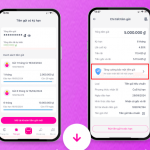

Customers updating biometric data for money transfers over 10 million VND, as per the new SBV regulations. Photo: Binh An

There has been a recent buzz among consumers about incidents of banking app fraud, specifically regarding the use of pre-captured images to bypass money transfer authentication. At a recent seminar on “Solutions to Protect Customers Using Banking Services” organized by the State Bank of Vietnam (SBV), Lieutenant Colonel Trieu Manh Tung, Deputy Director of the

Cyber Security and High-Tech Crime Prevention Department (Ministry of Public Security), assured that the technology systems of banks are fundamentally capable of handling this issue. However, he acknowledged the existence of certain risks, such as the potential use of Deepfake technology to circumvent banks’ biometric authentication measures.

According to Mr. Tung, with the rapid advancement of technology, it is challenging to predict what might happen tomorrow. Nevertheless, the current use of biometrics is the most advanced solution, and Vietnam is among the pioneering countries in implementing this measure.

Representing the banks’ perspective, Mr. Luu Danh Duc, Deputy General Director in charge of SHB’s Information Technology Division, proposed several solutions. These include the implementation of biometrics, along with additional research into preventing criminals from using Deepfake technology to spoof biometric data for fraudulent purposes. Mr. Duc suggested that customers should not only look straight but also turn their heads left and right during transactions. Furthermore, banks can enhance their mobile apps by incorporating smart features that can detect unusual user activity and provide alerts and blocking mechanisms.

“There’s always a way to combat fraudsters. We will continue to study criminal behavior and employ technology to prevent fraud and minimize customer losses,” assured Mr. Duc.

Meanwhile, SBV Deputy Governor Pham Tien Dung attributed the success of some banking app frauds using static images and Deepfakes to the temporary disabling of authentication systems by banks during the initial days of exceptionally high transaction volumes. The SBV has since instructed banks to strictly implement online customer identification and authentication solutions, with mandatory measures to counter Deepfakes and static images. The issue of using static images to bypass biometric systems has now been resolved.

Additionally, Mr. Le Hoang Chinh Quang, Deputy Director in charge of the SBV’s Information Technology Department, shared that since 2023, the SBV has been piloting a monitoring and warning system for suspicious and fraudulent payment accounts. Data from these accounts is provided to customers during transactions to ensure safety.

As of 5:00 PM on July 3, 2024, 16.6 million bank accounts have been biometrically authenticated, with 90% of customers completing the process themselves, according to SBV statistics.