The fact that commercial banks are raising deposit interest rates indicates that the economy is improving and businesses’ demand for capital to invest in production and trading is increasing.

Increasing capital demand for production

According to Dr. Nguyen Tri Hieu, an economic expert, in an interview with VTC News on the morning of July 7th, the growth in capital mobilization by banks was quite low in the first six months, at about 1.5%.

“That’s why banks need to continue raising deposits to lend more, so they need funds. In addition, low-interest rates in the past have attracted idle funds in the market to investment channels such as securities and gold. Banks have to increase interest rates to retain savings customers,”

said Dr. Nguyen Tri Hieu.

Illustration photo: Many banks continue to raise deposit interest rates.

According to Dr. Hieu, from now until the end of the year, the economy will develop more positively, with many bright spots in production and business, so banks also need to prepare capital to promote credit growth at the end of the year.

“In the last months of the year, Vietnamese enterprises will need a lot of money to promote production and business to serve domestic and foreign market demands. This is a very dynamic activity and a bright spot in the economy,”

Dr. Hieu said.

Meanwhile, Dr. Le Dang Doanh, an economic expert and former director of the Central Institute for Economic Management, said that the reason many banks are raising deposit interest rates is to mobilize capital for large-scale lending as the economy is recovering.

“This is a very positive sign that our economy is recovering rapidly and businesses need a large amount of capital to invest in production and business in the remaining months of 2024,”

said Dr. Le Dang Doanh.

Proactive solutions

However, Dr. Doanh also said that when the deposit interest rate increases, the lending interest rate also increases to ensure that banks have management costs and profits in doing business.

“The cost of raising the deposit interest rate is that the lending interest rate also increases, and borrowers, including businesses, have to bear the consequences. Therefore, enterprises themselves must improve labor productivity and production and business efficiency to cope with the increase in lending interest rates in the coming time,”

said Mr. Doanh.

Illustration photo: Many enterprises in Vietnam are in need of capital mobilization to boost year-end production.

Commenting on this issue, Dr. Nguyen Tri Hieu also said that when the interest rate increases, the lending interest rate will inevitably increase.

“When the input interest rate increases, the output interest rate must also increase because banks also have to maintain a profit margin of about 3% to ensure the system’s sustainability. However, the extent of the increase in lending interest rates also depends on many factors, including the government’s and State Bank’s management.”

“The increase in lending interest rates will directly affect Vietnamese enterprises because the capital cost for enterprises will also increase, affecting their profits and business situation,”

said Mr. Hieu.

To minimize the impact of the predicted increase in lending interest rates, Mr. Hieu suggested that enterprises need to have a solid production and business plan with three scenarios, including normal, good, and bad scenarios.

“In the bad scenario, if interest rates increase by 1-2%, enterprises will have to reduce other costs such as marketing, personnel, and administrative expenses to maintain profits. It is also important to increase revenue to ensure sustainable profitability,”

said Dr. Hieu.

Mr. Nguyen The Minh, Director of the Research and Customer Development Division of Yuanta Vietnam Securities, said that when the demand for new credit increases, banks need to supplement their capital to lend.

“So, they are likely to raise deposit interest rates to supplement liquidity. The credit injected a few months ago to refinance loans has not yet fallen due, and the new demand has increased, so more funds are needed to meet this demand. That’s why banks want to raise deposit interest rates,”

Mr. Minh analyzed.

Mr. Minh predicted that from now until the end of the year, banks would have to maintain a profit margin of 1.5%-2%, while the lending interest rate with collateral is about 8%-10%. Therefore, the highest deposit interest rate is only about 6%-7%/year.

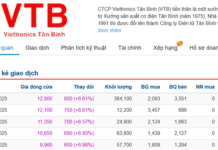

Which banks are raising deposit interest rates?

The trend of increasing deposit interest rates has been going on since May 2024, and now, in the third month, interest rates of 5%/year, which used to be offered by banks for deposits with a term of 18 months or more, are also appearing in the 6-15 month term.

Specifically, a month ago, all banks offered interest rates below 4.9%/year for deposits with a term of 6-8 months, but now ABBank, NCB, Eximbank, and CB offer interest rates above 5%/year for these terms.

For the 9-11 month term, interest rates above 5% are becoming more common. As of July 6th, ten banks offered interest rates from 5%-5.8%/year for these terms.

Notably, 23 banks offered deposit interest rates from 5% – 6%/year for the 12-month term. Among them, ABBank offered the highest interest rate of 6%/year for this term, the only bank offering this rate.

The longer the term, the higher the deposit interest rate, with the highest interest rate of 6.1% offered by NCB and OceanBank for deposits with a term of 18-36 months. HDBank also announced an interest rate of 6.1%/year for 18-month term deposits, while SHB offered this rate for customers depositing for 36 months or more.

In addition, customers can choose to deposit at the counter at some banks that maintain a “special interest rate” policy. The condition for enjoying this interest rate is that customers must have a deposit account of at least VND 200 billion.

Latest Interest Rates at Agribank in February 2023: Highest Rate for 24-month Term

Interest rates for deposits at Agribank have further decreased in early February 2024 compared to January. Specifically, individual customers’ deposits are subjected to interest rates ranging from 1.7% to 4.9% per annum, while business customers’ deposits are subjected to interest rates ranging from 1.7% to 4.2% per annum.

VPBank strengthens its system in 2023, laying the foundation for sustainable growth

By 2023, VPBank has made significant strides in expanding its customer base and scaling up its operations. The bank has managed to make progress amidst challenging macroeconomic conditions, focusing its resources on strengthening its system and building momentum for sustainable growth in 2024 and beyond.