Expectations for the second half of 2024 remain positive, with a target of 1,300 – 1,350 points

Looking back at the two main pillars for the market in 2024, including fundamentals and cash flow as mentioned in the annual strategic report, SSI Research believes that the fundamentals are turning positive as predicted and are even better than expected.

SSI Research still believes that the economic recovery will become more apparent in the second half of 2024. With the 6-month GDP growth exceeding expectations, the focus of policy management may shift towards macroeconomic stability factors such as inflation and exchange rates, while interest rates may continue to rise slightly. This may have been reflected in the recent decline in stock market liquidity.

On the other hand, regarding foreign capital flows, the pressure to withdraw foreign capital is expected to ease towards the end of the year if the US reduces interest rates, which will create a new positive momentum for the market.

Looking into the second half of 2024, SSI Research remains inclined towards a bullish market scenario, even though risk factors still exist and may cause market volatility.

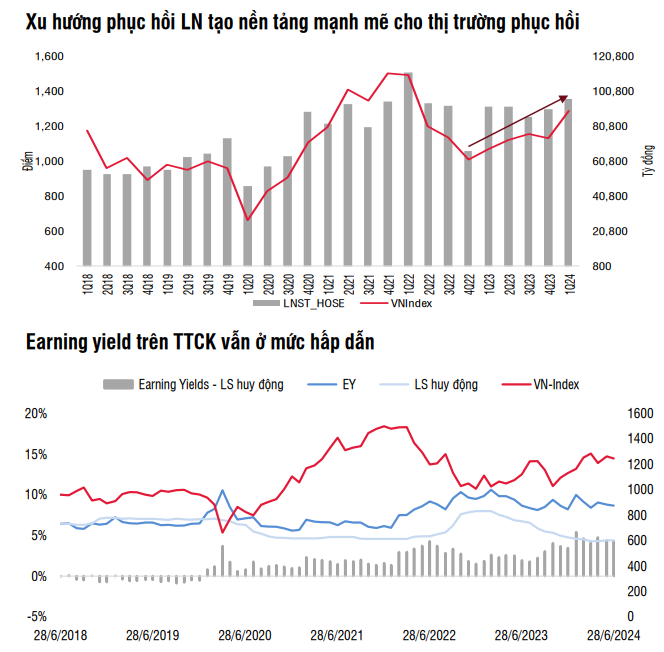

The estimated P/E for 2024 of the VN-Index is currently at 11.5 times, lower than the 5-year average of 13.4 times. SSI Research believes that at this valuation, the VN-Index still has room to grow in the second half of 2024 and into 2025, especially as the economy continues its recovery process.

SSI Research highlights several other driving forces, including an increase in the basic salary for the public sector starting from July 1st; a 2% VAT reduction policy to stimulate consumption that has been extended until the end of the year; and exports, which will become more favorable if the US recognizes Vietnam as a market economy by the end of July. In addition, obstacles in the process of upgrading are gradually being removed.

Based on these factors, SSI Research maintains its target of 1,300 – 1,350 for the VN-Index by the end of 2024.

|

Market supporting factors in the second half of 2024

Source: SSI Research July 2024 Strategic Report

|

Profit growth prospects for Q2 continue to be a driving force

The Vietnamese stock market has been on an uptrend since the beginning of Q4/2023, extending into the first half of 2024, with only a relatively minor correction in April 2024. This reflects the continuous improvement in profit growth quarter after quarter as economic growth drivers recover.

In the watch list of SSI Research, the profit growth prospects for Q2/2024 are positive for many large banks, steel companies, essential and non-essential consumer groups, and port and maritime transport companies.

Although some stock groups have risen sharply in the past period, which may have already reflected much of the profit growth prospects, the positive profit growth of alternating industry groups and stocks will continue to be a driving force for the market.

Source: SSI Research July 2024 Strategic Report

|

VN-Index expected to trade within the range of 1,220 – 1,295 in July 2024

The VN-Index retreated after slightly surpassing the 1,300-point mark in June 2024. Technical indicators such as the RSI remain neutral, while the mid-term ADX has returned to a weak position, indicating that the VN-Index’s trend in July 2024 may not be as optimistic as expected.

The medium-term uptrend of the VN-Index remains intact as it has not violated the support level of 1,195 – 1,205. The index is expected to trade within the range of 1,220 – 1,295 points in July 2024.

However, SSI Research also mentions the risk of these assumptions and trends being invalidated if the VN-Index falls below the 1,190 level.

Source: SSI Research July 2024 Strategic Report

|

Given the mixed factors, SSI Research believes that a cautious approach is necessary during this period as market risks are increasing. Therefore, investors should patiently wait for truly attractive price levels, focus on the individual stories of each stock for new investments, while continuing to hold stocks with strong growth potential.

From a cash flow perspective, it is also possible that the trend will continue to rotate and flow towards groups that directly benefit from policies, including real estate, retail, and exports. Some groups that underperformed in the first half of 2024 may also attract attention, such as financial services.

Huy Khai

Dragon Capital Chairman: “Long-term vision is needed, accepting necessary adjustments for a safer, more efficient, and higher quality market”

According to Mr. Dominic Scriven, Chairman of Dragon Capital, the role of the finance industry in the stock market will be significant in 2023 and possibly in 2024. The roles of other industries, such as real estate or consumer goods, will depend on their respective challenges.