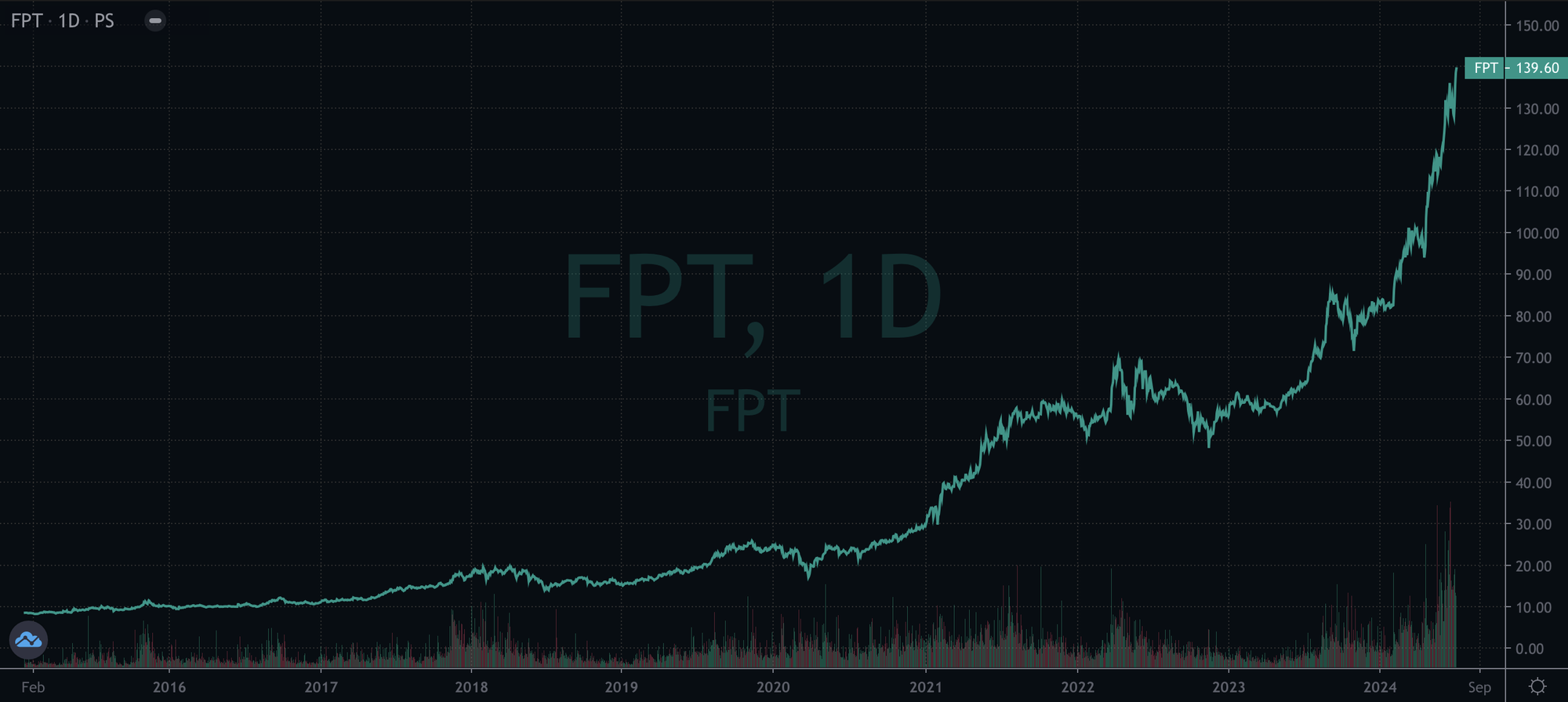

FPT shares continue their upward trajectory amidst market volatility, marking the 34th time it has reached a new peak since the beginning of the year. As of the market close on July 8, FPT’s share price stood at 139,600 VND per share, reflecting a remarkable 68% increase since the beginning of the year. Consequently, the company’s market capitalization also reached a record high of nearly VND 203 trillion, ranking third among the most valuable listed companies in Vietnam.

This impressive performance has brought great joy to FPT’s shareholders, especially its founding members, including Chairman Truong Gia Binh and his long-time associates Bui Quang Ngoc and Do Cao Bao. The trio holds a significant portion of their wealth in FPT shares, and their collective wealth is now estimated to be over VND 19.5 trillion, reflecting an increase of VND 7.9 trillion since the beginning of 2024.

As the “founding fathers” of FPT, the value of their stock holdings may not be their primary concern. Instead, the sustainable growth and success of the corporation are likely to be the source of their greatest satisfaction. After all, they have dedicated their efforts to the company since its early days.

Data as of July 8, 2024

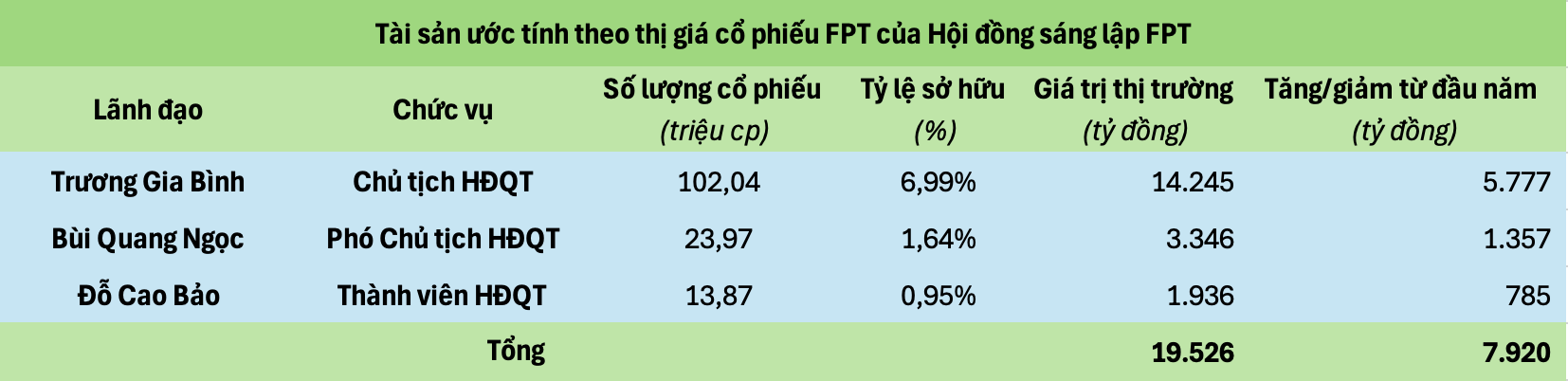

Over the past 36 years, FPT has established itself as Vietnam’s leading technology company and the country’s largest private corporation. The company’s consistent and resilient financial performance has been nothing short of remarkable, earning it the reputation of being a “growth machine.”

For the first five months of 2024, FPT reported impressive results, with revenue reaching VND 23,916 billion and pre-tax profit amounting to VND 4,313 billion, representing increases of 19.9% and 19.5%, respectively, compared to the same period last year. Moreover, profit after tax attributable to the parent company’s shareholders also increased by 21.2% to VND 3,052 billion, corresponding to an EPS of VND 2,403 per share.

Looking ahead, FPT has set ambitious business plans for 2024, targeting a record-high revenue of VND 61,850 billion (~USD 2.5 billion) and a pre-tax profit of VND 10,875 billion, reflecting approximate increases of 18% compared to the previous year’s results. Given the company’s performance in the first five months, FPT has already achieved 39% of its revenue target and 40% of its profit goal.

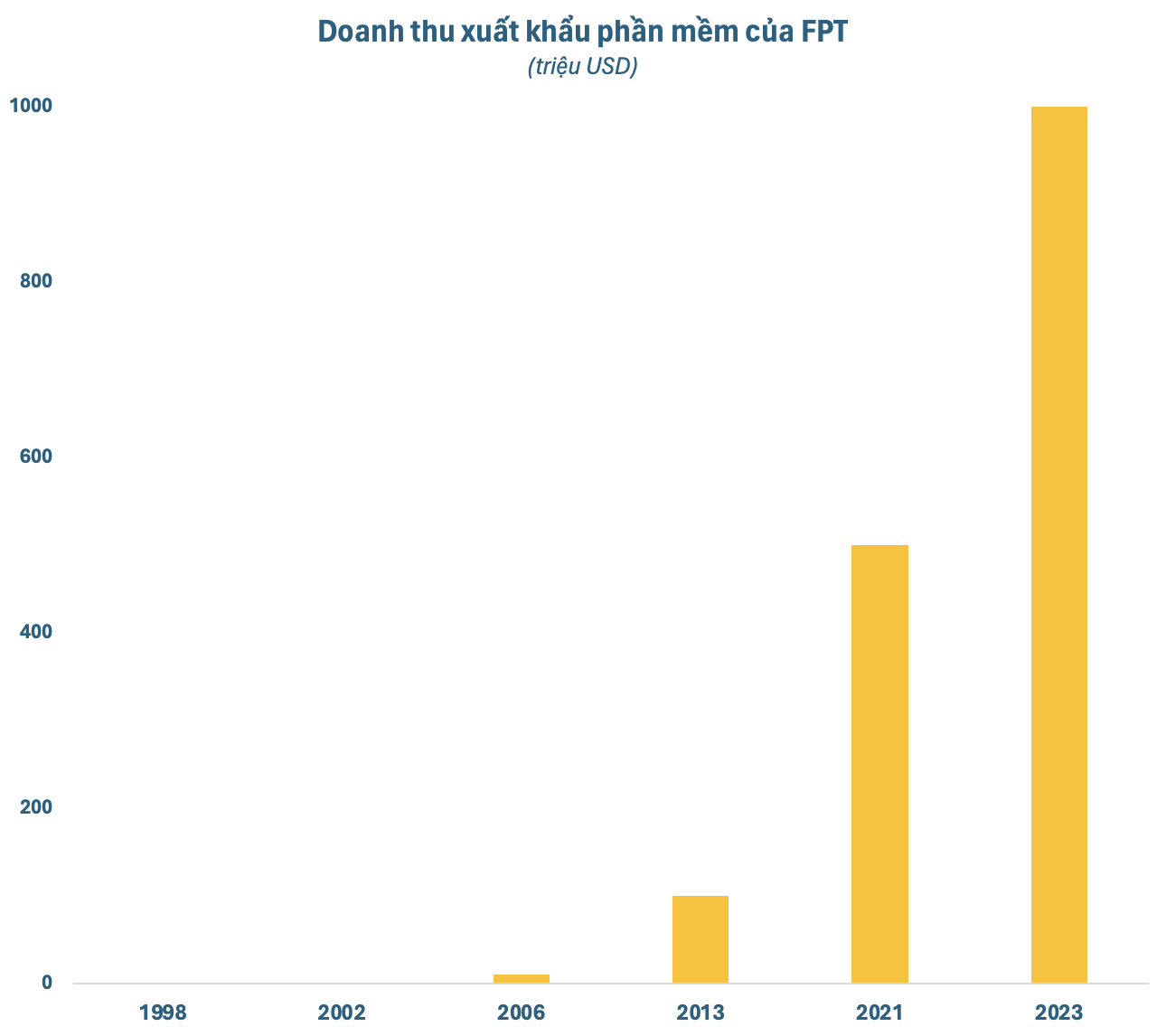

The year 2023 marked a significant milestone for FPT as it surpassed the USD 1 billion revenue mark in IT services from overseas markets for the first time. With a vision for the future, the company has set its sights on reaching a target of USD 5 billion by 2030, further solidifying its position among the billion-dollar IT services companies globally. The “sweet fruits” from the international market have significantly contributed to FPT’s impressive growth trajectory and are expected to continue doing so in the long term.

According to Gartner, IT spending abroad is projected to increase by 8% in 2024 (compared to 4% in 2023). Specifically, IT services spending abroad is expected to grow by 9.7% (compared to 6% in 2023) as foreign enterprises face a greater demand for IT consulting services due to challenges in attracting IT-related talent. This trend bodes well for FPT’s technology segment in the long run.

Recently, FPT and JAL Information Technology (JIT), a subsidiary of Japan Airlines (JAL), signed a memorandum of understanding to collaborate on developing IT systems for the aviation and non-aviation sectors in the Japanese market. Additionally, FPT Software has become a global system integrator for Creatio, a US-based no-code platform provider. These strategic partnerships are expected to enhance FPT’s telecommunications services, particularly in data centers, and expand its customer reach.

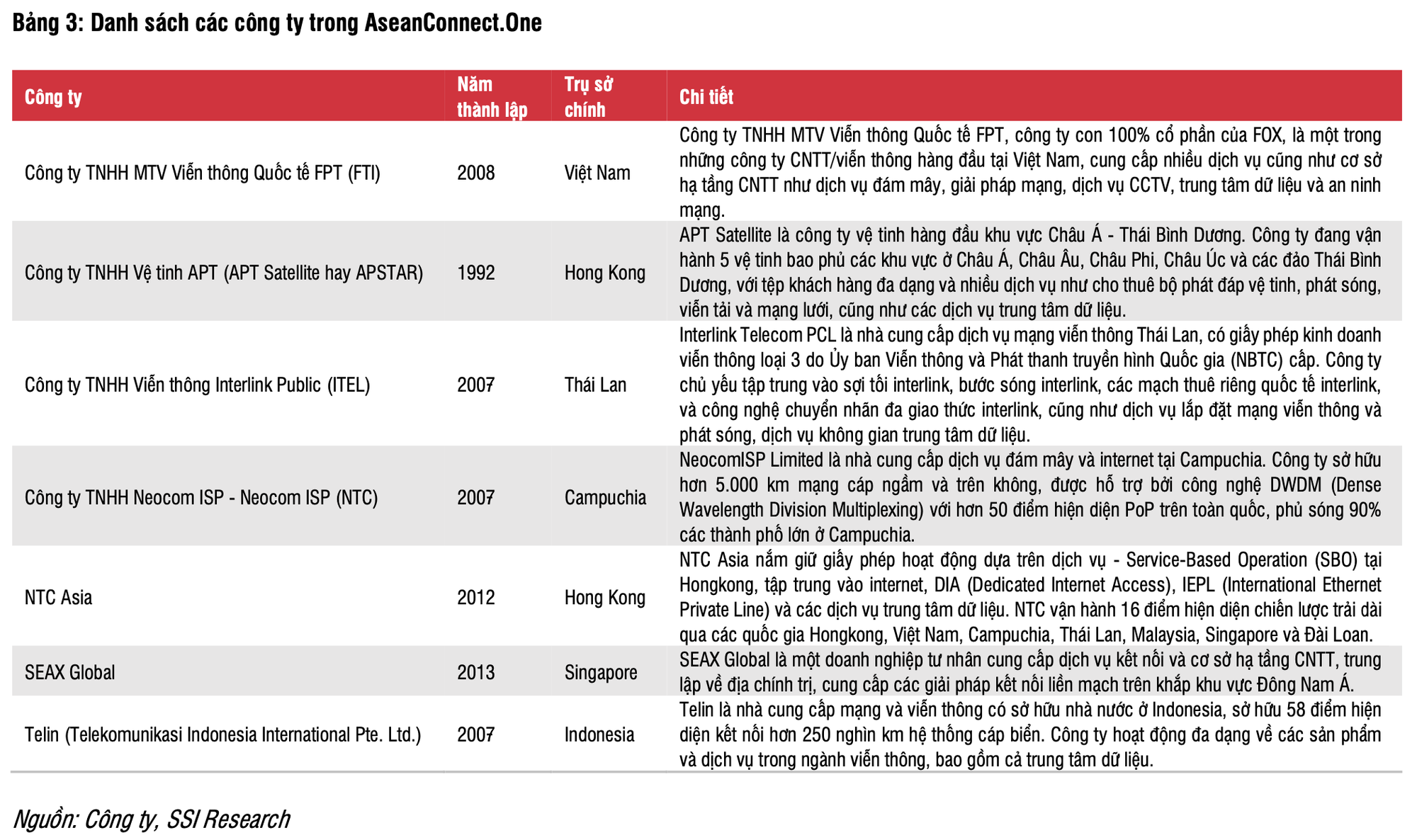

AseanConnect.One, a joint venture between FPT and its partners, aims to become a one-stop-shop service provider, offering enhanced service quality, reduced installation and maintenance times, and seamless access to telecom operators and OTT service providers throughout the ASEAN region.

Coteccons profits nearly 50% from investing in FPT stocks, sets aside full provision of 143 billion for Saigon Glory receivables.

In the first 6 months of this year, Coteccons achieved a net revenue of VND 9,784 billion, a nearly 5% increase, and a net profit of VND 136 billion, which is nearly 8.9 times higher than the same period last year.