On July 4, 2024, the Ministry of Industry and Trade and the Ministry of Finance adjusted retail fuel prices according to the 7-day adjustment cycle. This is the fourth consecutive increase since mid-June, reflecting the upward trend in Brent oil prices.

VietCap’s report noted that this price adjustment cycle applies the new regulated operating costs per liter of fuel, as per Official Dispatch No. 6808/BTC-QLG dated July 1, 2024, replacing the previous Official Dispatch No. 6800/BTC-QLG dated June 30, 2023.

Accordingly:

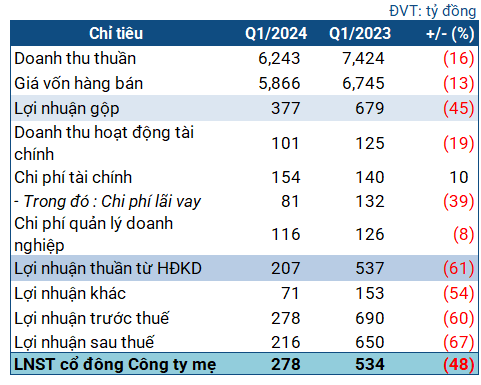

– The regulated operating costs for RON 95 gasoline increased by VND 60 per liter to VND 1,140 per liter (+5.6% YoY; double the increase of VND 30 per liter last year).

– The regulated operating costs for diesel increased by VND 140 per liter to VND 1,170 per liter (+13.6% YoY; 4.7 times higher than the increase of VND 30 per liter last year).

– The regulated operating costs for kerosene increased by VND 230 per liter to VND 1,180 per liter (+24.2% YoY; no change last year)

– The regulated operating costs for mazut increased by VND 70 per liter to VND 430 per liter (+19.4% YoY; last year decreased by VND 184 per liter)

VietCap assessed that this increase would have a significant positive impact on major fuel traders and distributors such as Vietnam Oil and Gas Group (PV Oil, stock code OIL) and Vietnam National Petroleum Group (Petrolimex, stock code PLX). The higher regulated operating costs allow these companies to achieve higher gross profits by better covering their actual operating expenses.

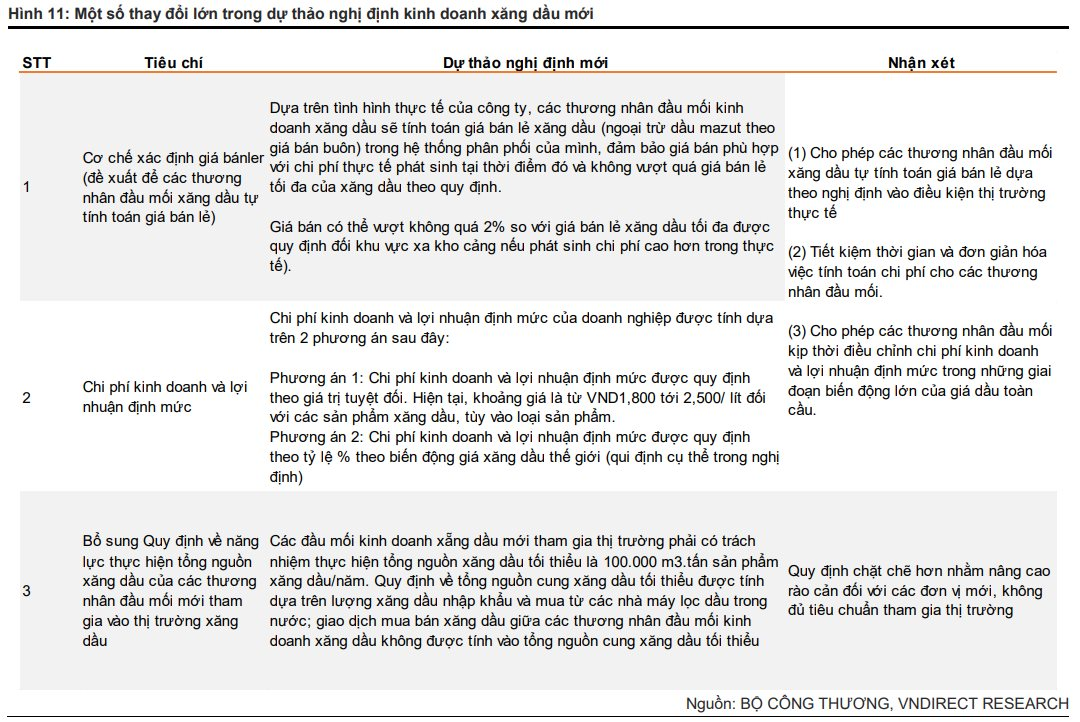

Meanwhile, a research report by VNDIRECT Securities Corporation mentioned the benefits that the two fuel distribution giants, as mentioned above, would gain from the Ministry of Industry and Trade’s submission of the second draft decree on fuel trading with important changes in the mechanism for determining retail prices and new regulated operating costs and profit margins.

According to VNDIRECT’s assessment, this decree will allow fuel traders: 1) to make autonomous decisions on retail prices based on market conditions; and 2) to promptly adjust fixed operating costs and profit margins (key factors affecting PLX’s gross profit) during periods of volatile global oil prices.

Specifically, the Ministry of Industry and Trade and the Ministry of Finance will no longer directly calculate and announce the base price for determining retail prices, as this process has two issues.

First, government agencies and businesses have to go through multiple steps and spend a lot of time.

Second, the components of the base price are calculated based on data from the past with a relatively long time frame, usually on a quarterly basis, which does not fully reflect the actual market situation.

Instead, the government will only announce the 7-day (or 15-day) average global price. Fuel traders will then base their retail price announcements on fixed factors such as various types of taxes, plus regulated operating costs and profit margins specified in the decree.

Additionally, the retail price is not allowed to exceed the maximum price determined by the new decree’s formula (only permitted to exceed by no more than 2% for remote areas far from ports and warehouses, where transportation costs are higher)

“Therefore, we expect the decree to come into effect by the end of 2024 and support a 0.5% increase in PLX’s gross profit margin to 6.1%” – the report stated.

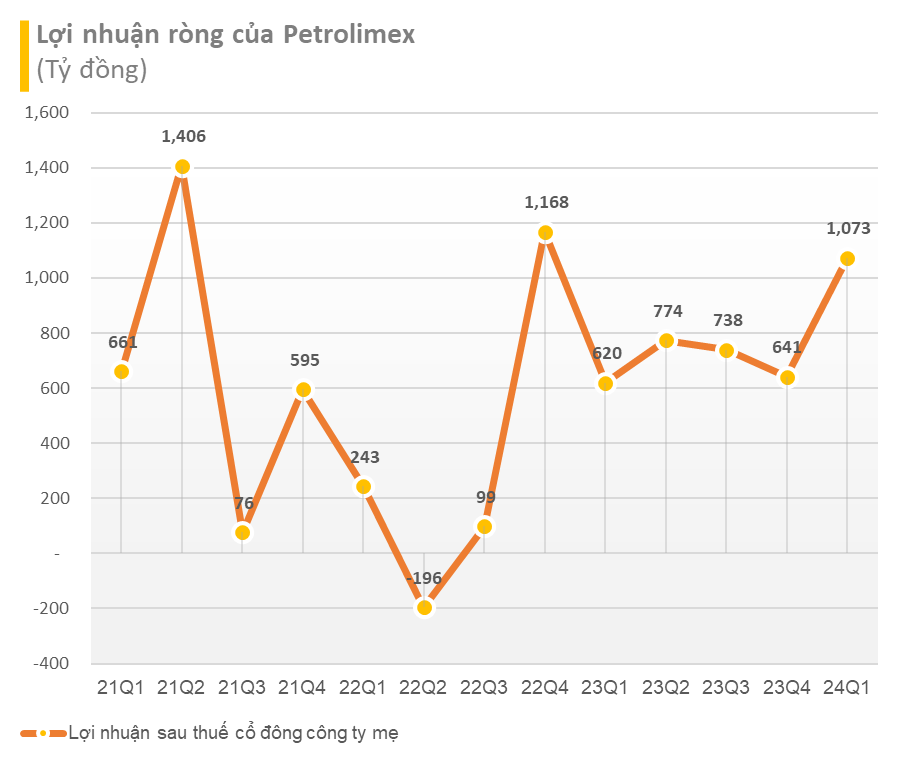

Additionally, an estimate from VNDIRECT showed that Petrolimex’s fuel sales volume in Q1/24 increased by more than 10% year-on-year and was 18% higher than the average quarterly sales volume over the past five years.

The significant increase in sales volume indicates that Petrolimex might have gained market share from smaller distributors, especially from some fuel traders and distributors who had their licenses revoked recently, such as Xuyên Việt Oil and Hải Hà Petro.

At the 2024 Annual General Meeting, Petrolimex also shared that this situation has positively impacted the company’s market share. Thanks to its dominant position in the market, Petrolimex can attract more agents and dealers (DODO) as they seek reliable fuel traders.

In the trading session on July 4, PLX and OIL shares both surged. PLX’s share price rose 4.9% to VND 43,900 per share, while OIL jumped 13.6% to VND 14,200 per share. These are the highest levels for both stocks in more than two years.

Since the beginning of 2024, PLX shares have increased by 32%, pushing Petrolimex’s market capitalization to nearly VND 56 trillion (over $2 billion). Similarly, OIL shares have also risen by 42% in the past six months, bringing its market capitalization to VND 14.6 trillion (over $500 million). However, these numbers are still far from the records set by the two companies in the past.