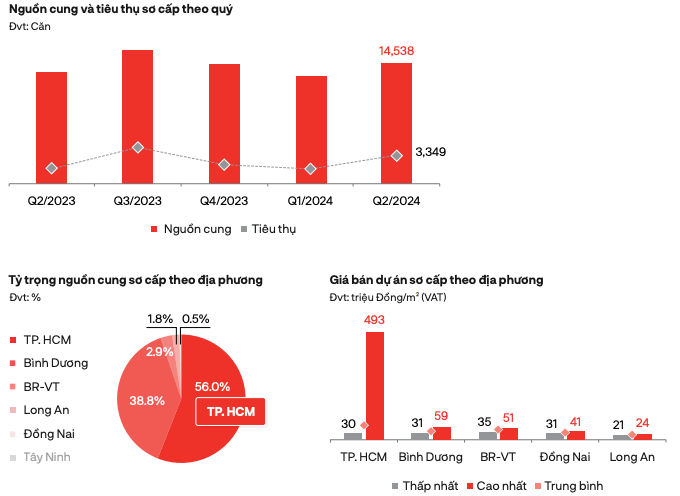

According to the Q2 2024 Southern Real Estate Market Research Report by DKRA, the city’s condominium segment saw a primary supply of 14,538 units, a 12% increase from the previous quarter and an 8% rise year-on-year. The majority of these projects are located in Ho Chi Minh City and Binh Duong. Specifically, Ho Chi Minh City led with 56% of the total primary supply, while Binh Duong accounted for 38.8%. The new supply introduced to the market mostly consisted of luxury apartments in the East of the city.

DKRA noted that in the past quarter, liquidity showed some positive signs, with primary consumption across the market reaching 3,349 units, a significant increase of 88% compared to the previous quarter and an 82% year-on-year rise. Transactions were focused on mid-range projects priced between VND 40-55 million/sqm in Ho Chi Minh City and VND 30-35 million/sqm in Binh Duong. Most of these transactions involved projects with completed legal procedures and rapid construction progress, offering convenient connections to the city center.

Source: DKRA

Notably, Ho Chi Minh City witnessed the highest primary apartment price of up to VND 493 million/sqm and the lowest price of VND 30 million/sqm. According to DKRA, primary prices remained stable in the second quarter compared to the first, with various incentives such as quick payment discounts, grace periods, and interest rate support.

“The secondary market experienced improved liquidity but remained low and unlikely to surge in the short term,” stated DKRA.

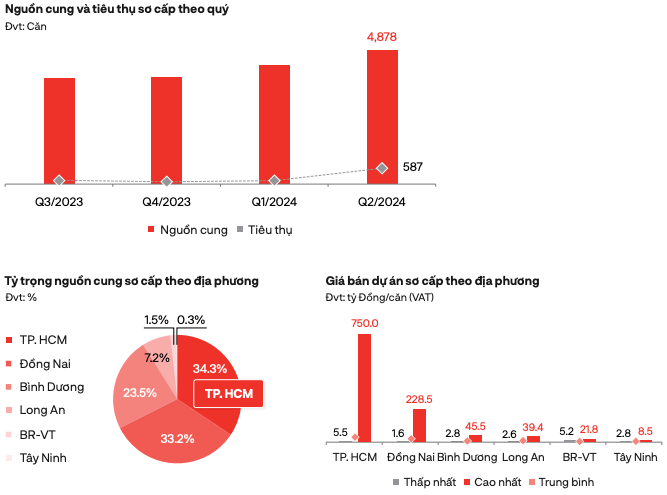

Regarding the townhouse/villa segment, DKRA reported that in Q2 2024, the primary supply reached 4,878 units from 86 projects, a 12% increase from the previous quarter and a 4.3-fold rise year-on-year. The new supply was mainly distributed in three areas: Ho Chi Minh City, Dong Nai, and Binh Duong, accounting for about 91% of the market’s total primary supply. Notably, townhouse/villa consumption in the quarter reached 587 units, a 4.5-fold increase compared to the previous quarter.

Binh Duong province dominated both new supply and consumption, accounting for 85% and 89%, respectively, of the market’s total new supply.

Source: DKRA

DKRA assessed that, in the past quarter, market demand improved significantly, and consumption surged compared to the previous quarter. Most transactions involved products with completed infrastructure and legal procedures, developed by reputable investors in the market.

Notably, Ho Chi Minh City recorded the highest townhouse/villa price of up to VND 750 billion/unit, while Dong Nai saw the highest price of up to VND 228.5 billion/unit.

However, DKRA evaluated that primary prices remained stable compared to the beginning of the year. Developers offered various incentives, including pre-sale reservation discounts, extended payment schedules, and interest rate support, to stimulate market demand.

The secondary market continued its sideways trend compared to Q1 2024. Secondary liquidity was concentrated in projects with completed infrastructure and legal procedures, developed by reputable investors in the market.

Comprehensive regional connectivity

In addition to building strong physical infrastructure, Ho Chi Minh City needs to strengthen its soft connections with other provinces in the region in order to promote economic development. This includes prioritizing the training of skilled workforce and ensuring access to quality healthcare.