The VN-Index marked a week of five consecutive gaining sessions, ending at 1,283 points, up 3.15 points from the previous session, along with low liquidity and highly differentiated performance, indicating lingering doubts.

The breadth was not favorable, with 231 declining stocks versus 182 gainers. Notably, banks made a recovery effort today with gains in some stocks such as VCB, BID, TCB, and MBB, while CTG rose by 1.24%, VPB by 0.52%, and ACB by 0.62%. The information technology group continued its upward momentum, increasing by 2.03% as FPT climbed by 2.14%. Transportation stocks surged by 2.28%, led by HVN’s impressive 6.29% gain. Oil and gas, chemicals, and seafood sectors also posted gains, rising by 0.13%, 0.53%, and 0.62%, respectively.

On the positive side, HVN and FPT were among the top contributors to the market, adding 1.15 and 1.01 points, respectively, along with LPB, CTG, and VPB. Conversely, securities and real estate sectors witnessed declines of 0.26% and 0.27%, respectively.

Total trading volume across the three exchanges reached VND18.3 trillion, with foreign investors net selling VND312.3 billion. Specifically, in matched orders, they net sold VND264.5 billion.

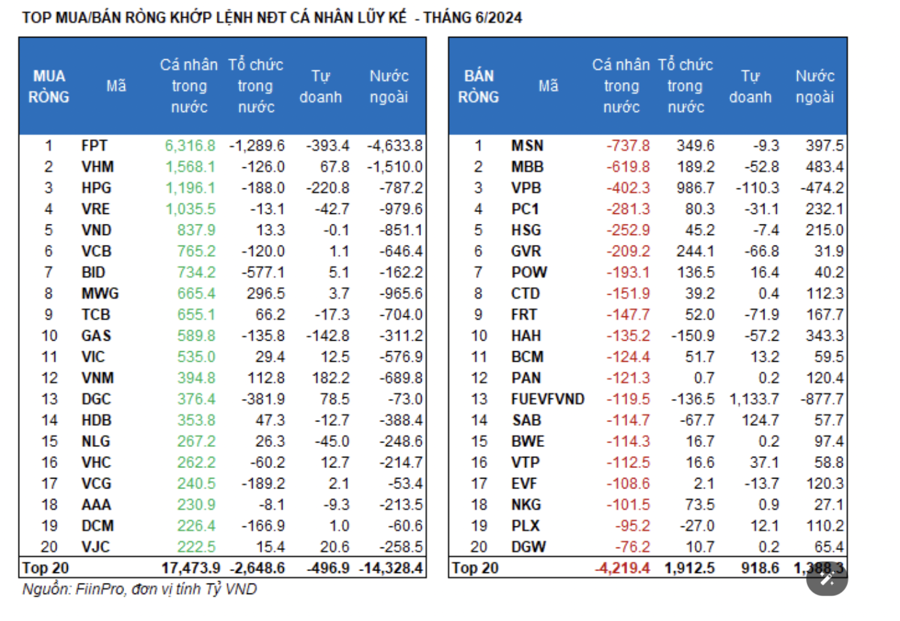

Foreign investors’ net buying in matched orders was focused on financial services and banking sectors, with top purchases including NLG, SSI, BID, HVN, GMD, VCB, STB, DGC, and DBC. On the selling side, they offloaded stocks in the information technology sector, particularly FPT, VRE, VHM, LPB, DXG, and FUEVFVND.

Individual investors net bought VND763.4 billion, with VND703.4 billion in net buying in matched orders. In terms of sector allocation, these investors net bought 11 out of 18 sectors, mainly focusing on information technology stocks. Their top purchases included FPT, EIB, VRE, LPB, VHM, MWG, DXG, HDB, SSB, and HPG.

In terms of net selling, individual investors offloaded stocks in 7 out of 18 sectors, primarily in financial services and tourism and entertainment. Their top sells included BID, SSI, HVN, NLG, VCB, VNM, STB, GMD, and FRT.

Proprietary trading groups net sold VND63.6 billion, with a net sell of VND205.6 billion in matched orders.

In terms of sector allocation for proprietary trading groups, they net bought 3 out of 18 sectors, with the highest net buy in financial services and retail sectors. Their top purchases included FUEVFVND, VCB, KBC, STB, VNM, GAS, MWG, DIG, VTP, and FUESSVFL. On the selling side, they offloaded information technology stocks, with top sells including FPT, GMD, PNJ, ACB, AAA, HPG, TCB, REE, PVP, and DBC.

Domestic institutional investors net sold VND328.3 billion, with a net sell of VND233.3 billion in matched orders.

Domestic institutions net sold 6 out of 18 sectors, with the highest value in the banking sector. Their top sells included EIB, MWG, SSB, NLG, DGC, VRE, GVR, FUESSVFL, LPB, and HAH. On the buying side, they focused on tourism and entertainment stocks, with top purchases including BID, HVN, GMD, FUEVFVND, VNM, PNJ, ACB, SSI, VJC, and REE.

Today’s matched orders contributed 4.8% to the total trading value, a decrease of 41.9% compared to the previous session, reaching VND880 billion.

Notably, MWG witnessed significant trading activities, with domestic institutions selling over 1.6 million shares (equivalent to VND99.7 billion) to individual investors.

Additionally, there was a transaction involving foreign institutions selling 3 million shares of HPG to proprietary trading groups.

Sector allocation of funds witnessed a decrease in securities, software, steel, food, construction, power production and distribution, and oil and gas sectors, while an increase was observed in banking, real estate, retail, chemicals, warehousing, logistics and maintenance, agricultural and aquatic products, textiles, aviation, and water transport sectors.

In terms of market capitalization, the matched order volume increased in the mid-cap VNMID and small-cap VNSML segments, while it decreased in the large-cap VN30 segment.

Investing in a volatile market: Should beginners consider putting money into high-yield bonds for 10-30% yearly profit?

Short-term stock market trading has proven to be a risky venture for many investors, leading to substantial losses. However, there are a few select open funds that have managed to achieve impressive returns, reaching up to 30%.