The HoSE’s large-cap stocks lacked stability, causing the VN-Index to fluctuate between green and red throughout the afternoon session, ultimately closing with a marginal gain of less than one point. This occurred despite a record net withdrawal by foreign investors since the beginning of 2023. However, medium- and small-cap stocks performed well, with 14 stocks reaching the ceiling price. The VNSmallcap index on the HoSE stood out with a 0.86% increase at the close.

The trading volume on the HoSE in the afternoon session only increased slightly by 6.7% compared to the morning session, with a 3.3% rise in the VN30 basket. Although 20 stocks in the VN30 basket improved in terms of price compared to the morning session, it was not enough to create a significant impact. The VN-Index had two periods of creating bottoms during the afternoon session before recovering in the last eight minutes of the continuous matching period.

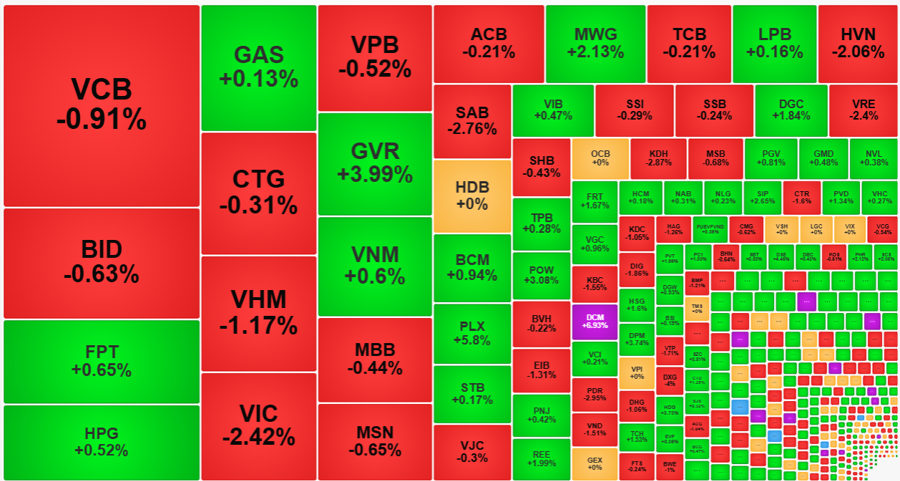

Out of the ten largest stocks capable of regulating the VN-Index, only four recorded gains, with GVR’s 3.99% increase being the most notable. Meanwhile, FPT rose by 0.65%, HPG by 0.52%, and GAS by a modest 0.13%. On the other hand, the VHM and VIC pair experienced a significant decline, falling by 1.17% and 2.42%, respectively. Additionally, the largest stock, VCB, decreased by 0.91%, and BID fell by 0.63%, negating most of the positive impact on the VN-Index.

The stocks driving the index today were mostly medium-cap stocks, with GVR being the only large-cap stock. PLX increased by 5.8%, DCM by 6.93%, POW by 3.08%, and DGC by 1.84%… MWG, FPT, and HPG also contributed to the index’s gains, but most of their increases were already achieved in the morning session. GVR and PLX stood out in the afternoon session, rising by an additional 2.96% and 2.2%, respectively, compared to their closing prices in the morning. POW, STB, and TCB were other stocks that managed to gain over 1% in the afternoon session, although TCB’s increase was not enough to surpass the reference price.

Bottom-fishing demand in the afternoon session was relatively subdued for the VN30 basket but was more enthusiastic for medium- and small-cap stocks. The VN30 basket closed with a slight decrease of 0.03%, with 12 gainers and 17 losers, a slight improvement from the morning session. On the other hand, the Smallcap group performed strongly, with the index closing with a double increase of 0.86% compared to the morning session. Out of the 14 stocks that closed at the ceiling price on the HoSE in the afternoon session, 10 belonged to the Smallcap group.

Surprisingly, the trading volume for small-cap stocks was quite healthy, reaching VND 2,194.2 billion. In the last two sessions, this basket has successfully traded over VND 2,000 billion per day. The stocks that reached the ceiling price had trading volumes above VND 20 billion, which is considered high for stocks in this basket, including CSV, TVS, LHG, BFC, VTO, and VIP. VOS even recorded a trading volume of nearly VND 143 billion. Stocks like NHA, STK, PVP, and MIG also witnessed increases of over 3% in value with good trading volumes.

The resurgence of small-cap stocks indicates a return of greed in the market. While the lackluster performance of large-cap stocks prevented a strong upward momentum, the strengthening of capital in small-cap stocks is a notable development. Last week, when the market rose thanks to the pull of large-cap stocks, trading in small- and medium-cap stocks was relatively calm, with only the last session of the week trading over VND 2,000 billion, and the weekly average was only VND 1,657 billion per session. Previously, signals of a retreat by hot money were observed on June 24-25 when trading suddenly weakened. The peak period for this capital flow was the second week of June when the average daily trading volume exceeded VND 3,000 billion.

The stagnation of large-cap stocks has caused the VN-Index to signal difficulty in breaking through the old peak. This may create psychological pressure, as investors often analyze the market through this index. However, the signal from capital inflows into speculative stocks tells a different story: investors are still eager to seek out individual opportunities, and their enthusiasm is evident as they push stock prices to ceiling prices or increases of 3-4% in a single day.

Foreign investors continued to sell in the afternoon session, offloading an additional VND 295.7 billion after selling VND 1,921 billion in the morning session on the HoSE. Today’s selling spree by foreign investors set a record since the beginning of 2023, second only to the VND 3,110 billion selling on January 13, 2023, which included a VND 3,387 billion agreement for EIB stock. Since then, today has been the only day when foreign investors have sold stocks exceeding the VND 2,000 billion mark in a single day.

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.