted across 16 banks, the highest annual interest rate for online savings deposits at a 6-month term is 5%, while for a 12-month term, it is 5.35%.