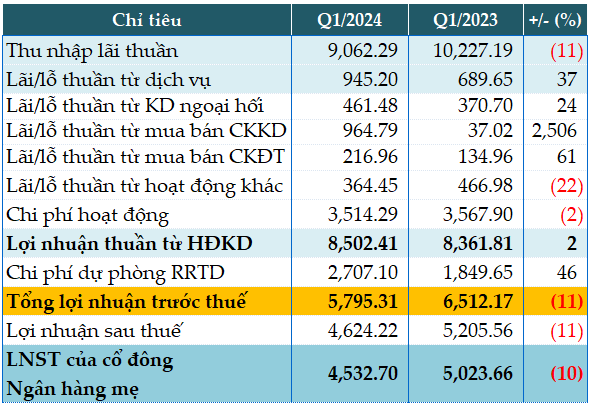

In the first quarter, MB’s major revenue decreased 11% year-on-year, only earning 9,062 billion VND in net interest income.

Nevertheless, MB’s non-interest revenue sources all grew well compared to the same period.

Net service revenue reached 945 billion VND, a 37% increase, with revenue from payment services and treasury operations increasing 48% (711 billion VND) and revenue from debt servicing, valuation and asset exploitation increasing 2.6 times (147 billion VND).

Of note, trading in securities earned almost 965 billion VND, while in the same period last year only over 37 billion VND was earned. Revenue from foreign exchange trading also increased 24% (462 billion VND), and revenue from investment securities increased 61% (217 billion VND).

Operating expenses in the quarter were reduced by 2%, down to 3,514 billion VND. However, MB allocated 2,707 billion VND for credit risk provisioning, leading to the bank earning only 5,795 billion VND in pre-tax profit, an 11% decrease year-on-year.

In 2024, MB aims for pre-tax profit to increase by 6-8% compared to the results in 2023, equivalent to between 27,884 billion VND and 28,410 billion VND. Thus, after the first quarter, MB has achieved 21% of its target.

Financial Results of Q1/2024 of MBB. Unit: Billion VND

Source: VietstockFinance.

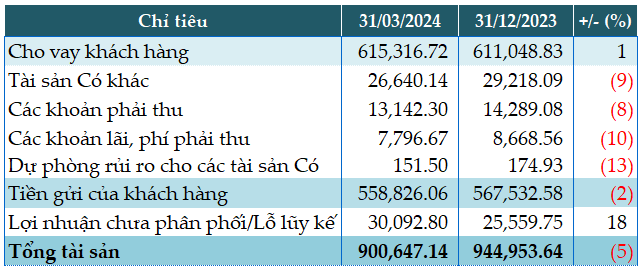

By the end of the first quarter, the bank’s total assets decreased by 5% from the beginning of the year, reaching only 900,647 billion VND. Thereof, deposits at the State Bank of Vietnam (SBV) decreased sharply by 82% (down to 11,915 billion VND), while deposits and loans to other banks increased by 68% (77,809 billion VND), and loans to customers increased by 1% (615,316 billion VND).

Regarding its funding sources, customer deposits decreased slightly by 2% (down to 558,826 billion VND), while government and central bank debts increased by 3,900 billion VND, compared to nearly 9 billion VND in the same period.

Some Financial Indicators of MBB At March 31, 2024. Unit: Billion VND

Source: VietstockFinance

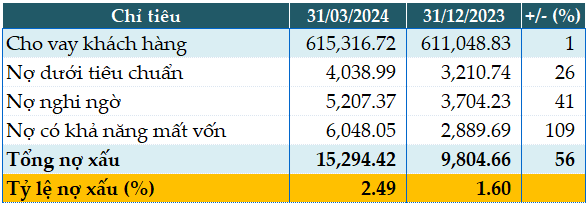

MB’s total bad debt as of March 31, 2024 was 15,294 billion VND, a 56% increase from the beginning of the year. The ratio of bad debt to total loans increased from 1.6% at the beginning of the year to 2.49%.

Quality of Credit of MBB At March 31, 2024. Unit: Billion VND

Source: VietstockFinance.