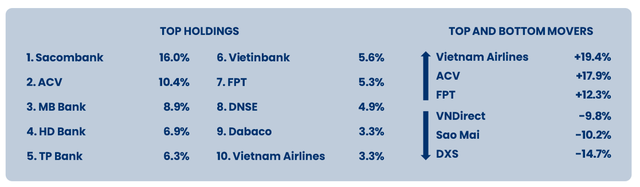

In its recent June performance report, Pyn Elite Fund outperformed the declining VN-Index, posting a positive performance of 1.8%. The fund attributed this growth momentum to the surge in aviation stocks ACV of Airports Corporation of Vietnam (+18%) and HVN of Vietnam Airlines (+19%) in June.

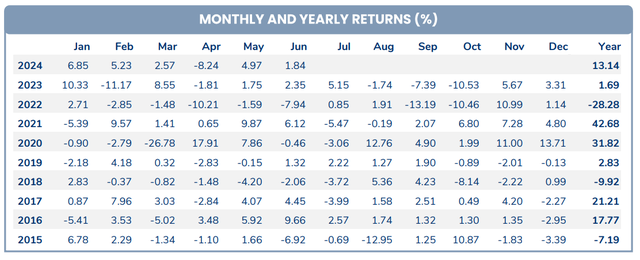

For the first half of 2024, Pyn Elite Fund’s investment performance reached an impressive 13.14%, outpacing the VN-Index’s 10.2% rise over the same period. The fund managed a substantial portfolio size of 791.1 million EUR (~21,750 billion VND) as of the end of June.

Among the top 10 investments, bank stocks remained dominant, claiming 5 out of 10 spots: STB, MBB, HDB, TPB, and CTG. In June 2024, alongside the remarkable performance of HVN and ACV, FPT stock also witnessed a significant increase of over 12%, while DXS (-14.7%), ASM (-10.2%), and VND (-9.8%) experienced the most substantial declines in the portfolio. Notably, HVN and DBC of Dabaco entered the top 10 holdings with the same weight of 3.3%, replacing VHC and SHS from the previous month.

Regarding HVN, the foreign fund highlighted that it is Vietnam’s largest airline, with the state owning more than 86% of its shares. HVN has recently been granted a three-year extension to repay its $160 million loan. According to Pyn Elite Fund, HVN also owns numerous subsidiaries across the industry’s value chain and is expected to partially divest at a good price to reduce accumulated losses. In 2024, Vietnam Airlines is anticipated to achieve record-high revenue and profit turnover.

In a recent statement, Petri Deryng, head of Pyn Elite Fund, expressed confidence in the VN-Index reaching 1,700 points by the end of 2024. Based on consensus forecasts from securities companies, the VN-Index is projected to reach 1,400-1,500 points in the remainder of the year. However, with a positive outlook based on income growth, the fund believes that the index could climb even higher this year.

In addition to robust income growth, the fund also pointed out other factors that could boost the sentiment of domestic investors and even lead to a strong market momentum. Firstly, the anticipated US interest rate cut is expected to ease pressure on the VND, which has been negatively impacting the Vietnamese stock market. Simultaneously, the new KRX trading system, slated for implementation this year, and the potential resolution of the pre-transaction margin issue for foreign institutional investors after the third quarter, are expected to positively influence the market. Moreover, Pyn Elite Fund anticipates that interest rates in Vietnam will remain very moderate, thereby fostering economic growth.

Bank stocks sold off heavily

Today (2/2), the VN-Index continues to rise, but in a cautious trading atmosphere. It is noteworthy that most banking stocks in the VN30 basket are facing strong selling pressure.