The National Assembly passed the amended Social Insurance Law at its 7th session of the XVth term. The new Social Insurance Law will officially come into force from July 1, 2025, consisting of 11 chapters and 141 articles, an increase of 1 chapter and 5 articles compared to the draft Law submitted by the Government, and an increase of 2 chapters and 16 articles compared to the current Social Insurance Law. There are 9 groups of new points, including:

First: Regulation of social retirement allowance regime funded by the state budget, building on and developing from the monthly social allowance regime for the elderly. Specifically, those eligible for the social retirement allowance are Vietnamese citizens aged 75 years and older or from 70 to under 75 years old from poor or near-poor households; not receiving a pension or monthly social insurance allowance (except in cases prescribed by the Government).

The monthly social retirement allowance shall be prescribed by the Government, suitable to the socio-economic development conditions and the state budget capacity of each period. At the same time, those receiving the monthly social retirement allowance shall have their health insurance paid by the state budget; in case of death, the organization or individual in charge of the funeral shall receive a funeral support.

Vietnamese citizens aged 75 and above, not receiving a pension or social insurance benefits, are entitled to a social retirement allowance.

Second: Demonstrating intra-system linkage in the social insurance system by providing for a monthly allowance for the period before reaching the age to receive the social retirement allowance. Accordingly, Vietnamese citizens of retirement age but with less than 15 years of social insurance contributions to be eligible for a pension, and who do not yet meet the conditions to receive the social retirement allowance, if they do not receive a lump-sum social insurance payment and do not wish to preserve their contributions, may request to receive a monthly allowance from their own contributions.

The minimum monthly allowance shall be equal to the social retirement allowance. The period and amount of the monthly allowance shall be determined based on the employee’s contribution period and basis. During the period of receiving the monthly allowance, the employee shall have their health insurance paid by the state budget; in case of death, the dependents shall receive a lump-sum allowance for the unpaid months and a funeral allowance if eligible.

Third: Expansion of compulsory social insurance participants, including: household business owners participating in accordance with Government regulations; enterprise managers, inspectors, state capital representatives, enterprise representatives in companies and parent companies as prescribed by the Law on Enterprises; members of the Board of Directors, General Directors, Directors, members of the Supervisory Board or inspectors and other elected management positions of cooperatives and cooperative alliances as prescribed by the Law on Cooperatives, who do not receive salaries; part-time employees with monthly salaries equal to or higher than the minimum compulsory social insurance contribution base salary; in cases where the employee and employer agree to use a different term but the content reflects the existence of paid work, salary, and the management, direction, or supervision of one party by the other…

In addition, in order to gradually move towards a compulsory social insurance policy for all employees with stable jobs, income, and salaries when necessary conditions are met, the Law stipulates that the National Assembly Standing Committee decides on the participation in compulsory social insurance for other subjects with stable jobs, income, and regular salaries based on proposals from the Government, suitable to the socio-economic development conditions of each period.

Voluntary social insurance participants are entitled to maternity benefits.

Fourth: Expansion of benefits for social insurance participants, such as reducing the minimum number of years of social insurance contributions to be eligible for a monthly pension (from 20 years reduced to 15 years; not applicable to those receiving a pension due to reduced working capacity); Voluntary social insurance participants are entitled to a maternity allowance of VND 2 million for each child born and each fetus of 22 weeks of age or older who dies in the uterus or during labor.

Fifth: A separate chapter is dedicated to regulating the management of social insurance collection and contribution; clarifying the meaning and handling of late payment and evasion of social insurance contributions.

Sixth: Specific regulations on the “reference level” instead of the “base salary level”. Accordingly, the reference level is the amount of money used to calculate the contribution and benefit levels of some social insurance regimes prescribed by the Law, to be decided by the Government. The reference level shall be adjusted based on the increase in the consumer price index, economic growth, and the capacity of the state budget and the social insurance fund.

Seventh: More specific provisions on investment and management of the social insurance fund, approval and auditing of the budget for the organization and operation of social insurance.

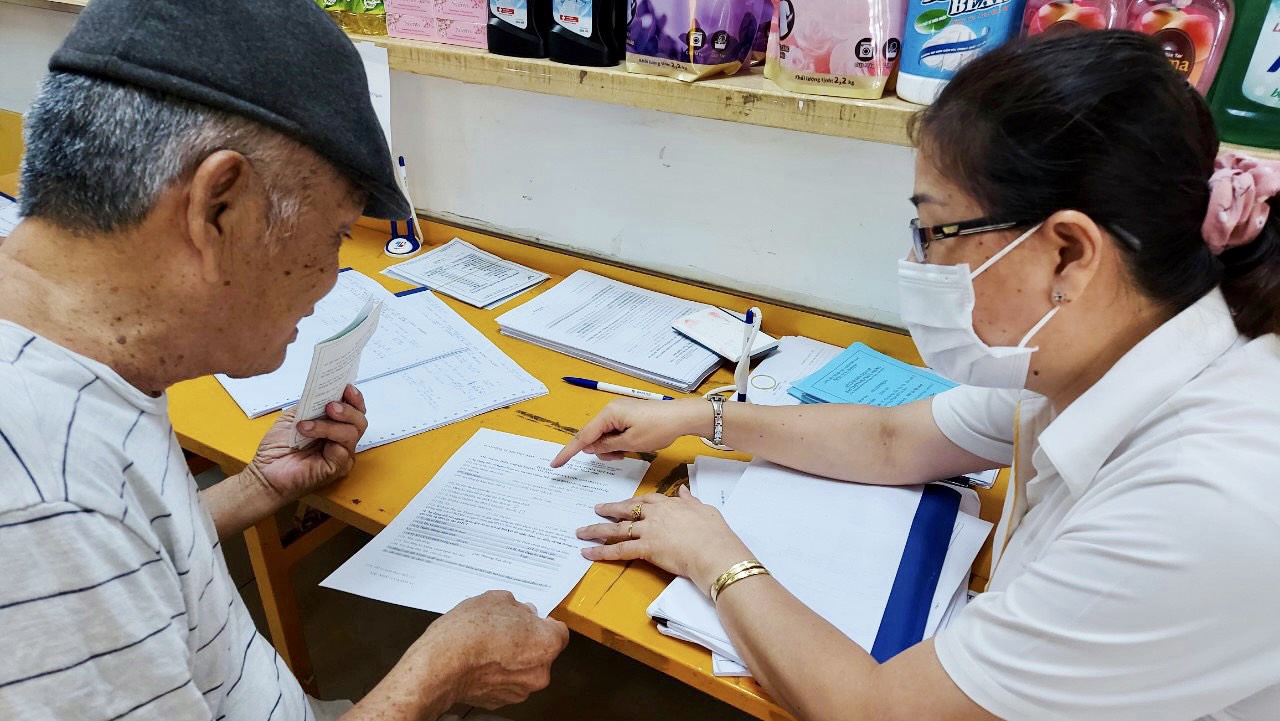

Eighth: Simplification of administrative procedures related to social insurance, electronic transactions in the field of social insurance, and assessment of people’s satisfaction with the organization and implementation of social insurance policies and regimes.

Ninth: Addition of provisions on international cooperation and clearer definition of the management responsibilities of the Ministry of Labor, Invalids, and Social Affairs and the Ministry of Finance.

Two adjacent towns near Ho Chi Minh City will be considered for upgrading to a city at the upcoming session of the National Assembly.

The 31st Session of the Standing Committee of the National Assembly is expected to take place over a span of 3.5 days, from March 14th to March 19th, 2024.

Unlocking the Secrets to Effective Lawmaking: The 7th Session of the 15th National Assembly

The upcoming 7th Session of the National Assembly is set to be a busy one, with 39 agenda items up for discussion. Of these, 24 are related to law-making, reflecting the importance of this session in shaping the legislative landscape. Additionally, 15 items will focus on economic, social, and budgetary matters, as well as oversight and other significant issues. This session promises to be a pivotal moment in the nation’s political calendar.