Illustrative image

In its recently published July strategy report, Rong Viet Securities (VDSC) noted that deposit interest rates have recovered from their lows, increasing by an average of 0.3-0.5 percentage points compared to the end of March 2024. However, deposit rates remain 0.15-0.45 percentage points lower than last year’s levels. VDSC attributed the rise in deposit rates to expectations of exchange rate movements and interest rate policy adjustments.

On the exchange rate front, the analysis team anticipated persistent pressure on the currency. They cited the strength of the US dollar, which is expected to persist due to: (1) the interest rate differential between the US and other countries, as the Fed’s pace and magnitude of rate cuts are slower and smaller compared to other central banks, (2) predictions by economists that a Trump victory in the upcoming US presidential election could lead to a return of inflation, influencing the Fed’s interest rate decisions, and (3) prolonged geopolitical risks driving demand for USD as a safe-haven asset. Additionally, due to seasonal factors, foreign currency demand (for importing goods) may surge again in Q3, ahead of the Fed’s official shift in interest rate policy, prolonging exchange rate pressures during this period.

Meanwhile, after 10 consecutive weeks of selling foreign currency to stabilize the exchange rate (since April 22), the State Bank of Vietnam (SBV) is estimated to have sold an amount equivalent to approximately 30% of last year’s foreign exchange spending. Looking ahead, VDSC suggested that the SBV might consider a policy rate hike (by 0.2-0.5 percentage points) in Q3 to protect foreign reserves while managing exchange rate stability.

Additionally, the recovery in credit growth in the second half of the year is noteworthy. As of the end of June 2024, credit growth reached 4.45% compared to the beginning of the year. While credit growth has been slower compared to the same period last year, VDSC expected it to pick up pace towards the end of 2024.

“This, coupled with the net inflows of money through foreign currency sales, could create liquidity pressure for the banking system and impact interest rates in the latter half of 2024,” the analysts remarked.

However, VDSC believed that the increase would not be as abrupt as in 2022 due to differing macroeconomic conditions. The year 2024 lacks the shock factors that drove credit demand and sudden monetary policy changes witnessed in 2022. Moreover, net foreign currency outflows are expected to ease significantly if there is a “convergence” effect on interest rates, with the Fed reducing rates while the SBV raises them in the latter half of the year. Therefore, VDSC forecasted a rise of 0.5-1.0 percentage points in interest rates to return to pre-pandemic levels as a reasonable scenario.

Latest Interest Rates at Agribank in February 2023: Highest Rate for 24-month Term

Interest rates for deposits at Agribank have further decreased in early February 2024 compared to January. Specifically, individual customers’ deposits are subjected to interest rates ranging from 1.7% to 4.9% per annum, while business customers’ deposits are subjected to interest rates ranging from 1.7% to 4.2% per annum.

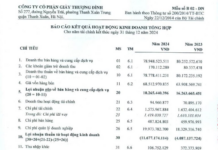

VPBank strengthens its system in 2023, laying the foundation for sustainable growth

By 2023, VPBank has made significant strides in expanding its customer base and scaling up its operations. The bank has managed to make progress amidst challenging macroeconomic conditions, focusing its resources on strengthening its system and building momentum for sustainable growth in 2024 and beyond.