Cake by VPBank Enhances Security with New Passcode Feature

Cake by VPbank, a digital bank, has recently implemented a new passcode feature to enhance security. This multi-layered security feature allows customers to proactively increase the safety of their deposits, providing them with an additional option to protect their funds.

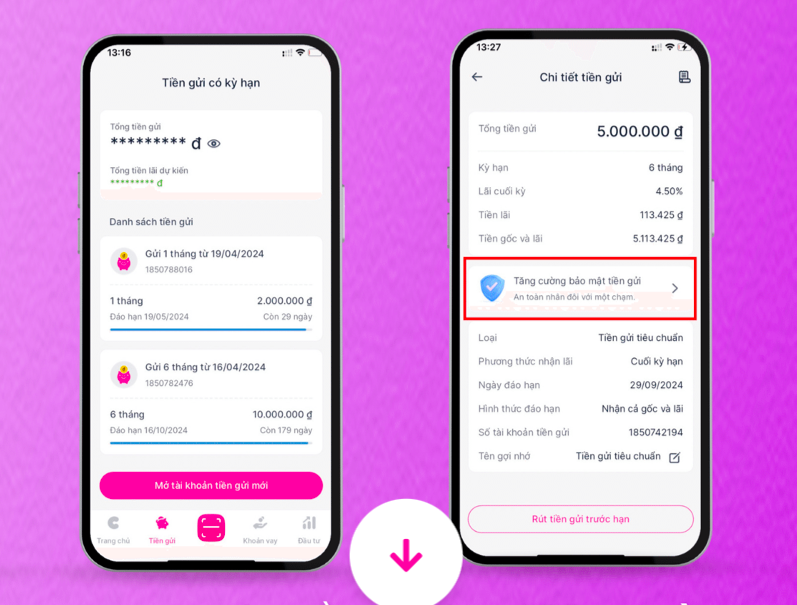

Specifically, each savings account on Cake gives customers the option to enable the “enhanced deposit security” button within the app. The system will generate a unique passcode. The account holder must actively save this passcode and avoid sharing it with anyone. From that point forward, whenever they wish to close their savings account early, the account holder must enter the correct passcode in addition to their PIN, SmartOPT, or other biometric authentication methods.

Users can enable the enhanced deposit security feature in the digital banking app.

“This feature helps customers actively enhance the level of protection for their savings accounts, reducing the risk of unauthorized access aimed at taking control of their devices or stealing their information. This is the first time such a feature has been introduced in Vietnam to proactively safeguard deposits through a banking app,” said a Cake by VPBank representative.

Enhanced deposit security using passcodes is a purely digital technology solution that allows customers to operate 100% online.

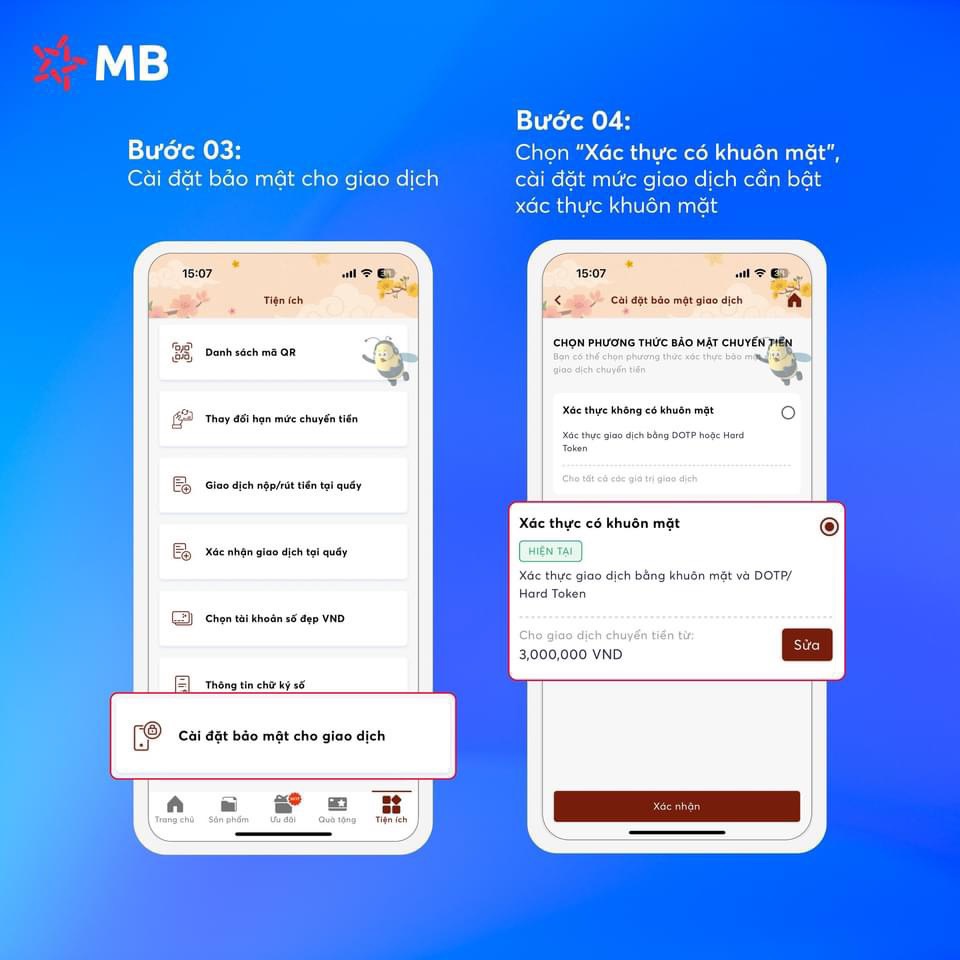

The Military Bank (MB) has also recently implemented a facial recognition feature for authenticating transfer transactions. This solution aims to implement Decision No. 2345/QD-NHNN on implementing secure and safe solutions for online payments and bank card payments issued by the State Bank of Vietnam.

Consequently, MBBank app users can proactively choose the level of transactions that require authentication on this digital bank. With two-factor security and biometric authentication on the MBBank app, users can have peace of mind when transferring money through the banking app, especially for large transactions.

Users can set up transaction security in the digital banking app.

According to MB, given the current increase in fraud and bank account theft, implementing two-factor security and biometric confirmation before transferring money will have a positive impact on the user experience. Requiring biometric authentication before transferring money enhances security, prevents unauthorized access, and minimizes the possibility of fraud.

At Techcombank, since the beginning of April 2024, the bank has actively begun collecting biometric data to implement Decision 2345 of the State Bank of Vietnam, aiming to enhance the security of online transactions for customers.

Techcombank’s biometric data update feature from chip-based CCCD cards helps customers update and add biometric data to protect their accounts and facilitate authentication steps when making transactions (transfers and payments) that exceed the specified limits on the digital banking channel.

According to Decision No. 2345 of the State Bank of Vietnam, starting from July 1st, online bank transfers or e-wallet deposits exceeding 10 million VND must be authenticated using facial or fingerprint recognition. Transfers below 10 million VND, with a total daily transfer amount not exceeding 20 million VND, can be authenticated using an OTP code without facial or fingerprint recognition. The total amount of transactions exceeding 20 million VND per day must be authenticated using biometrics (either using a chip-based CCCD, a VNeID account, or biometric data stored in the bank’s database). The primary objective of Decision 2345 QĐ/NHNN is to protect customers on digital transaction platforms.

Banks believe that this decision will serve as a catalyst, encouraging banks to swiftly implement solutions that utilize artificial intelligence (AI) and biometric recognition to comply with and simplify the customer identification process.

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)