Many investors in Vietnam have found themselves in a difficult situation due to their investments in condotel apartments. Mr. Le Van Linh from Hanoi shared his story of purchasing three condotel apartments in Cam Ranh, Nha Trang in 2019 for nearly VND 2 billion each, with an initial payment of almost VND 700 million per apartment. At the beginning of 2022, he took out a loan of over VND 3 billion to cover the remaining cost. However, he has been struggling to bear the burden of the loan ever since, as the apartments have been challenging to rent out, and there have been no prospective buyers despite his attempts to sell.

Mr. Linh was attracted to the project due to its proximity to the airport, aesthetically pleasing design, and the fact that he only had to pay 30% of the contract value upfront. The remaining 70% could be paid after taking possession of the apartment and starting to rent it out. The developer also offered assistance with bank loan procedures, and Mr. Linh saw potential in the future tourism development of the Cam Ranh area. However, the project was delayed, and the apartments were not handed over until 2022. To make matters worse, the COVID-19 pandemic hit, and the monthly rental income offered by the developer was a mere VND 3 million per apartment, while the loan installments, including interest, amounted to VND 13-14 million per month per apartment.

“The rent I receive from the developer for all three apartments is only VND 9 million per month, while the loan installments and interest amount to more than VND 40 million per month,” Mr. Linh calculated.

Many investors who purchased condotels are struggling with loan repayments. (Illustrative image)

Unable to bear the financial burden, Mr. Linh has been trying to sell the apartments since the end of 2022. However, after almost two years, he has only managed to sell one apartment, incurring a loss of VND 300 million compared to the purchase price. The remaining two apartments have yet to find buyers.

Ms. Nguyen Tran Ngoc Han from Ho Chi Minh City shared a similar story. In 2019, she invested in two condotel apartments in Nha Trang and Da Nang, each 60m2 in size and costing VND 1.6 billion, plus additional costs for renovations and furnishings, totaling nearly VND 2 billion per apartment. After taking possession and renovating the apartments, she was able to rent them out for five months. However, the COVID-19 pandemic hit soon after, and the apartments have been sitting vacant for most of the time since then. Ms. Han shared her distress as she still owes the bank nearly VND 2 billion, with monthly installments of around VND 25 million. Her family has run out of funds, and she has decided to cut her losses and sell both apartments to repay the bank loan. However, due to the unclear legal status of condotels, she has been unable to find buyers despite her efforts over the past three years.

According to a recent market report by DKRA Group, a real estate services company with 13 years of experience, the vacation property market, especially condotels, continues to struggle with low liquidity. In the first quarter of the year, out of more than 4,800 units launched, mainly in central Vietnam, only 64 were sold, equivalent to 1%. Most projects are facing slow sales. “90% of condotel projects did not record any transactions,” DKRA stated.

The majority of the supply comes from the inventory of older projects, while new launches are very limited. The five provinces with the highest share of primary supply, including Quang Nam, Binh Dinh, Khanh Hoa, Binh Thuan, and Ba Ria-Vung Tau, all experienced a decrease in the number of units launched, ranging from 8% to 21% compared to the same period last year.

A report by the Vietnam Real Estate Brokers Association also revealed that out of nearly 10,000 tourism and resort properties launched in the first quarter, mostly condotels, only 160 transactions were made, resulting in a sales rate of just 1.6%.

According to Professor Dang Hung Vo, former Deputy Minister of Natural Resources and Environment, the liquidity of tourism and resort real estate, especially condotels, has been extremely low since the Cocobay Da Nang project collapsed. Following this event, several other condotel projects faced similar issues, and developers failed to deliver the promised profits to investors.

Mr. Vo attributed the low liquidity to the lack of a legal framework for land, management, and operation of multi-functional tourism real estate, as well as the impact of the pandemic, which has dampened investor enthusiasm for this segment.

Mr. Nguyen Van Dinh, Vice Chairman of the Vietnam Real Estate Brokers Association (VARS), agreed that the condotel market is facing challenges due to the impact of the pandemic on the tourism industry and the lack of significant policy changes regarding this type of property. He also emphasized the legal issues surrounding tourism real estate projects in various localities, which have hindered new investments. “These limitations have prevented the tourism real estate segment, including condotels, from building trust with investors,” Mr. Dinh stated.

The most extensive bribery case ever in Thanh Hoa: Numerous suspects prosecuted for “Giving and Receiving Bribes”

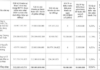

The Provincial Security Investigation Agency (PSIA) of Thanh Hoa province announced on January 31st that it has made the decision to initiate a prosecution against 23 individuals in connection with the offenses of “Accepting bribes” and “Giving bribes” as stipulated in Article 354(3) and Article 364(2) of the Criminal Code.

“Prosecution of government officials, land registration officers, and tax department employees in the largest bribery case ever”

The Thanh Hoa Police Investigative Agency has initiated legal proceedings against 23 individuals involved in the crimes of “Bribery” and “Receiving bribes”. This is the largest bribery case in terms of the number of suspects ever discovered and apprehended by the Thanh Hoa Police.