Joint Stock Commercial Bank for Foreign Trade of Vietnam (MB Securities JSC) has just announced its second-quarter 2024 financial statements, becoming the first in the group to reveal financial and business figures for the first half of 2024.

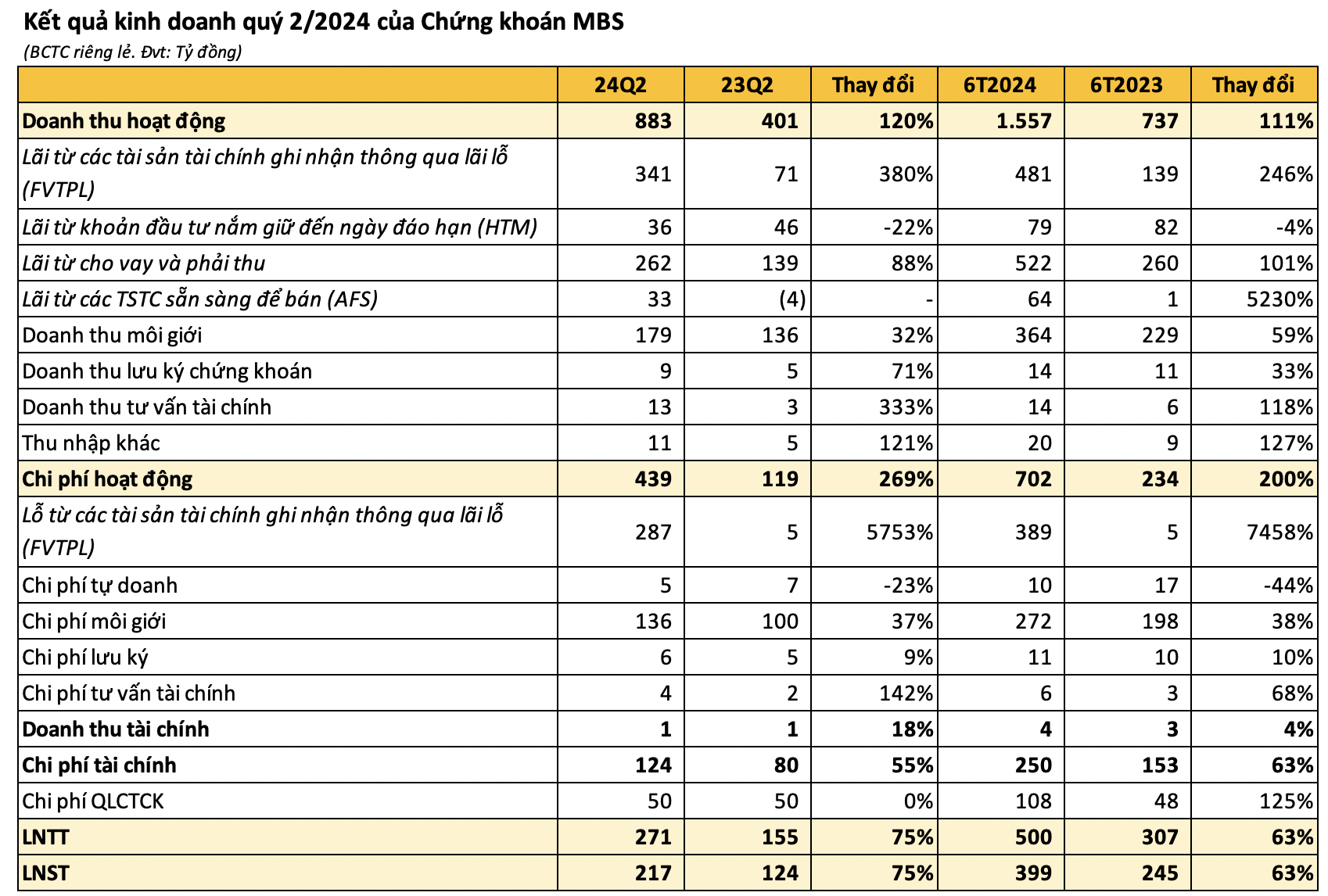

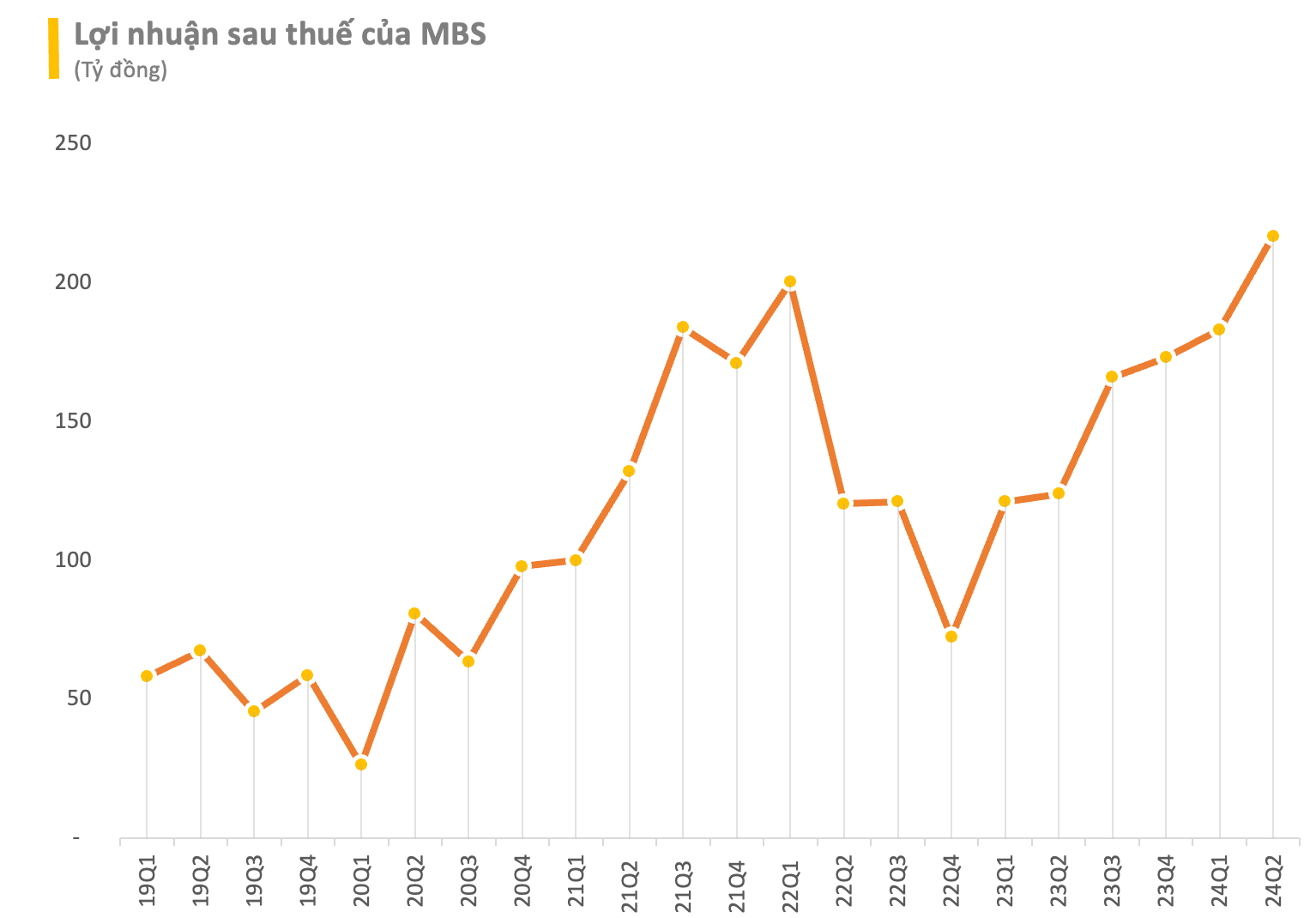

In the second quarter of 2024, MBS recorded growth in almost all main business segments, with operating revenue reaching VND 883 billion, up 120% over the same period last year. Pre-tax profit reached VND 271 billion, up 75% over the same period in 2023. Net profit was nearly VND 217 billion, up 74% over the first quarter of 2023 and was the highest quarterly profit in the history of this securities company.

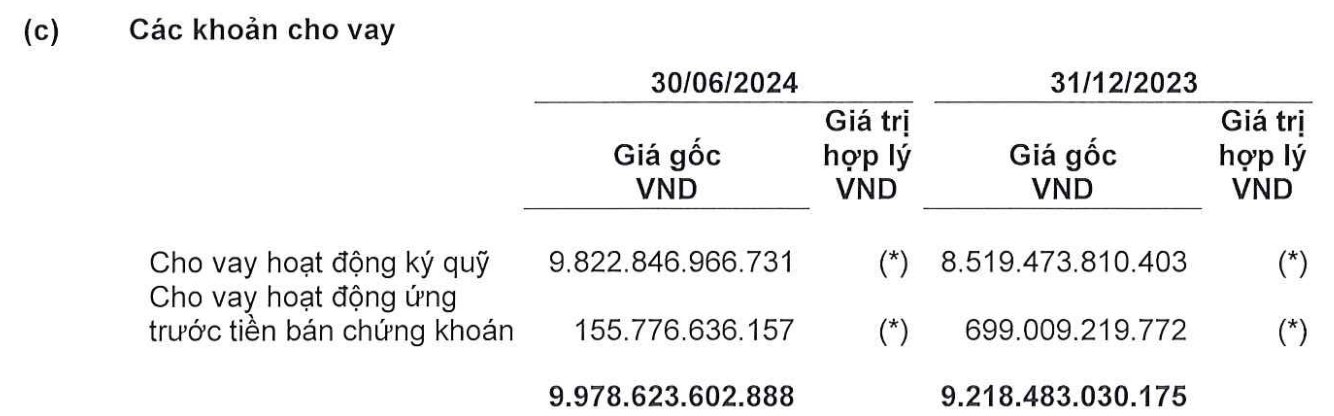

In the second quarter, profit from lending and receivables contributed nearly VND 262 billion, up 88% over the same period last year. As of the end of the second quarter of 2024, MBS’s loan balance recorded VND 9,979 billion, of which margin lending was nearly VND 9,823 billion, an increase of VND 549 billion compared to the end of the first quarter.

MBS’s brokerage segment also continued to improve in the second quarter, with revenue exceeding VND 179 billion, up 32% from the same period last year. The company said that the value and volume of securities transactions in the whole market increased sharply compared to the same period last year.

In the proprietary trading segment, profit from financial assets recognized through profit and loss (FVTPL) reached VND 341 billion, nearly five times the figure for the second quarter of last year; profit from available-for-sale financial assets (AFS) recognized VND 33 billion (compared to a loss of more than VND 4 billion in the same period last year); in contrast, profit from held-to-maturity investments (HTM) decreased by 22% to VND 36 billion.

As of the end of the second quarter of 2024, the FVTPL item of MBS had a market value of nearly VND 1,600 billion, an increase of VND 480 billion from the beginning of the year, mainly in listed bonds (VND 843 billion) and other securities (VND 689 billion). The AFS item at the end of June 2024 mainly consisted of unlisted bonds (VND 1,889 billion) and nearly VND 118 billion in unlisted shares. The company did not elaborate on this item.

For the first six months of the year, MBS’s operating revenue reached VND 1,557 billion, up 111% over the same period in 2023. Profit before tax increased by 63% to VND 500 billion, and net profit was VND 399 billion.

In 2024, MBS set a plan with a total revenue of VND 2,786 billion and a pre-tax profit of VND 930 billion, up 53% and 36% respectively compared to the previous year.

Thus, after the first six months of the year, the company has completed nearly 54% of its full-year 2024 profit plan.

SHB achieves excellent cost control with a CIR of only 23% in 2023, with profits exceeding 9,200 billion VND.

Saigon – Hanoi Bank (SHB) has recently released its consolidated financial report for the year 2023, showcasing stable business growth and strong safety indicators amidst a challenging market.