Nam Kim Steel Joint Stock Company (stock code: NKG) has just announced a resolution on offering additional shares to the public and bonus shares to shareholders. With the offering plan, Nam Kim Steel intends to offer a maximum of 131.6 million new shares to existing shareholders at a ratio of 2:1, meaning that for every 2 shares owned, shareholders will be entitled to buy 1 new share.

The offering price is VND 12,000 per share, only half of NKG’s closing price on July 5 (VND 24,550 per share). The newly issued shares will not be restricted from transfer, and the expected timeline for implementation is from Q3 to Q4 2024, after obtaining approval from the State Securities Commission.

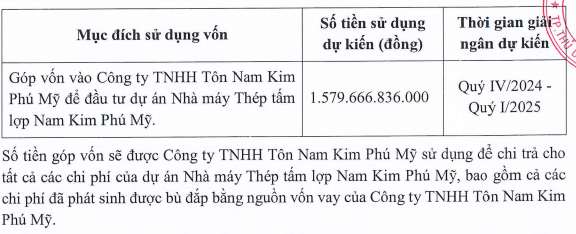

With the number of shares to be issued and the offering price as mentioned above, Nam Kim Steel expects to raise nearly VND 1,580 billion. All proceeds will be contributed to Nam Kim Phu My Steel JSC to invest in the Nam Kim Phu My Steel Sheet and Roofing Project in Ba Ria – Vung Tau province.

The above-mentioned project was granted an investment registration certificate on February 6, 2024. The plant specializes in the production of various metal products, including steel sheets such as galvanized steel, zinc-aluminum alloy-coated steel (cold-rolled steel), zinc-aluminum alloy-coated steel with paint, galvanized steel with paint; as well as iron, steel, and cast iron.

The project has a scale that includes a 350,000-ton/year galvanizing line, two zinc-aluminum alloy coating lines with capacities of 300,000 tons/year and 150,000 tons/year, and a 150,000-ton/year color coating line. The total investment capital for phase 1 (excluding VAT) is VND 4,500 billion. As of March 31, 2024, Nam Kim has contributed VND 500 billion to the project.

Regarding the plan to issue bonus shares to shareholders, Nam Kim plans to issue more than 52.6 million shares at a ratio of 100:20, meaning that for every 100 shares owned, shareholders will receive 20 new shares. The issuance is expected to take place in Q3 to Q4 2024, simultaneously with the additional offering to existing shareholders.

If both issuances are successful, Nam Kim’s charter capital is expected to increase from VND 2,633 billion to nearly VND 4,500 billion. On the stock exchange, Hoa Sen Group (HSG) is currently the largest listed company in the coated steel industry, with a charter capital of VND 5,980 billion, while Nam Kim, the second-largest company in the industry, has less than half of that. With the planned capital increase, Nam Kim will bring its charter capital closer to that of the industry leader.

In 2024, the company targets a total output of 1 million tons. Financially, Nam Kim aims to achieve VND 21,000 billion in revenue and VND 420 billion in pre-tax profit, representing increases of 13% and 137%, respectively, compared to the previous year.

The Board of Directors acknowledges that 2024 will remain a challenging year for the steel and coated steel industry. Globally, geopolitical conflicts persist, interest rates remain high, and intense competition from rivals will be key obstacles to Nam Kim’s recovery.

Tracodi (TCD) earns 163 billion VND profit in 2023

Throughout the year 2023, Tracodi achieved a consolidated net revenue of VND 1,784.5 billion and a post-tax profit of VND 163.3 billion.