The Nam Kim Board of Directors has approved a resolution to issue a maximum of 131.6 million shares to existing shareholders at VND 12,000 per share. The rights ratio is 2:1, meaning that for every 2 shares owned, shareholders will have the right to purchase 1 new share.

All proceeds from the capital raise will be allocated to the Nam Kim Phu My Project in Ba Ria-Vung Tau Province. This project includes a 350,000-ton-per-year zinc plating line, 2 aluminum-zinc alloy plating lines with capacities of 300,000 and 150,000 tons per year, and a color plating line with a capacity of 150,000 tons per year. The total investment for Phase 1 is VND 4,500 billion.

At the 2024 Annual General Meeting of Shareholders held in late April, Chairman Ho Minh Quang announced that the factory has received a construction permit and is expected to be operational by Q4 2025 or Q1 2026. The plant is projected to reach full capacity by 2027, increasing the company’s capacity from 1 million tons per year to 1.6 million tons per year.

CEO Vo Hoang Vu shared that the construction of the new factory is aimed at capitalizing on the expected recovery of the global economy in 2025-2026. The new factory will focus on higher-quality products, catering to the auxiliary industries, auxiliary mechanics, electrical appliances, and automotive industries.

Nam Kim’s Recovery

Turning to the company’s recent business performance, Nam Kim has demonstrated a noticeable recovery. In Q1 2024, Nam Kim recorded a net profit of VND 150 billion, higher than the previous quarter and a significant improvement from the same period last year (loss of VND 50 billion). This positive result was mainly driven by the export sector, while the domestic market continued to face challenges due to the slow economic recovery and tight consumer spending.

Securities companies forecast a continued recovery in Nam Kim’s business performance, driven by exports. Key markets for Nam Kim, such as North America and Europe, are preparing to ease monetary policies in the second half of this year, boosting demand in the real estate and construction sectors.

Additionally, the company’s export activities are expected to benefit from the implementation of safeguard measures in the European market. Specifically, the European Commission has reduced the liberalization quota from 4% to 1% per year and set a maximum import limit of 15% per country on the existing duty-free quota for products in Groups 1 and 16, effective from July 1, 2024, to June 30, 2026.

|

In addition to the share offering plan, Nam Kim Steel also intends to issue 52.6 million shares to increase its charter capital. The rights ratio is 100:20, meaning that for every 100 shares owned, shareholders will receive 20 new shares. If both schemes are completed, Nam Kim Steel’s charter capital will increase to more than VND 4,700 billion, an 80% increase. |

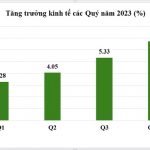

Vietnam Economy 2024: 8 Drivers for Growth

Vietnam’s economy in 2023 has achieved remarkable accomplishments despite facing challenges. To ensure sustainable development, it is crucial to identify the bright spots, understand the current reality, and anticipate new factors and drivers that will impact the economy. This will enable us to provide effective solutions for 2024 and the years ahead.