“SME Pain Points: An Insider’s Perspective”

According to Vietnam’s General Statistics Office, over 172,000 businesses exited the market in 2023, a 20.5% increase from 2022. (1) The year 2024 continues to be challenging, with 86,400 businesses exiting in the first four months, a 12.2% rise year-on-year. (2) These figures highlight the myriad of “pain points” faced by SMEs, requiring effective solutions for survival in a highly competitive landscape.

Soaring production, operational, and marketing costs pose a significant burden on SMEs. Mr. N.T.S., a fashion store owner in Ho Chi Minh City, shared, “Raw material prices have surged recently, while product prices cannot increase proportionally. This has severely impacted our profits. We’ve been struggling to stay afloat but don’t know how long we can endure.”

Management capabilities and competition from large corporations and foreign companies are additional challenges for SMEs. Mr. D.H.L., a owner of a household goods manufacturer in Binh Duong, said, “We compete with imported products that are cheaper and of better quality. This forces us to innovate and adapt to remain competitive.”

Aside from costs and management capabilities, one of the most significant issues for SMEs is the lack of access to reasonable capital. Ms. T.H.T., a owner of a furniture manufacturer in Hanoi, expressed, “Our company always encounters difficulties in accessing loans. Complex borrowing procedures and high collateral requirements hinder our ability to expand production.”

E-Fast: Eximbank’s Solution for SME’s Capital Needs

Understanding the challenges faced by SMEs, Eximbank introduced E-Fast, a timely and urgent solution to facilitate SME’s access to affordable loans and efficient financial management.

E-Fast addresses SMEs’ capital shortage with simplicity, convenience, and speed.

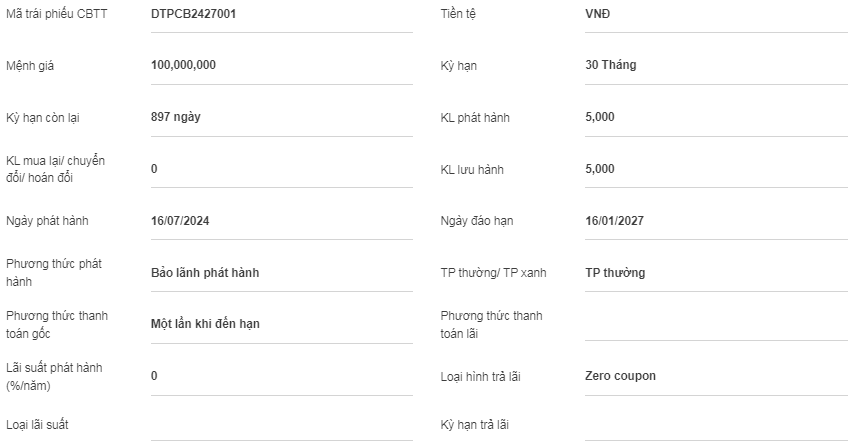

With a credit package of VND 5,000 billion, E-Fast by Eximbank enables SMEs to swiftly tackle their loan challenges. The offering includes easy access to credit limits of up to VND 15 billion per customer, approval within 4 hours, an attractive interest rate of 5.25%/year, and a fixed rate during the promotional period.

Mr. P.T.B., an Eximbank customer, shared his experience, “E-Fast helped us address our capital shortage promptly. Consequently, we could expand our production scale and enhance product quality amidst complex economic conditions and fierce market competition. Moreover, the fixed interest rate throughout the loan tenure has enabled us to plan our operational costs more effectively.”

Another customer, Mr. P.N.L., also praised E-Fast’s advantages: “The simplicity and convenience of the loan process, along with the swift disbursement, saved my business from potential failure during economic fluctuations. Without E-Fast, my company might have ceased operations.”

In today’s complex economic landscape, SMEs desperately need practical support from financial institutions and banks. Eximbank’s E-Fast product not only addresses immediate challenges but also paves the way for sustainable development for SMEs. This assistance is crucial not just for the survival and growth of these businesses but also for the overall development of the economy.