In recent news, Techinasia reported that founder Kevin Tung Nguyen has temporarily shut down operations for JobHopin and Skola.

According to Techinasia, Kevin Tung Nguyen is involved in a legal dispute with his wife over ownership of Skola, an edtech platform registered in both Vietnam and Singapore.

Kevin Tung Nguyen is a well-known figure in the startup community, having founded the recruitment platform JobHopin, which was featured in the Forbes 30 under 30 Asia list in 2019. As such, this news has sparked interest among the entrepreneurial community, especially given the context of JobHopin’s significant losses and apparent exhaustion of its raised capital.

RAISING OVER $4.5 MILLION FROM INVESTORS

JobHopin, officially registered as CTCP Doanh nghiệp Xã hội Ivy Care (Ivy Care), was established on August 5, 2016, with a focus on elderly healthcare services. Its initial capital was 2.5 billion VND, later increased to 3.4 billion VND.

In 2018, JobHopin successfully raised $710,000 in a seed funding round led by KK Fund and Japanese human resources service company Mynavi Corporation.

In May 2020, JobHopin secured $2.45 million in a Series A funding round, bringing its total raised capital to over $3 million (approximately 75 billion VND).

That same year, Ivy Care increased its capital by 20 times to 71.6 billion VND with the participation of a foreign investor from Singapore, JOBHOP PTE. LTD., which held 99% of the shares. The company’s capital was further increased to 163.3 billion VND in early 2023, with its primary business being management consulting (excluding financial, accounting, and legal consulting).

In addition to equity funding, Ivy Care has issued two bond lots, raising a total of 37.5 billion VND. Specifically, in 2022, Ivy Care issued bonds worth 22.5 billion VND. In June 2023, the company issued another bond lot worth 15 billion VND with an interest rate of only 1.33%/year. For both lots, in the event of a violation that remains unrectified, Ivy Care will have to repurchase the bonds before maturity with a 15% interest rate differential.

JobHopin was introduced as a platform that utilizes AI and machine learning to automate the recruitment process. The startup claimed to have achieved over 300% annual revenue growth since 2018 and expected to turn profitable in the Vietnamese market by early 2021.

Its leadership proudly shared that they had over 2,000 corporate clients as of 2020. When businesses uploaded candidate resumes to the application, it would automatically analyze the most suitable jobs for the candidates and match their skills and career desires with the criteria set by the recruiters.

“The recruitment industry has survived world wars and economic downturns, and one thing you will see through the process of creating this generation is that businesses thrive or fail based on their people,” said Kevin Tung Nguyen, Founder of JobHopin.

CONSECUTIVE LOSSES TOTALING OVER 115 BILLION VND

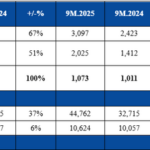

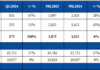

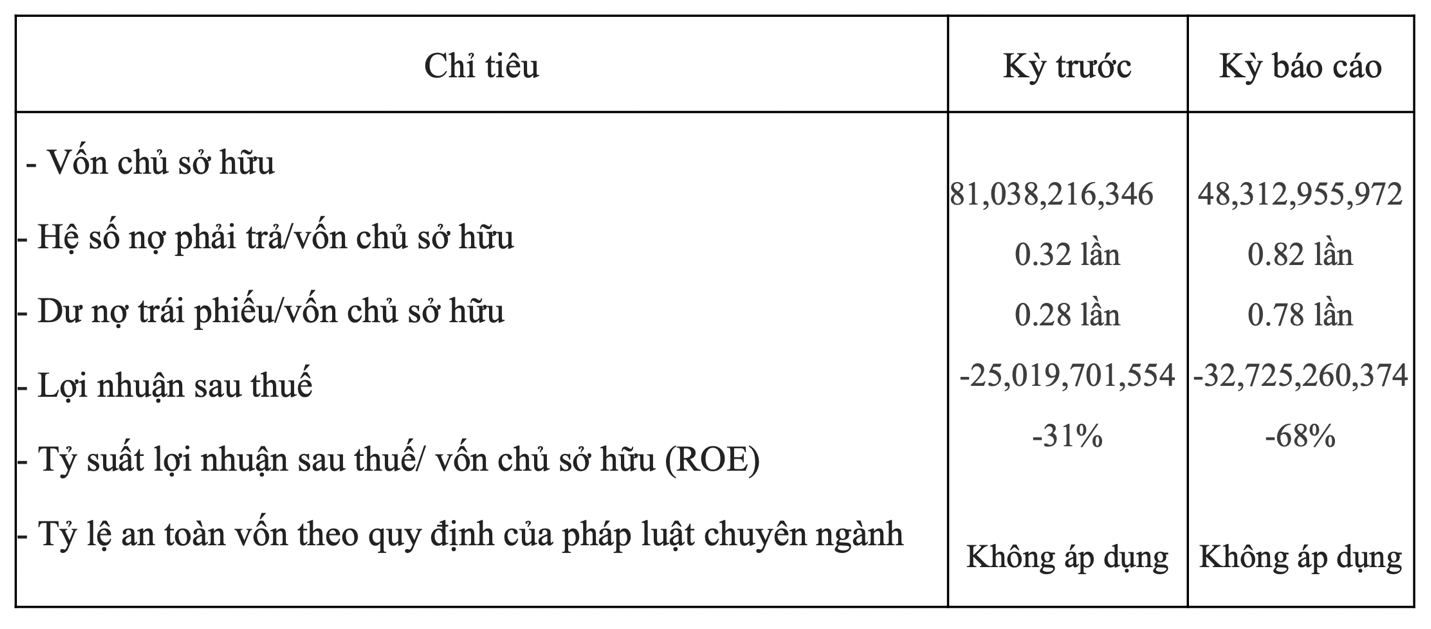

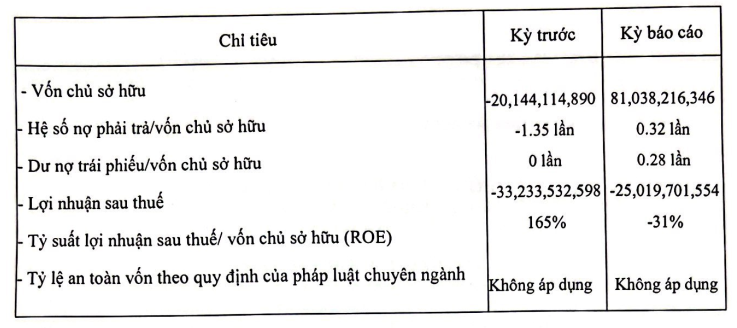

According to financial reports published on the Hanoi Stock Exchange, in 2023, CTCP Doanh nghiệp Xã hội Ivy Care incurred a loss of nearly 33 billion VND after taxes. The company also reported losses of over 25 billion VND in 2022 and 33 billion VND in 2021. With these consecutive losses, as of December 2023, the company’s equity capital decreased to 48 billion VND. At this time, the company’s charter capital was 163.3 billion VND, estimating a minimum accumulated loss of 115 billion VND.

According to our sources, Ivy Care’s losses for 2019 and 2020 were 2 billion and 21 billion VND, respectively. The total loss from 2019 to 2023 amounts to 115 billion VND.

As of December 31, 2023, the debt-to-equity ratio was 0.82, indicating a total debt of approximately 39 billion VND, with a bond debt of 37.5 billion VND.

Financial Situation in 2022-2023

Financial Situation in 2021-2022