Illustrative Image

Southeast Asia Commercial Joint Stock Bank (SeABank) has made an adjustment to its deposit interest rate at the beginning of July, with a significant increase across all terms.

Specifically, for the term deposit product with interest payable at maturity, the interest rate for 1-2 month terms has been increased by 0.5% per annum to 3.2% per annum. Terms from 3-5 months increased by 0.8% per annum, reaching 3.7% per annum.

The interest rate for 6-11 month terms has been increased by 0.6% per annum across the board. Specifically, the 6-month deposit interest rate is listed at 4.2% per annum, 7 months at 4.3% per annum, 8 months at 4.35% per annum, 9 months at 4.4% per annum, 10 months at 4.45% per annum, and 11 months at 4.5% per annum.

The 12-month savings interest rate has been adjusted upward by 0.5% per annum to 4.95% per annum. The 15-month term has also increased by 0.5% per annum, currently reaching 5.5% per annum. Meanwhile, the interest rate for 18-36 month terms has increased by 0.7% per annum to 5.7% per annum.

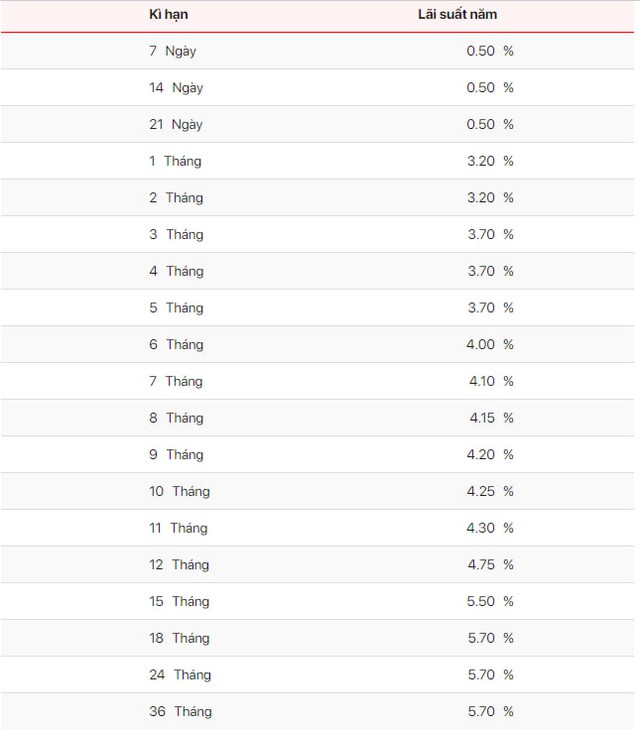

SeABank’s Deposit Interest Rate for Term Deposit Product with Interest Payable at Maturity

In addition to the term deposit with interest payable at maturity, SeABank has also increased interest rates for other types of deposits. Among these, the highest interest rate currently offered by the bank is 6.2% per annum for the Step-up Deposit product with a minimum deposit amount of VND 10 billion for terms of 15-36 months. For smaller deposit amounts, the highest interest rates offered by SeABank range from 6.0% to 6.15% per annum, depending on the amount deposited.

SeABank is the third bank to raise savings interest rates in July. Previously, NCB and Eximbank also adjusted their deposit interest rates this week. Notably, Eximbank recently increased its deposit interest rate for the 4-month term to 4.7% per annum, approaching the ceiling rate of 4.75% per annum set by the State Bank of Vietnam.

The National Citizen Bank (NCB) has also increased its deposit interest rate by 0.1% per annum for terms of 1-13 months since July 3. The 7-month term has an interest rate of 5.4% per annum, 8 months at 5.45% per annum, 9 months at 5.55% per annum, and 10 months at 5.6% per annum. The 11 and 12-month terms are offered at interest rates of 5.65% and 5.7% per annum, respectively, while the 13-month term has increased to 5.8% per annum.

With this adjustment, NCB continues to be one of the banks with the highest deposit interest rates for terms below 12 months in the system.

At the same time, NCB is still offering an interest rate of 6.1% per annum for deposits with terms of 18-60 months. This is also one of the highest deposit interest rates in the market today (excluding special large-sum deposits).

The trend of increasing deposit interest rates began in late March and became more widespread in April, May, and June. However, the increase has been mainly driven by private joint-stock banks.

In June, 23 commercial banks in the market raised their deposit interest rates, including: TPBank, VIB, GPBank, BaoViet Bank, LPBank, Nam A Bank, OceanBank, ABBank, Bac A Bank, MSB, MB, Eximbank, OCB, BVBank, NCB, VietBank, VietA Bank, VPBank, PGBank, Techcombank, ACB, SHB, and VietinBank. Many of these banks increased their interest rates two to three times during the month.

According to analysts, the low growth in deposits from individuals and businesses in the first months of the year, coupled with the recovery in credit growth, has prompted many banks to raise deposit interest rates to ensure a balance in capital sources. Additionally, the State Bank of Vietnam’s interventions through bill issuances and foreign currency sales have also impacted the Vietnamese Dong liquidity of banks.

Deposit interest rates are expected to face upward pressure in the second half of the year, but the increase is not expected to be significant as credit demand during this period is not expected to surge.

According to Rong Viet Securities (VDSC), due to pressure on exchange rates caused by the large interest rate differential between USD and VND, the State Bank of Vietnam has intensified bill issuances in the open market while gradually increasing bill interest rates since April 2024. This development, along with the expected improvement in credit demand in the second half of the year, is likely to push interest rates higher for the remainder of 2024.

“Most commercial banks forecast that interest rates by the end of the year will increase by 1.0 – 1.5 percentage points compared to the low levels at the beginning of the year,” VDSC said.

From the perspective of MBS Securities, deposit interest rates are expected to increase slightly in the second half of 2024. The analysis group projects that the 12-month deposit interest rate of large commercial banks may increase by 0.5 percentage points to 5.2% – 5.5% by the end of 2024.

Latest Interest Rates at Agribank in February 2023: Highest Rate for 24-month Term

Interest rates for deposits at Agribank have further decreased in early February 2024 compared to January. Specifically, individual customers’ deposits are subjected to interest rates ranging from 1.7% to 4.9% per annum, while business customers’ deposits are subjected to interest rates ranging from 1.7% to 4.2% per annum.

Easier mortgage interest rates

Starting from the beginning of the year, banks have been implementing various low-interest credit packages, offering loans to pay off debts from other banks… with the aim of stimulating the demand for home loans.