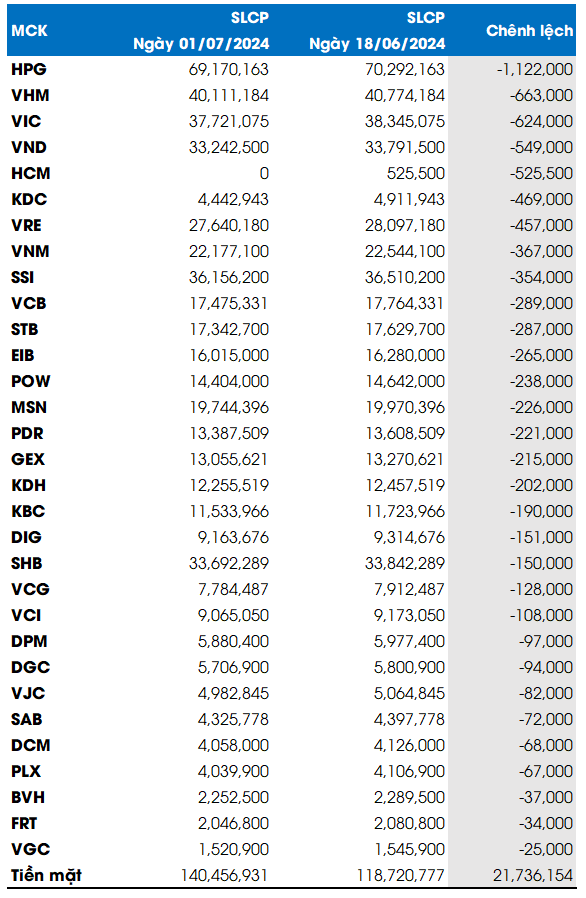

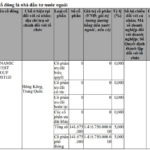

Fubon FTSE Vietnam ETF (Fubon ETF) offloaded a significant portion of its holdings during the period of June 18 to July 1, with a particular focus on HPG, VHM, VIC, and VND. The sale of HCM shares was complete by the end of this period.

As of the beginning of July, HPG, VHM, VIC, SSI, and SHB were the top five stocks by volume in the Fubon ETF portfolio, with respective holdings of 69 million, 40 million, 38 million, 36 million, and 34 million shares.

|

Fubon ETF’s Trading Activity

|

The fund continued its net selling even as it sought to raise additional capital for investment in Vietnam. On June 14, Taiwan’s Financial Supervisory Commission approved Fubon FTSE Vietnam ETF’s plan to raise an extra TWD 5 billion (nearly VND 4 trillion).

Fubon ETF’s selling spree coincided with a broader trend of foreign investor exits. According to experts, international investors have been withdrawing capital not just from Vietnam but also from other regional markets such as Thailand, the Philippines, and Indonesia. This wave of divestment is largely attributed to exchange rate pressures in Vietnam and a reevaluation of market attractiveness across the region. Currently, markets with strong performance, such as the US, Japan, and India, are attracting capital.

|

Fubon FTSE Vietnam ETF is a familiar name to Vietnamese investors. Established in late March 2021, the fund, which is part of the Fubon Financial Holdings conglomerate, closely tracks the FTSE Vietnam 30 Index, focusing on large-cap stocks listed on the Ho Chi Minh City Stock Exchange (HOSE). As of the market close on July 8, the ETF’s net asset value stood at over TWD 23.475 billion (more than VND 18,300 billion). |