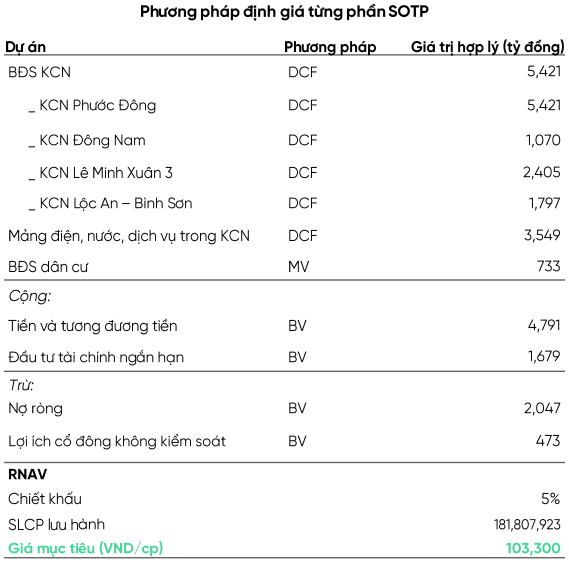

Buy SIP with a price target of VND 103,300/share

VPBank Securities (VPBankS) projects that the 2024 revenue of Saigon Investment Corporation (VRG), listed on the HOSE as SIP, will continue to improve with a modest 2.7% growth year-over-year. This improvement stems from positive developments in most of SIP‘s core business areas.

Firstly, the provision of utilities and services within industrial parks is expected to grow steadily due to (1) increased electricity and water consumption driven by heightened demand from both existing and new customers, as well as a rebound in production across various sectors, particularly in the textile industry, and (2) an increase in electricity prices following the implementation of a new retail electricity mechanism in 2024.

Among its industrial parks, Phuoc Dong is expected to remain a standout performer, with an estimated annual sales volume of 30ha. This can be attributed to (1) its position as the largest industrial park in Tay Ninh province, leading the way in attracting FDI to the region among existing industrial parks, (2) substantial remaining land reserves to meet leasing demands, and (3) its focus on attracting investors in high-tech industries, as well as rubber processing, textiles, and auxiliary industries.

Meanwhile, Loc An – Binh Son industrial park is expected to resume contributions in 2024 due to land transfers to SEA Logistics Partners (SLP) as per an agreement to lease 16.3ha for the construction of factories with an investment of 121 million USD.

Secondly, improvements in industrial park leasing are anticipated due to four new industrial park projects by SIP.

Specifically, electricity prices are projected to increase by approximately 5% in 2024 following the implementation of new regulations on electricity pricing, which came into effect on May 15, 2024. VPBankS believes that this new pricing mechanism provides a basis for EVN to adjust electricity tariffs, leading to an increase in both input and output electricity prices within SIP‘s industrial parks.

Additionally, electricity consumption within SIP‘s industrial parks is expected to maintain its positive growth trajectory due to (1) successful leasing activities and the continuous addition of new tenants, and (2) a notable improvement in manufacturing, especially in the processing and manufacturing industries, as evidenced by a 3.6% month-over-month increase and a 13.4% year-over-year increase in the industry’s production index for May 2024.

Overall, VPBankS believes that SIP‘s financial performance in 2024 will not deviate significantly from that of 2023. Consequently, the securities firm forecasts a modest 2% year-over-year increase in net profit for 2024. Based on this projection, VPBankS recommends buying SIP shares with a price target of VND 103,300/share.

Source: VPBankS

|

Read more here

Hold HPG with a price target of VND 31,121/share

Yuanta Securities Vietnam (YSVN) assesses that the most challenging phase for the steel industry and Hoa Phat Group (HOSE: HPG) is now behind us. HPG is transitioning towards the production of high-quality steel, evident in the first quarter of 2024, where HRC steel output reached 805,000 tons, a 67% increase year-over-year. Notably, the proportion of HRC steel in total output rose to 40%, up from 31% in the previous year, indicating HPG‘s ascent within the steel industry value chain. YSVN highly regards HPG compared to other steel companies due to its advantage as one of the only two HRC steel producers in Vietnam.

For 2024, HPG has set ambitious targets, aiming for a 140 trillion VND revenue (a surge of 18% year-over-year) and a post-tax profit of 10 trillion VND (a remarkable 46% increase). YSVN forecasts that the company’s financial performance for 2024 will align with these goals, and the securities firm believes that HPG‘s scenario is likely to closely reflect reality. The expected 19% year-over-year growth in revenue can be attributed to 1) robust domestic demand for public investment and construction within industrial parks, 2) increased exports, and 3) HPG‘s move up the steel industry value chain with HRC steel. However, the ongoing anti-dumping case against Chinese HRC steel, if ruled in favor by the Ministry of Industry and Trade, could positively impact domestic HRC steel prices and, consequently, HPG‘s stock price.

YSVN projects that HPG‘s gross profit margin will recover to 12.5% (up from 10.9% in 2023 and 13.5% in the first quarter of 2024) due to declining coking coal prices. Nonetheless, steel selling prices are not expected to witness a significant rebound by the year’s end, given the still-elevated levels of steel inventory in China and the dim prospect of a swift recovery in China’s real estate market. In addition, HPG‘s debt is likely to increase in 2024 to finance the Dung Quat 2 project, which is slated for operation in early 2025.

In summary, YSVN foresees a lack of significant breakthroughs in HPG‘s business landscape in 2024, aside from the aforementioned anti-dumping case. Investors are advised to await the commencement of operations at the Dung Quat 2 project in early 2025.

Applying projected P/E and P/B ratios of 18.7x and 1.8x, respectively, YSVN recommends holding HPG shares with a price target of VND 31,121/share.

Read more here

Buy STK with a price target of VND 38,100/share

Vietcap Securities attributes the substantial increase in orders during the second quarter of 2024 to the anticipated recovery of Century Yarn Joint Stock Company (HOSE: STK) in the latter half of 2024. Following a period of inventory reduction in 2022-2023, the inventory levels of some retailers and textile brands have returned to reasonable levels.

In the second quarter of 2024, STK received orders totaling 9,000 tons, reflecting a 67% increase from the previous quarter and a 14% year-over-year rise. This growth can be attributed to inventory replenishment and order transfers from China. However, preliminary actual sales volume for the same quarter stood at approximately 6,700 tons, representing a 25% increase from the previous quarter but a 15% decline year-over-year. This discrepancy is attributed to issues with the recently implemented automatic quality control system, which replaced the previous manual system at the beginning of the year. Nonetheless, Vietcap Securities believes that the overall trend indicates a continued recovery in demand during the second half of 2024.

On another positive note, the construction of the Unitex factory is 90% complete, and the installation of machinery is 60% finished. Vietcap expects Unitex to commence operations on some long-fiber spinning (DTY) lines in the third quarter of 2024 and become fully operational in the fourth quarter. Currently, the securities firm forecasts that Unitex will add 36,000 tons (a 60% increase) to STK‘s existing capacity in 2024.

Given these optimistic expectations, Vietcap Securities recommends buying STK shares with a price target of VND 38,100/share. The securities firm notes that this price target corresponds to projected P/E ratios of 25.3/12.4 for 2024/2025, higher than STK‘s five-year average of 14.2. Vietcap justifies this premium by highlighting the expected high growth rate of STK, with a projected compound annual growth rate (CAGR) of 46% for EPS in the 2024-2026 period. This growth is attributed to the anticipated profit recovery in 2024-2025 and a 60% increase in capacity from Unitex in the third quarter of 2024, with expectations of high absorption rates given STK‘s recovering order volume.

Read more here

Steel sales volume in January 2024 increases nearly 60% YoY for Hoa Phat

The sales volume of hot-rolled coil steel, construction steel, and high-quality steel decreased by 16% compared to the last month of 2023, mainly due to the market preparing for the Lunar New Year holiday and having low demand.