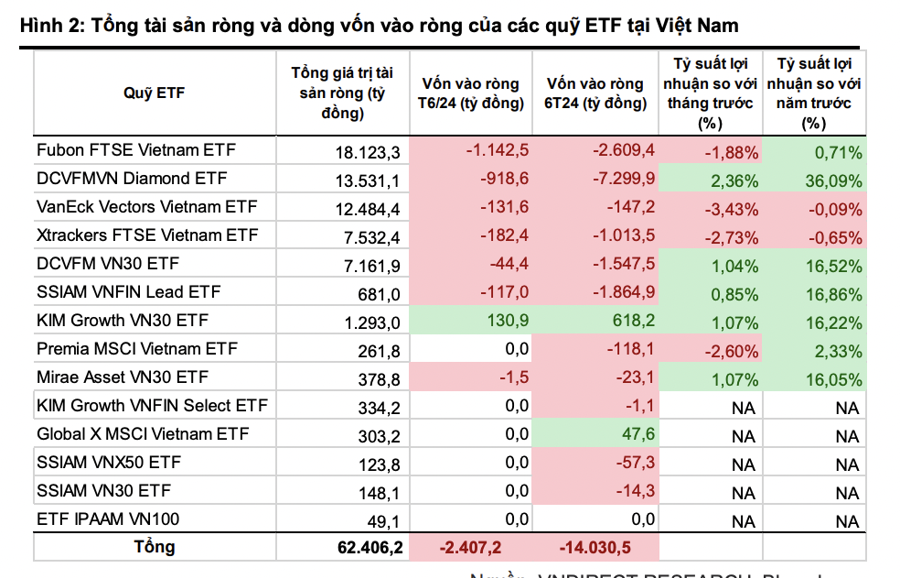

Vietnamese ETFs witnessed net outflows in June 2024, with a withdrawal value of over VND 2,407 billion. According to statistics from VnDirect, the cumulative net outflow for the first six months of 2024 exceeded VND 14,030 billion.

The net outflow from ETFs in June 2024 was mainly due to net withdrawals from the Fubon FTSE Vietnam fund, which experienced outflows of more than VND 1,142 billion, followed by DCVFMVN Diamond ETF with outflows of over VND 918 billion, Xtrackers FTSE Vietnam ETF with outflows of over VND 182 billion, VanEck Vector Vietnam ETF with outflows of over VND 131 billion, and SSIAM VNFIN Lead ETF with outflows of over VND 117 billion.

On the other hand, the KIM Growth VN30 ETF witnessed a net inflow of over VND 130 billion.

In terms of investment performance, the ETFs underperformed in the past month. Fubon FTSE declined by 1.88%, VanEck Vectors by 3.43%, Xtrackers FTSE by 2.73%, and Premia MSCI Vietnam ETF by 2.60%. Conversely, DCVFMVN Diamond ETF increased by 2.36%, DCVFM VN30 ETF by 1.04%, and KIM Growth VN30 ETF by 1.07%.

VnDirect predicts no changes in the composition of the VN30 basket for the Q2/2024 review.

The HOSE – Index, comprising indices such as VN30, VNMidcap, VNSmallcap, VN100, VNAllshare, VNAllshare Sector Indices, as well as investment indices including VNDiamond and VNFin Lead, will undergo a periodic review for Q2/24 with the following timeline: July 15, 2024, for the announcement of periodic review results, and August 5, 2024, for the new indices to take effect.

In this review, the VN30 and VNFin Lead indices will be assessed for compositional changes, while the VNDiamond index will only update data and recalculate portfolio weights.

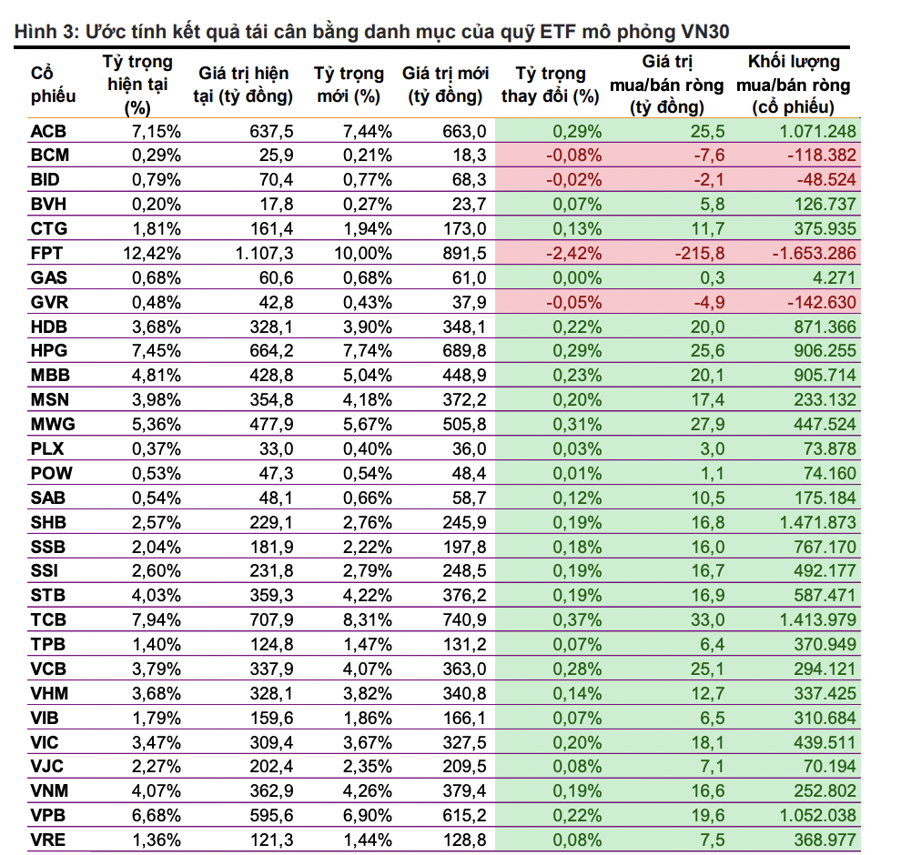

Based on data up to June 28, 2024, VnDirect forecasts no changes in the composition of the VN30 basket for the Q2/24 periodic review. This is because the stocks in the current VN30 basket still meet the criteria for trading value, trading volume, and are among the top 40 stocks by market capitalization on the HoSE. Thus, the VN30 basket will continue to include 13 banking stocks and 17 stocks from other sectors.

The ETFs tracking the VN30 index include DCVFM VN30 ETF, SSIAM VN30 ETF, FUEMAV30 ETF, and KIM Growth VN30 ETF. These four ETFs currently have a total asset size of over VND 8,900 billion. They will rebalance their portfolios from July 16, 2024, to August 2, 2024.

It is estimated that during this portfolio rebalancing, the stocks that will be most bought by the VN30-tracking ETFs include TCB and MWG, with corresponding volumes of 1.4 million shares (approximately VND 33 billion) and 447,000 shares (approximately VND 27.9 billion), respectively. On the other hand, FPT is expected to be the stock most sold by these ETFs, with a volume of 1.65 million shares (approximately VND 215.8 billion).

Foreign investors continued to increase their net selling. In June 2024, foreign investors maintained strong net selling with a value of over VND 16,738 billion. The cumulative net selling value for the first six months of 2024 by foreign investors exceeded VND 49,700 billion. In June 2024, foreign investors net sold over VND 16,591 billion on the HoSE and over VND 220 billion on the UPCoM, while net buying over VND 74 billion on the HNX.

The stocks that foreign investors net bought the most in June 2024 included MBB, MSN, HAH, PC1, and IDC. Conversely, the stocks that foreign investors net sold the most during the same period were FPT, CCQ FUEVFVND, VHM, MWG, and VRE.

In the recent two months of strong net selling by foreign investors, the net selling value of ETFs accounted for only about 15% of the total net selling value of foreign investors. This indicates that the recent net selling by foreign investors was not primarily driven by ETF outflows.

The reason for the strong net selling by foreign investors recently could be attributed to the strengthening US dollar, which continues to put depreciation pressure on the VND. Additionally, the second reason could be the global capital reallocation, where foreign capital continues to be withdrawn from weak-performing markets like China and Vietnam and redirected to more efficient markets such as the US.