The afternoon session saw a significant improvement in liquidity compared to the morning, especially among the VN30 stocks, leading to a strong recovery for many large-cap stocks. The impact of this group on the indices was evident in the final 30 minutes, with the VN30-Index even reclaiming most of its morning gains. However, the market breadth still favored decliners.

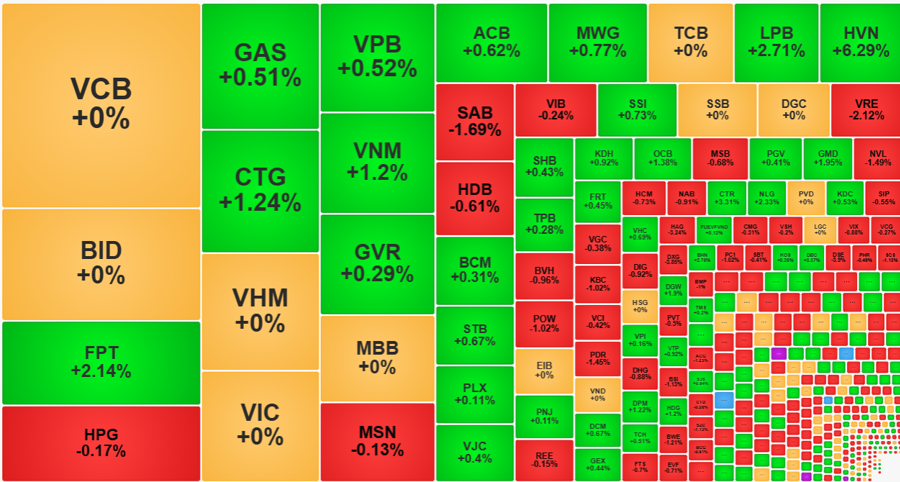

The VN30-Index closed up 0.42%, outperforming the VN-Index’s gain of 0.25%. The Midcap index rose 0.32%, while the Smallcap index edged up 0.23%. There was a notable shift in the performance of large-cap stocks, with 15 gainers and 8 losers (compared to just 6 gainers and 21 losers at midday).

Liquidity in the VN30 basket also increased by 38% from the morning session, reaching approximately VND3,593 billion. Improved buying interest helped many stocks rebound. Statistics showed that 23 out of 30 stocks in this group traded higher compared to the morning session, with only 6 declining. However, the performance of the VN-Index heavyweights was lackluster, while the VN30-Index constituents fared better.

FPT remained the strongest performer in the VN-Index, closing up 2.14% and contributing 1.05 points to the index. In the afternoon session, FPT’s gains slowed, rising only about 0.43%. VIC and VHM also showed some improvement but with a smaller margin. Meanwhile, BCM surged 1.27% from its morning price and successfully reversed its losses. ACB, GVR, SSI, STB, and TPB were also among the notable gainers in the afternoon, mainly influencing the VN30-Index and pushing it to close above the morning’s high, while the VN-Index remained nearly 2 points below its peak.

Overall, the large-cap stocks are still providing decent support to the VN-Index, but the lack of consensus among them has resulted in a significant loss of momentum for the index. For instance, VCB, BID, VHM, and VIC failed to post gains today. Among the top 10 stocks by market capitalization, only 3 showed strength: FPT (+2.14%), CTG (+1.24%), and VNM (+1.2%). Even the banking sector couldn’t find a clear leader, as only 11 out of 27 stocks in this group ended in positive territory, and only 4 managed to gain more than 1%, with the rest underperforming.

Liquidity in the large-cap segment was also concentrated in a few individual stocks. The top 5 most traded stocks, FPT, MWG, VRE, HPG, and VPB, accounted for nearly 44% of the total matched order value in the VN30 basket.

The market witnessed another downturn in the afternoon, pushing the VN-Index below its reference level. It wasn’t until after 2 PM that the market started to recover, with the actual rally occurring in the final 15 minutes. Many stocks also rebounded with the index, and the market breadth reflected this dynamic: at 2 PM, there were 127 gainers and 286 decliners on the HoSE, but at the close, the numbers improved to 182 gainers and 231 decliners. However, this rally couldn’t reverse the market breadth, indicating a significant divergence in strength. Among the 231 declining stocks, 77 fell by more than 1%. Heavy selling pressure was observed in VRE (-2.12%, VND407.9 billion in liquidity), DXG (-3.85%, VND233 billion), HAG (-3.24%, VND178.3 billion), POW (-1.02%, VND165.5 billion), and NVL (-1.49%, VND115.6 billion). PC1, ITA, PDR, NKG, and KBC also faced intense selling pressure, with above-average trading volumes.

The divergence in strength was evident among mid- and small-cap stocks, even as their representative indices, the Midcap and Smallcap, posted gains. This reflects the impact of short-term trading activities, which vary from stock to stock. Investors make decisions based on their current portfolios rather than the overall market performance. Stocks facing heavy selling pressure and price declines continue to fall, regardless of the broader market’s gains.

Foreign investors unexpectedly increased their selling in the afternoon session. Specifically, they net sold VND1,170.8 billion worth of stocks on the HoSE, an increase of 50% compared to the morning session. Their buying value stood at approximately VND959.8 billion, resulting in a net sell position of VND211 billion. In the morning session, they had net sold VND160.2 billion. FPT witnessed a sharp turnaround, with net selling of VND270.7 billion after a slight net buy in the previous session. VRE also experienced net selling of VND156 billion. Additionally, HPG (-VND92.3 billion), VHM (-VND65.8 billion), VPB (-VND58.9 billion), LPB (-VND45.2 billion), HDB (-VND42.6 billion), and DXG (-VND42.6 billion) were among the most sold stocks. On the buying side, NLG (+VND98.3 billion), SSI (+VND64.3 billion), BID (+VND56.6 billion), HVN (+VND39.8 billion), GMD (+VND35.3 billion), and VCB (+VND32.3 billion) saw net buying.

The VN-Index has risen for five consecutive weeks, closing at 1,283.04 points. As a result, the index has returned to its previous high and is testing this critical resistance level for the third time. However, weekly liquidity has weakened significantly, with the average matched order value per session falling by 37% compared to the previous week.